Arable Market Report - 21 October 2024

Monday, 21 October 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

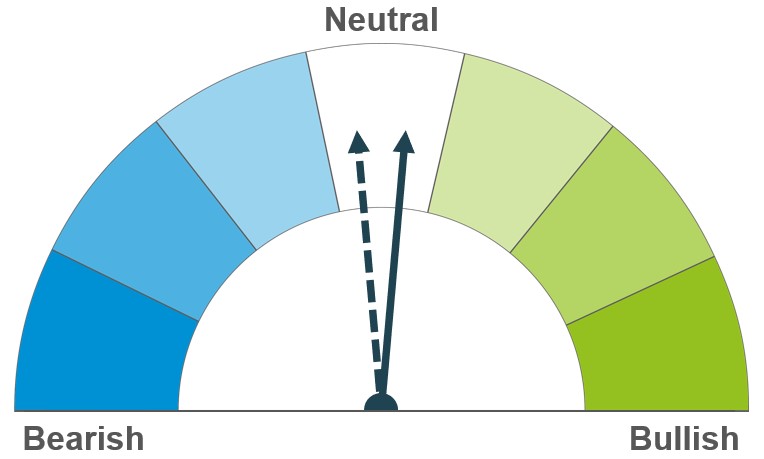

Grains

Wheat

Beneficial rains over southern Russia and forecasts for the US Plains improve the outlook for the respective 2025 wheat crops but uncertainty regarding the minimum export price for Russian wheat offers support.

Maize

Expectations of the second largest Brazilian maize crop and above average harvest pace of the US maize harvest pressures the market. However, Chicago maize futures (Dec-24) is nearing the key $4/bushel level ($157.47/t), which could offer some support.

Barley

Despite reduced barley production in France, EU supply remains sufficient to cover demand. As such, the barley market is following the wider cereals market.

Global grain markets

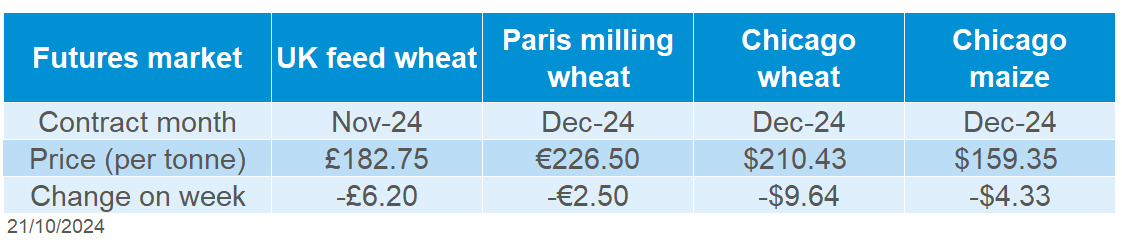

Global grain futures

Global grain markets were pressured over the week (Friday-Friday), and Chicago maize and wheat futures (Dec-24) fell 2.6% and 4.4% respectively on the week. The US maize harvest continues to outpace the five-year average and Conab reassured on expectations of a sizable maize crop for Brazil. Rains forecast over the US Plains and southern Russia could alleviate dryness concerns, while Russian export values and policy remain a key watchpoint.

Conab (linked to Brazil’s Agricultural Ministry) released its first estimates for the 2024/25 maize crop on Tuesday (15 October), with production at 119.7 Mt. While 7.3 Mt less than the USDA’s estimate, both estimates suggest this would be the second largest Brazilian maize crop on record. The first maize crop was 29% planted (by 13 Oct), with generally favourable conditions in the south supporting the pace of where the majority of the first maize crop is produced.

Recent rains in key wheat-producing areas in Russia have partially alleviated concerns regarding the delays to winter cereals planting. While not plentiful, some have said it is enough to reduce the fears of prolonged dryness. In addition, the forecast of rains over the US Plains has tempered concerns regarding dryness which, although supporting planting progress, led to some concerns about autumn establishment.

The market remained vigilant to Russian wheat export values during the first week following the Russian Agricultural Ministry’s recommendation for wheat to not be sold under $250/t (FOB). Reuters reported the approximate market value for Russian wheat (12.5% protein, Black Sea, FOB) was $235/t on Friday (18 October), however some question whether greater adherence is to be expected). A change to Russian export policies whereby Russian grain exporters will sell directly to sovereign buyers has also led to concerns that commercial grain companies, who currently hold large wheat supplies, may be excluded from buyers’ tenders.

On Tuesday, France’s Agricultural Ministry reduced the 2024 soft wheat output by 1.4% on the month to 25.43 Mt and barley 2.5% to 9.80 Mt due to the heavy rains which impacted planting and development.

