An update to US planting figures: Grain market daily

Tuesday, 2 June 2020

Market Commentary

- UK new crop futures (Nov-20) declined yesterday to close at £171.50, a fall of £2.80 from Friday 29 May.

- The Egyptian state grain buyer (GASC) opened its first wheat tender of the 2020/21 season yesterday with delivery scheduled for July. The results of the tender will be released later today.

- Many moisture meter calibration clinics are not currently operating so you may be concerned how you will meet the requirement of the Red Tractor standard (ST.c) at your next assessment. Please click here to find out more information regarding this.

- The AHDB Spring Planting and Variety Survey provides the only pre-harvest planting view of grain and oilseed crops. Please help your industry to navigate these uncertain times by completing the planting survey form, click here to complete the form.

An update to US planting figures

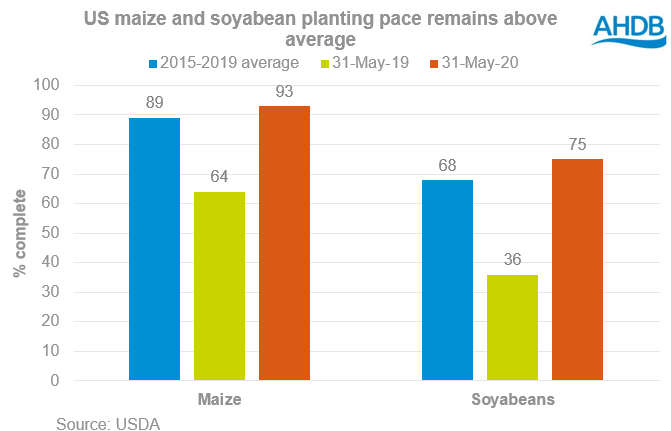

Planting figures for US maize and soyabean crops were slightly below market pre-release estimates, according to Monday’s US crop progress report. Progress has slowed from the rapid pace seen at the start of the season, but remains above the five-year average (2015-19).

As of 31 May, 93% of the intended US maize area had been planted, four percentage points above the five-year average. For soyabeans, 75% of the intended US area was planted, 7% ahead of the five-year average. Markets had anticipated a planted figure of 95% for maize and 77% for soyabeans.

A lack of significant detrimental weather across planted regions this season has meant crops are progressing well. An estimated 74% of US maize was in a ‘good to excellent’ rating, up from 70% last week. For soyabeans, in its first rating this season, 70% of the crop was rated as ‘good to excellent’. Crop emergence rates were also above the five-year average.

Looking to the next couple of weeks, weather across the Midwest looks quite beneficial for the emerging crop. Warmer weather is expected with potential for slightly above average precipitation, which could improve crop conditions further.

Yesterday, reports that Chinese state-owned firms had been told to pause purchases of US soyabeans worried markets. However, it was announced yesterday that these state-owned firms for Oct/Nov delivery had purchased three cargoes totalling 180Kt of soyabeans. However, this volume was low compared to usual purchases.

A sustained halt to large Chinese purchases puts a real risk of ‘phase-one’ deal commitments being missed, which will likely result in elevated stocks of US soyabeans.

Further reductions to EU rapeseed production estimates by Stratégie Grains will advance EU oilseed import requirements. The EU is a large customer for US soyabeans, over 5.18Mt had been imported in the season to 24 May, according to EU commission data.

So while EU rapeseed balance for the next marketing season remains tight, heaviness in global oilseed stocks could cap, and likely pressure, EU and domestic prices over the longer term. Further tensions between the US and China will increase the likelihood of this.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.