Arable Market Report – 17 March 2025

Monday, 17 March 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

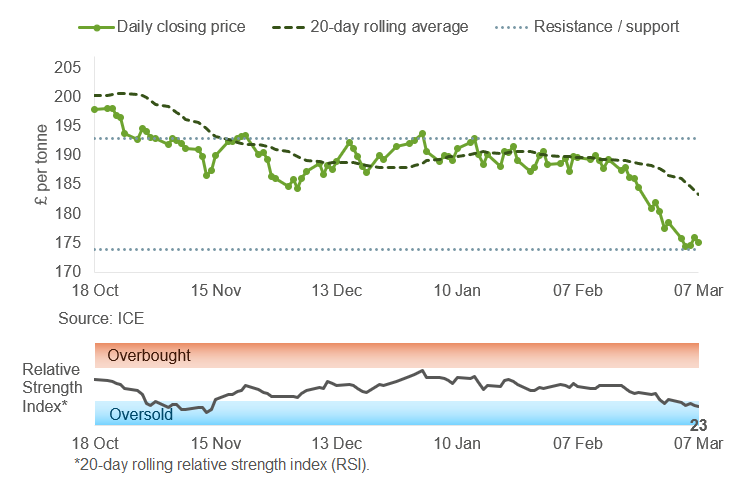

The 20-day rolling average is now acting as a resistance level for May-25 UK feed wheat futures, with recent support at £174/t holding steady. New information will be required to push prices beyond this range.

Find out more about the graphs in this report and how to use them here.

Market drivers

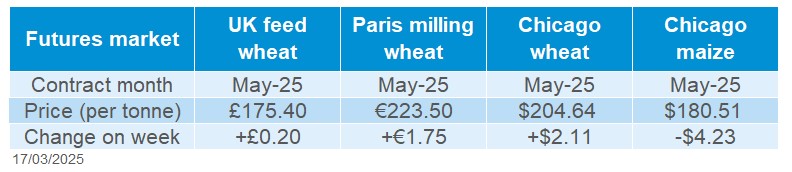

May-25 UK feed wheat futures rose for the first time in five weeks, closing at £175.40/t on Friday, up £0.20/t from the week before. The Nov-25 contract increased by £1.20/t week-on-week, settling at £190.45/t on Friday.

Domestic wheat prices followed the changes in both Chicago wheat and Paris milling wheat futures (May-25), which rose by 1% and 0.8% respectively. This was driven by lower export expectations in Russia, competitive US exports, and reduced output in the EU.

Consultancy firm IKAR revised its baseline wheat export forecast for Russia for the 2024/25 season to 41.0 Mt, down from 42.5 Mt last month, due to the existing export quota and currency fluctuations.

Meanwhile, US net export sales of wheat for the week ending 6 March reached 783.4 Kt, up 83% from the previous four-week average and above the trade estimate range of 275 Kt – 650 Kt. Net export sales of maize also rose to 967.3 Kt, within the trade estimate range of 725 Kt – 1.4 Mt.

Stratégie grains reduced its forecast for EU soft wheat production in 2024/25 to 113.5 Mt, down from 113.7 Mt last month. The 2025 crop forecast was also lowered to 127.5 Mt but remains much larger than this year's rain-affected crop, due to a greater area planted and better yield expectations.

Similarly, the grain trade association Coceral cut 2024/25 soft wheat production forecast for the EU and UK to 137.2 Mt, down from 140.4 Mt in December.

The USDA WASDE report on Tuesday showed larger-than-expected global wheat stocks, limiting price rises. Wheat crop production estimates increased by 2.1 Mt in Australia, 0.8 Mt in Argentina, and 0.5 Mt in Ukraine, while the global export figure was revised down by 0.9 Mt.

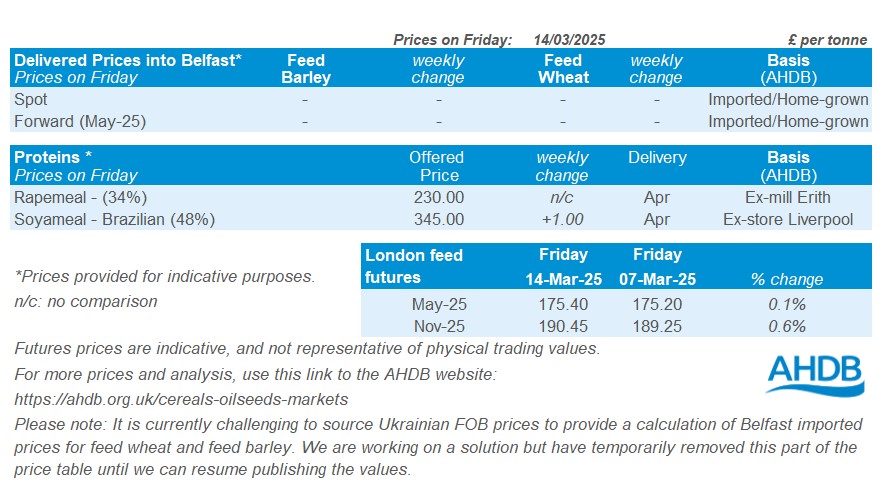

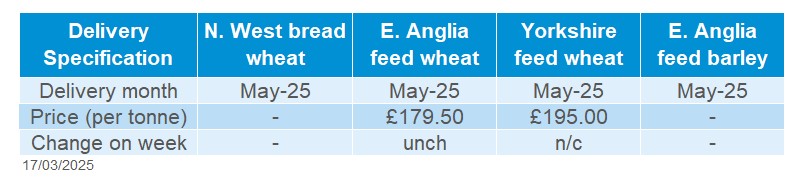

UK delivered cereal prices

Domestic delivered wheat prices were mostly down across the week (Thursday-Thursday) with a stronger sterling against the US dollar. Feed wheat delivered into East Anglia for harvest 2025 (Aug-25) fell £0.50/t to £185.50/t, while bread wheat delivered to Northamptonshire for March 2025 was quoted at £200.50/t, down £1.50/t.

