A dry July in Canada impacts the rapeseed crop: Grain market daily

Wednesday, 14 August 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £190.00/t yesterday, falling £0.35/t from Monday’s close. The May-25 contract fell £0.40/t over the same period, to close at £201.50/t.

- Egypt purchased 280 Kt of wheat from Ukrainian and Bulgarian origins on Monday, from the 3.8 Mt they had sought. It is believed Egypt is now negotiating a purchase of 1.8 Mt of wheat from different origins, potentially including Russia. Consequently, global wheat markets were pressured yesterday, as the price competitiveness of Black Sea wheat weighed on the market.

- Paris rapeseed futures (Nov-24) closed at €452.75/t yesterday, down €7.25/t from Monday’s close. The May-25 contract lost €5.00/t over the same period, to close at €456.50/t.

- The bearish outlook for soyabeans in the latest USDA WASDE report continued to cast pressure on the oilseeds complex as the most actively traded Chicago soyabeans futures contract (Nov-24) closed at an all-time low yesterday at $353.66/t. Also, weakness in Malaysian palm oil futures due to a slow start for exports in August weighed on an already pressured vegetable oils complex.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

A dry July in Canada impacts the rapeseed crop

Higher than normal temperatures and minimal rain throughout July, leading to dryness in the Canadian Prairies, has negatively impacted the country’s rapeseed crop during a key period for yield development. With fewer exports forecast from key producing countries this season, a poorer yielding rapeseed crop in Canada crop could contract the already tighter global balance going in to 2024/25.

Unfavourable July weather

On Monday, the Canadian government reported that rainfall during July was below normal for most areas in the Prairie region, alongside above average temperatures, after experiencing more favourable conditions earlier in summer and spring. Expansion and intensification of the drought area across the Canadian Prairies has resulted in reports of heat stress and considerable decline in soil moisture. As at the end of July, 87% of agricultural land in the Canadian Prairies was classified as in abnormally dry to exceptional drought conditions, notably up from 32% at the end of June.

Canadian rapeseed in sub-optimal condition

In the latest Saskatchewan crop report, where 55% of Canada’s rapeseed crop is grown, the dry conditions are reported to have accelerated the crops development. As the crop continues to mature in such conditions, farmers are reporting crop stress as well as aborted pod development. In Alberta, where 28% of Canada’s rapeseed is produced, thunderstorms have helped to provide rainfall and lower temperatures. This helped to alleviate the prolonged dryness and consequential crop stress that was being experienced. However, rapeseed’s condition in Alberta remains poor, as 39% is rated in good or excellent condition, markedly poorer than the five-year average of 56% for this time of year.

How important are Canadian exports?

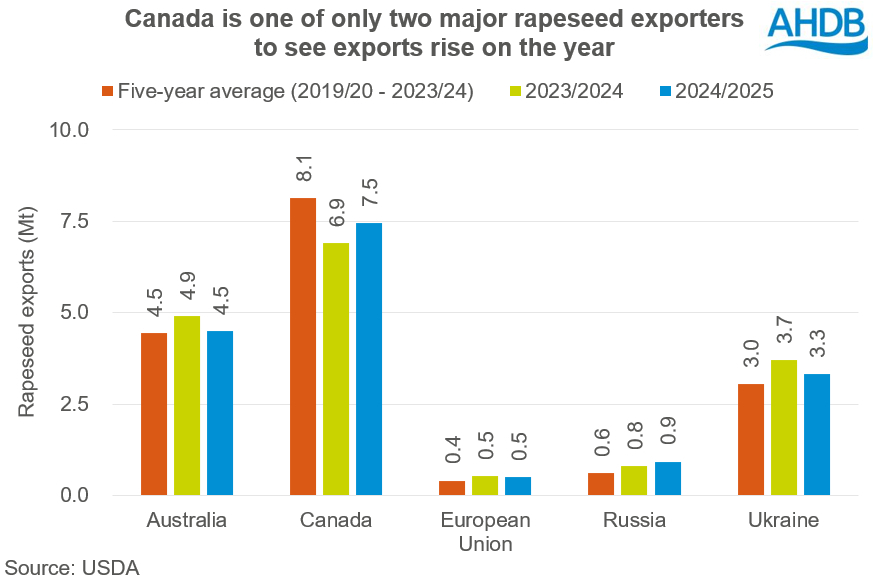

Canada is one of just two major rapeseed exporters forecast to see a yearly climb in exports this season. The USDA forecasts global rapeseed exports by major exporters (incl. Australia, Canada, EU, Russia and Ukraine) for 2024/25 at 16.7 MT, down 0.8% from last year.

The IGC has forecasted that rapeseed consumption will marginally exceed production for 2024/25, and therefore any further pressure on global supply could tilt the balance to further tightness.

What could the Canadian rapeseed harvest bring?

As the rapeseed harvest nears in Canada, the impact of dryness in July and August on the crop during its critical flowering and seed development stages, will become clearer. As seen in Europe, poor rapeseed yields in early July triggered a considerable rally in Paris rapeseed futures. Therefore, insight into rapeseed yields when harvest soon begins in Canada could influence the direction of the rapeseed market should they vary from what is currently expected.

Next Tuesday, the Canadian government will release its monthly outlook for principal field crops where forecasts for 2024/25 rapeseed production and exports will be reported. Something to look out for.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.