2025 wheat futures prices rise vs crop 2024: Grain market daily

Tuesday, 22 October 2024

Market commentary

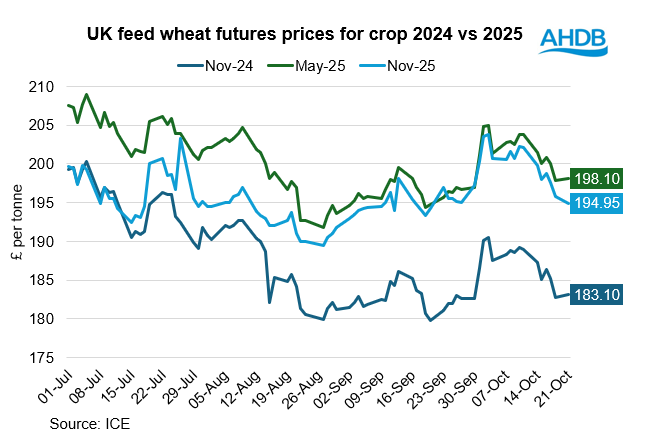

- UK feed wheat futures (Nov-24) closed yesterday at £183.10/t, up £0.35/t from Friday’s close. The May-25 contract ended the session at £198.10/t, up £0.25/t over the same period.

- Domestic wheat futures closed slightly higher yesterday in contrast to falls in Chicago and Paris wheat futures. The UK futures gained form support of a decrease in the value of sterling versus the US dollar. Paris wheat futures fell on Monday due to a high pace of Russian export loadings.

- Nov-24 Paris rapeseed futures closed at €504.50/t yesterday, gaining €3.50/t from Friday’s close. The May-25 contract gained €3.25/t over the same period, ending at €508.00/t.

- European rapeseed prices rose yesterday as the global oilseeds complex moved higher. Chicago soybean futures gained yesterday as lower prices spurred international demand for the US origin in the spot market. Winnipeg canola was supported yesterday on hopes that Beijing would ease an anti-dumping on imports of Canadian rapeseed. The US soybean harvest 2024 was 81% complete as of 20 October, the fastest pace seen since 2010.

2025 wheat futures prices rise vs crop 2024

Recently, the market has received information that is supporting futures prices for the wheat crop 2025. Indeed, there is information about sub-optimal weather conditions for winter crops in Russia and Ukraine, plus the delayed maize harvest in France due to heavy rains, which may affect the sowing of winter crops, including wheat.

After repeated heavy rains last autumn and this summer led to the smallest wheat crop in 40 years, France had its wettest September in 25 years. This, and further rainfall in the first half of October have left some crop land waterlogged again. FranceAgriMer said 10% of the country's expected soft wheat area and 20% of the projected winter barley area had been sown by Monday October 14. This is low compared with five-year averages of 27% and 42%, respectively.

Argentina and southern Australia could also face weather risks in the future. Over the past week we have received information about potential dry weather in these countries. This could support both spot and forward prices.

UK feed wheat futures for Nov-24 (crop 2024) and Nov-25 (crop 2025) started the marketing year 2024/25 with little difference in price. However, from the second half of July 2024, the spread between feed futures widened. The main reason for this was pressure from the harvesting campaign and increasing concerns about the global wheat area for 2025. The planting pace in the UK is also likely a factor. As of 21 October, London feed wheat futures Nov-25 closed higher £11.85/t than Nov-24. While May-25 futures closed £3.15/t higher than Nov-25 on the same date, this is a much smaller gap than at the start of 2024/25.

As of 21 October, Chicago Sep-25 futures (2025 crop) were already £4.51/t above the May-25 contract (2024 contract). On the same date, Paris May-25 milling wheat futures were £7.91/t higher than the Sep-25 (2024 crop higher than 2025 crop). However, it needs to be remembered that the 2024 French crop is the smallest in over 40 years.

Looking ahead

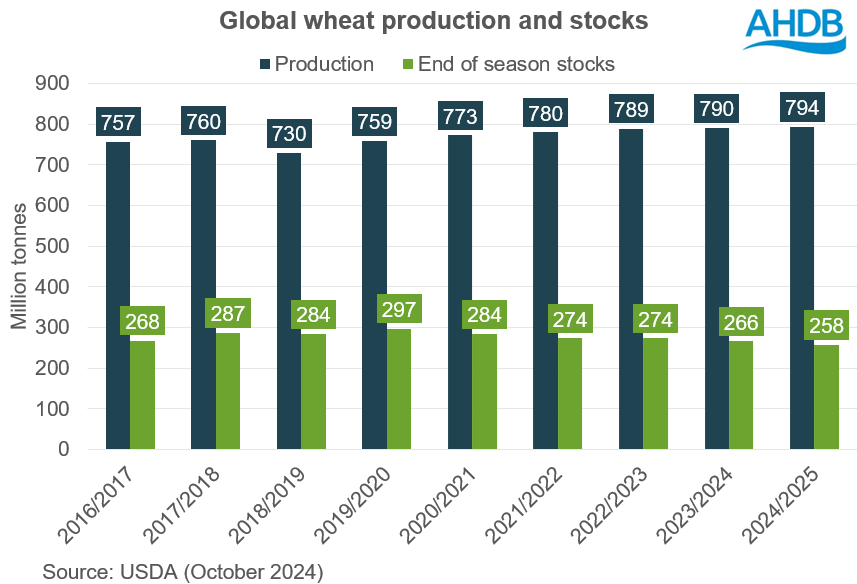

The combination of unfavourable weather for winter wheat in Northern Hemisphere, high delivery pace from major exporters and the forecast lowest world wheat ending stocks in 2024/25 in the last eight years could continue to support futures prices for crop 2025.

So far, there has been a strong start of wheat export campaign in US, Ukraine and Russia in 2024/25 marketing year compared to this time last year. But as of 16 October, the export volume of wheat in current marketing year from the EU is 29% down compared to last year’s figures. Nonetheless, in 2024/25 lower wheat ending stocks are still expected in EU, Russia, Australia and Argentina compared to last season.

It’s necessary to monitor the pace of wheat exports from key exporters and likely final stock levels in relation to weather risks for 2025 wheat crops. These will influence the price differential between the wheat crop 2024 and crop 2025.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.