A weak week for wheat? Grain Market Daily

Friday, 3 September 2021

Market commentary

- UK wheat futures (Nov-21) closed yesterday at £191.40/t, down £0.35/t on Wednesday’s close. The May-22 contract closed yesterday at £196.90/t, also down £0.35/t on Wednesday’s close.

- Global wheat markets were slightly lifted yesterday, consolidating their position after recent declines and reminders of export demand lending support.

- The uptick was not felt on our domestic market as sterling strengthened against both the Euro and Dollar. Trading closed yesterday at £1 = €1.1647 & £1 = $1.3829.

A weak week for wheat?

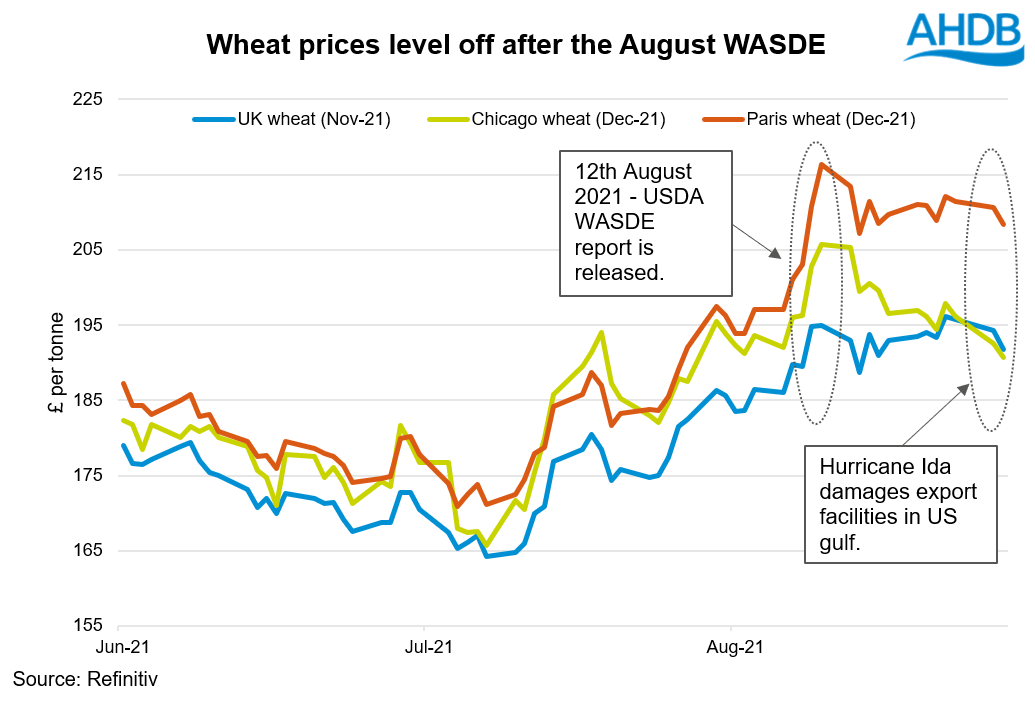

The month of August captured continued growth in wheat markets, as bullish market news such as the August USDA World Agriculture Supply & Demand (WASDE) report spurred the market. The domestic market followed this trend, with the Nov-21 contract starting the month closing at £186.35/t (02 Aug) and peaking at £196.10/t towards the end of the period (26 Aug).

A week of slight pressure?

However, the aftermath of Hurricane Ida has resulted in market pressure, following the damage caused to export terminal facilities in the US Gulf Coast. A disconnect in the supply chain, with grains and oilseeds being delayed to their respective markets, is now apparent and pressurising prices. How long this damage will be impactful is yet unknown, as assessments are ongoing. With US Gulf Coast ports responsible for over half (54%) of US grain and oilseed exports this year to date, a speedy return to full operational capacity is needed.

This damage has meant that Chicago maize (Dec-21), wheat (Dec-21) and soyabeans (Nov-21) are down 5.1%, 2.1% & 3% in USD terms respectively since last Friday, based on yesterday’s close.

This has subsequently resulted in domestic pressure, with UK wheat futures (Nov-21) closing yesterday at £191.40/t, losing £4.35/t over the same period.

Where could it all go now?

With much of the bullish wheat news now priced into the market this means that fresh news will drive the short-term sentiment.

The next main piece of news will be the September USDA WASDE. This report is highly anticipated as the maize and soyabeans acreage will be reviewed, a month earlier than usual.

Moreover, the latest FAO cereal supply and demand brief, released yesterday, shadowed the global cuts to wheat. It pegged global wheat production at 769.5Mt and world stocks-to-use at 36.2%, down 15.2Mt and 1.6 percentage points respectively on July’s report.

Interestingly, the header of the report stated that ‘world cereal production and stocks revised down.’ However, following this statement with ‘…but overall supplies in 2021/22 remain adequate.’

Despite these reductions to wheat, coarse grain output for 2021/22 is still 19.4Mt (1.3%) higher than the previous year.

However, it’s still early days with a lot of information yet to come, such as US spring crop data and South American plantings of maize/soyabeans this autumn, with the potential impacts of a successive La Niña.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.