Rapeseed

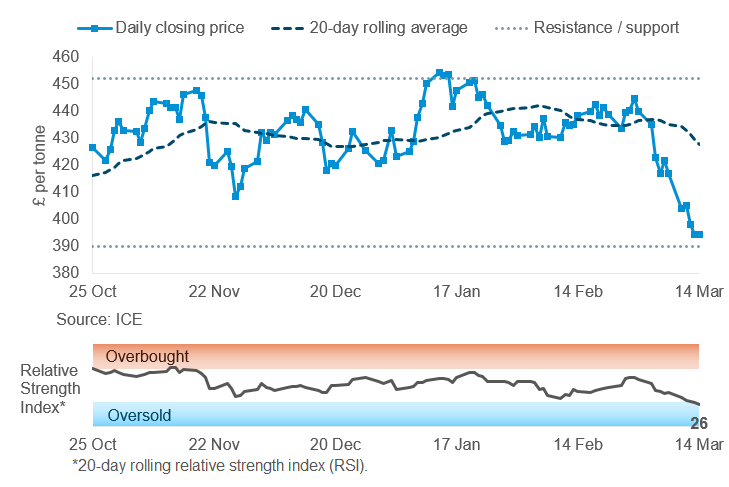

May-25 Paris rapeseed futures traded notably lower than the 20-day moving average last week. After a significant drop Friday-Friday, the price chart has found a new lower support level at £390/t.

Find out more about the graphs in this report and how to use them here.

Market drivers

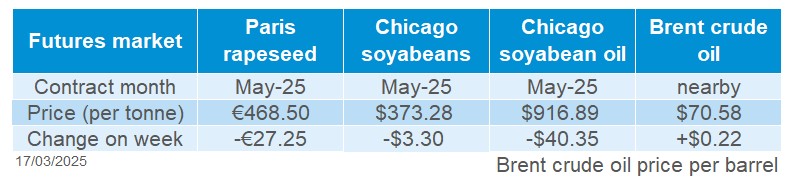

May-25 Paris rapeseed futures closed at £394.40/t on Friday, down £22.47/t on the week. New crop (Nov-25) futures finished on Friday at £387.24/t, down £16.17/t.

As we mentioned in a Grain market daily last week, the spread between old crop (May-25) and new crop (Nov-25) Paris rapeseed futures continues to narrow due to significant unpredictability surrounding tariffs and global trade, pressuring old crop futures.

Winnipeg canola futures (May-25) fell by 13.1% over the last week (Friday to Friday). The implementation of tariffs by the US and China on Canadian goods including canola oil and meal, continue to have a huge impact on the market.

Rapeseed imports into the EU so far this season (01 July to 06 March) have reached 4.65 Mt compared 4.05 Mt for the same period last year. The share of rapeseed imported into the EU from Australia and Canada has increased to 34% and 10% respectively, from 22% and 1% last season. This means that Australia and Canada are having a greater influence on European rapeseed prices.

For the 2025 rapeseed crop Canada and Ukraine are estimated a decline in planted area, while the EU and Australia are expected to increase production compared to old crop.

May-25 Chicago soyabeans and soyabean oil futures decreased by 0.9% and 4.2% respectively (Friday-Friday). US net export sales of soyabeans were reported at 752 Kt by the USDA for the week ending 6 March, up noticeably from the previous week and at the top trade estimates.

The Brazilian crop agency Conab, increased its 2024/25 soyabean production estimate to 167.4 Mt, up from 166.0 Mt previously. However, a weather-related drop in Argentinian soyabean production could offset the Brazilian increase. As a result, South America's historically large soybean production will continue to weigh on the market. Additional pressure could come from the accelerated soyabean harvesting campaign in Brazil.

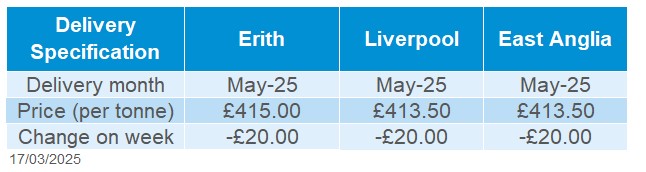

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in May was quoted at £415.00/t on Thursday, down £20.00/t from the previous week. Delivery to East Anglia in May was quoted at £413.50/t, also falling £20.00/t. In a volatile market, please note that the survey is usually conducted mid-late morning on Friday, so can show different trends from Paris futures closing prices.

The delivered price difference between old crop (May delivery) and new crop (November delivery) is narrowing, mirroring the fall in old crop futures.

Extra information

The latest HMRC trade data released on Friday shows wheat (including durum) exports are picking up pace somewhat. Wheat exports totalled 18.7 Kt in January, while for the first six months of the season, monthly pace had averaged 11.7 Kt. Look out for more detailed analysis of this data over the coming days.

Fertiliser prices firmed in February, with UK produced AN (34.5% N) averaging £367/t, up £11/t from January, marking the highest price reported since August 2023. Imported AN averaged £370/t in February, an increase of £18/t from January, the highest price since May 2023. This reflects the higher cost of natural gas experienced last month.

Last week, the government announced that applications for the Sustainable Farming Incentive (SFI) are now closed. As of March 2025, over 50,000 farm businesses have joined these schemes, reportedly covering more than half of all farmed land in the country. The Government plans to provide more details about a reformed SFI offer later this year, with information to follow the official government Spending Review. However, until we see details of any new scheme, we have no sight of potential budget size or scope.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.