Black Sea maize pressuring UK cereal exports: Grain Market Daily

Wednesday, 22 January 2020

Market Commentary

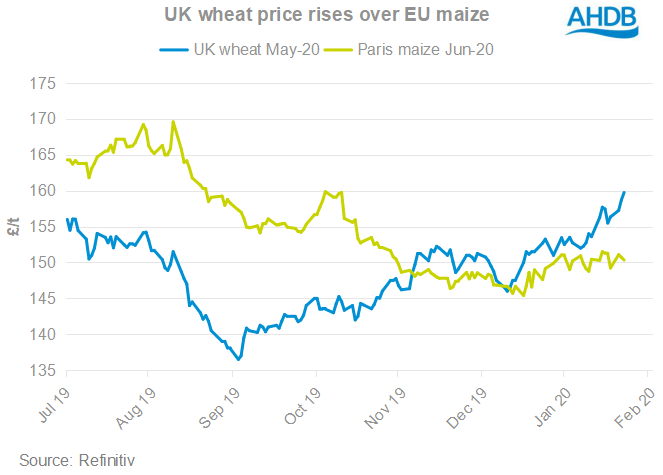

- UK wheat futures have continued to benefit from global wheat price increases recently. Concerns surrounding global wheat supply tightness and strong global demand going forward have supported prices. UK May-20 wheat futures increased £1.45/t to close at £158.70 yesterday.

- Chicago soyabean futures (nearby) fell to a five-week low yesterday as markets continue to await new Chinese purchases of US soyabeans for support. Expectations of a large soyabean harvest in Brazil continue to add pressure to US oilseed markets.

Black Sea maize pressuring UK cereal exports

As mentioned previously, until the end of October, the UK was on track to clear the large exportable surplus of wheat and barley by the end of the season. This season, destinations including Spain, Netherlands, Portugal and Ireland have seen the largest volume of UK exports.

Since November however, UK export trade has reportedly dampened. Concerns surrounding the difficult winter planting conditions pushed UK cereal prices above European prices, reducing export competitiveness. Furthermore, we have also seen the increased competition for grain demand from Black Sea maize exports, which started ramping up in volume towards the end of 2019.

To highlight this, season-to-date EU imports of maize were at 12.2Mt as of 20 January. Despite increased EU grain production in the EU in 2019/20, imports of maize are only 0.8Mt below last year, and 3.6Mt above the 17/18 season. Over 50% of the imports originated from Ukraine, a consecutive annual ‘norm’ as the country fast increases its maize production. Of Ukraine’s 35.5Mt maize crop, the USDA pegs Ukraine’s maize exports this season at 30.5Mt.

Despite EU wheat and barley supply reaching higher levels in 2019/20 season, Spanish production was tighter raising the countries import demand. Total maize import levels for Spain stand at 5.2Mt (as of 20 January), 0.7Mt above the same period last season. Spanish total wheat and barley imports stand at 0.65Mt (as of 20 January), 0.15Mt above the same period last season.

Global wheat prices have seen increases recently, with support filtering through to UK wheat prices. Such increases will continue to widen the spread between UK cereal and Black sea maize prices. Ukrainian FOB maize prices are currently offered at £136.32/t (20 Jan), below UK barley FOB values of £141.00/t (14 Jan). While wheat exports are likely to tail off this year given tight supply expectations in 2020/21, UK barley trade is likely to continue facing strong competition from Black Sea maize supplies.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.