A bleak outlook for domestic rapeseed: Grain Market Daily

Tuesday, 9 June 2020

Market Commentary

- New crop UK, French and US wheat futures all closed down yesterday. The UK contract (Nov-20) closed at £169.00/t, down £1.00/t on Friday’s close. Showers over the weekend helped alleviate some drought concerns.

- US soyabean futures (Nov-20) closed yesterday at $322.61/t, down $0.55/t on Friday’s close. After last week’s rally from Chinese purchases, gains have been capped at the start of this week as the latest USDA crop condition report rated 72% of the US soyabean crop as good to excellent, up from 70% from the previous week.

A bleak outlook for domestic rapeseed

The latest crop development report released last month does not pose much confidence for UK rapeseed in 2020/21. We could be heading into the worst domestic rapeseed production this millennium.

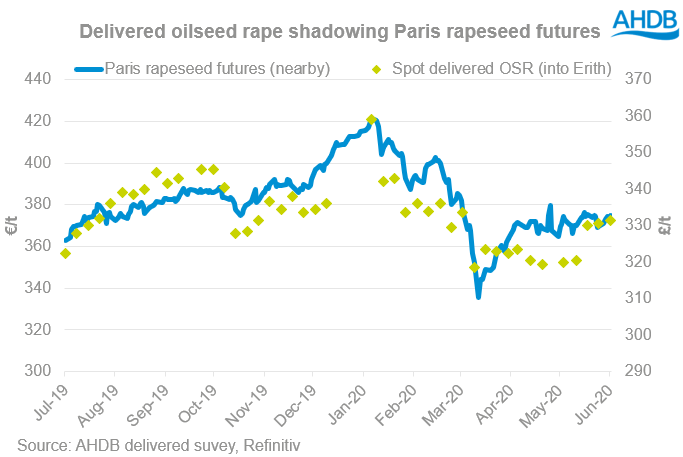

Despite the potential lack of domestic production, the UK’s rapeseed price will be at import parity to the EU’s continental price. The future outlook for rapeseed is a balance between crude oil markets being supported in a coronavirus recovery and production increases for the main global rapeseed exporters.

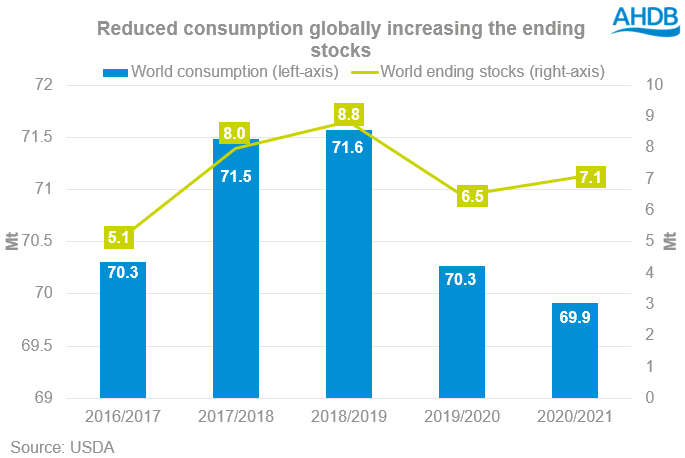

Outlook: global rapeseed markets

Going into the next marketing year the continental balances could be tighter as overall area planted in the EU reduces by 2% year-on-year according to EU analysts Strategie Grains and unfavourable weather conditions have potentially hindered production.

Therefore, imports of rapeseed into the EU have recently been revised up by 300kt to 6.0Mt, setting an import parity price into the continent that will eventually filter back down to our domestic market.

Although Europe’s balance of rapeseed may seem tight going into the next marketing year, large global exporters of OSR will help balance this deficit.

Canada is forecast to have a year-on-year increase in canola production of 76Kt according to the Canadian Department of Agriculture and Agri-food, putting their preliminary 2020/21 forecast production at 18.7Mt and recent dry weather in the prairies has helped canola drilling.

Australia are forecast to have a year-on-year increase of canola production to 3.1Mt according to the USDA after the unfavourable conditions for 2019/20, which saw a large fall in planted area. Recent localised rains in western Australia have aided the germination of planted canola crops.

Another key player closer to home is the Ukraine, at the moment there is disparities on the forecast 2020 production of the Ukraine crop between UkrAgroConsult (3.1Mt) and the USDA (4Mt). There are estimates that up to 10% of winter rapeseed area has been damaged over the winter months. What is key to note is that regardless of the exact production, the majority of this rapeseed will be an exportable cash crop.

The final point is the global economic recovery from the coronavirus. A faster recovery in theory will support crude oil prices, this in-turn will support the vegetable oil complex, just like it was pressured with crude oil several months ago. But economic risks will still remain.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.