UK focus

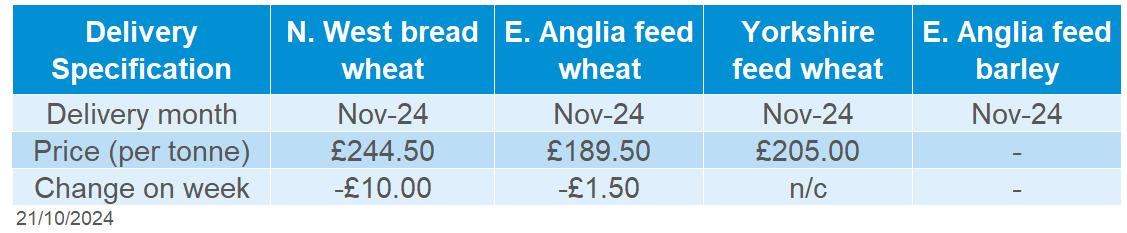

Delivered cereals

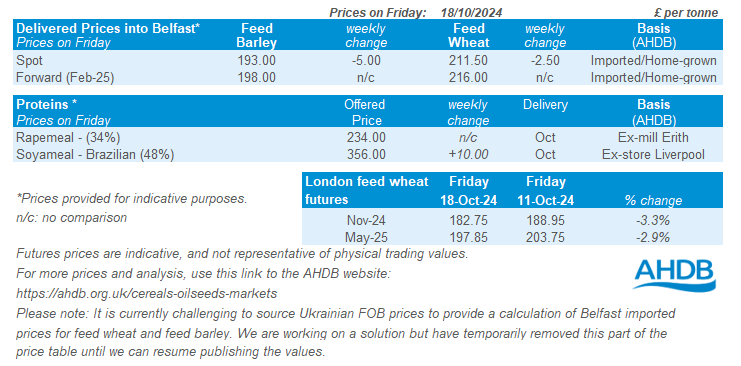

Last week (Friday to Friday), UK feed wheat futures faced downward pressure, mirroring global trends. The Nov-24 contract dropped by £6.20/t, closing at £182.75/t. Similarly, the May-25 contract fell by £5.90/t, finishing at £197.85/t.

UK delivered feed wheat prices followed futures movements Thursday to Thursday. Feed wheat delivered into East Anglia for November delivery was quoted at £189.50/t on Thursday, down £1.50/t over the week. However, bread wheat into the North West for November delivery was quoted at £244.50/t on Thursday, down £10.00/t on the week.

The latest UK trade data shows maize imports at 515 Kt for July and August, 28% greater than last year and 37% more than the five-year average. For wheat (inc. durum), 266 Kt was imported during August, which is 22% less than July but brings the total import volume to 608 Kt, since the start of the marketing year, nearly the equivalent of July-October last year (618 Kt).

Last week, AHDB released its provisional UK crop production estimates for 2024. This follows the release of provisional data by Defra for England and by the Scottish government for Scotland. The provisional figures show a widely expected fall in UK wheat production for 2024, which is provisionally estimated at 11.1 Mt, down 2.9 Mt from 2023 harvest. Despite increases in barley and oat production from 2023, both remain below their respective five-year averages. As a result, the UK will be much more reliant on imports than usual this season.

AHDB will release its first estimates of wheat and barley UK supply and demand for the 2024/25 season later this month.

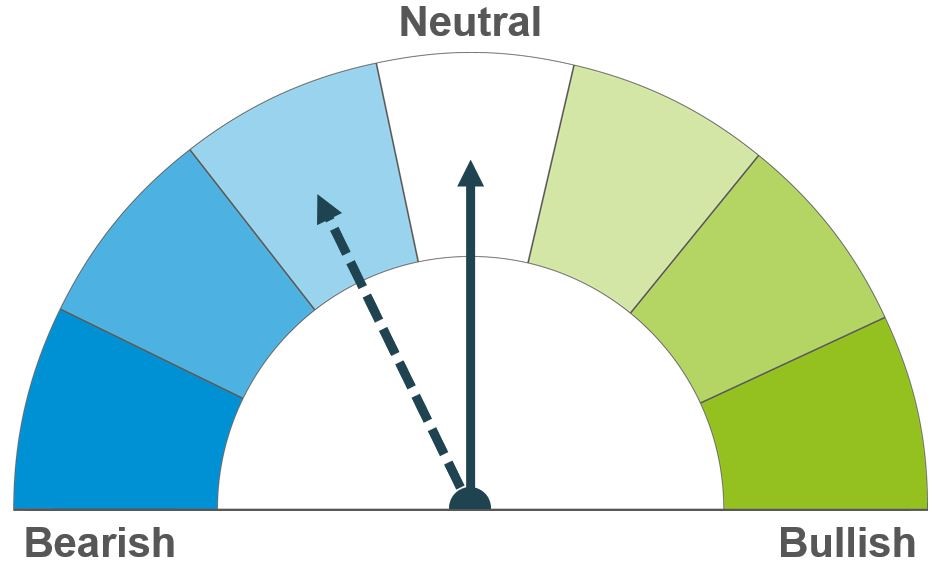

Oilseeds

Rapeseed

Weather concerns in key producing regions and increasing demand globally could provide short-term support for rapeseed prices. However, rapeseed prices are influenced by the wider oilseed complex. Crude oil and vegetable oil prices are also important short term, while the expectation of ample soybean supplies will be important longer term.

Soyabeans

Low prices have incentivised some demand in the physical market, though harvest pressure in the US and improved weather in Brazil are weighing on prices in the short-term. It also adds to expectations of heavy supplies longer-term.

Global oilseed markets

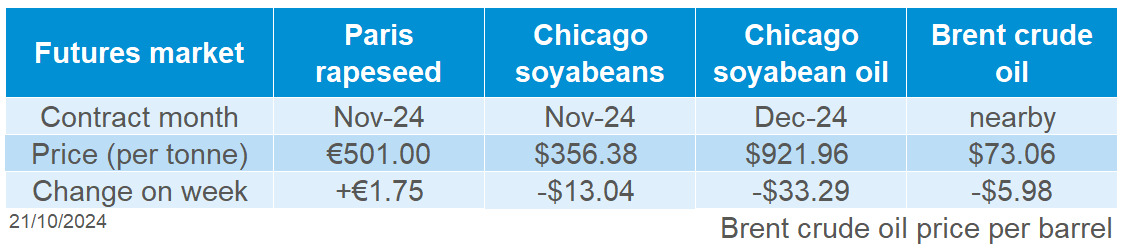

Global oilseed futures

Global oilseeds markets were pressured last week (Friday – Friday). This was primarily due to a drop in crude oil prices and the accelerating soybean harvest in the US. Brent crude futures Dec-24 were down 7.6% on the week, following weaker energy demand in China and reduced concerns about potential disruption to Iran’s crude infrastructure by Isreal. Also, Chicago soyabeans Nov-24 contract closed at a two-month low level of $356.38/t on Friday (18 October) and below a technical support level, despite strong US weekly export sales. The vegetable oils complex also remains softer and Speculators increased their net short position in Chicago soyabean futures for the week to 15 October.

As of 13 October, the US soyabean harvest was 67% complete. This is ahead of last week’s 47% and the previous five-year average of 51%. Net sales of US soyabeans for the 2024/2025 season were 1.7 Mt for the week ended 10 October, up 35% from the previous week and 16% from the prior four-week average but in line with market expectations. The primary buyer was China (1.0 Mt). However, China’s import volumes from the US remain much smaller than from top producer Brazil.

International Grains Council raised its 2024/25 world soyabean production forecast by 2 Mt to 421 Mt, with ending stocks projected to increase by 4 Mt to 86 Mt. Forecasts of more favourable weather in Brazil are needed to support soyabean planting in the coming weeks. Safras forecasts Brazilian soyabean export for the 2024/25 campaign at 107 Mt, which is higher than the latest USDA’s estimate of 105 Mt.

Malaysian palm oil futures (Dec-24) decreased last week (Friday – Friday). However, Malaysian palm oil futures edged higher this morning, after two sessions of declines, supported by higher export estimates and expected seasonal declines in palm production.

Rapeseed focus

UK delivered oilseed prices

Nov-24 Paris rapeseed futures were supported last week (Friday to Friday), following improved global demand for rapeseed and a weakening of euro. The Nov-24 contract gained €1.75/t on the week to close at €501.00/t on Friday.

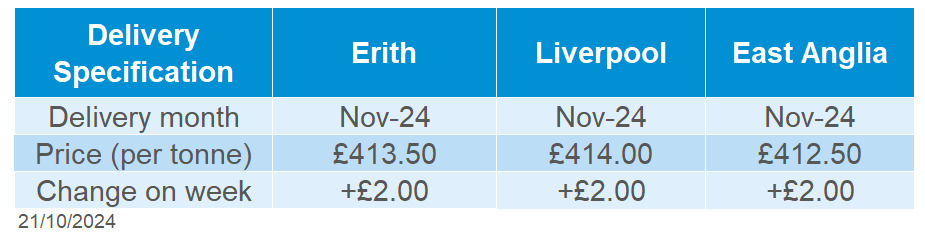

Rapeseed delivered into Erith in November was quoted at £413.50/t, up £2.00/t on the week. For December delivery to the same location, rapeseed was quoted at £416.50/t, up £1.00/t on the week.

The French farm ministry estimates 2024 rapeseed production at 3.85 Mt, down from 3.95 Mt last month and 4.28 Mt last year. This decrease is attributed to a 1.78% reduction in planted areas and an 8.49% decline in yields compared to 2023.

The stronger EU-27 2024/25 rapeseed import campaign continues to reflect reduced production in the region. As at 13 October, the EU Commission reports that rapeseed imports for the 2024/25 season have reached 1.57 Mt, up from 1.40 Mt at the same time last year.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.