GB OSR and winter barley yields down sharply: Grain market daily

Friday, 31 July 2020

Market commentary

- UK feed wheat futures edged lower yesterday, after a sharper drop in early trading, before recovering partially towards the end of the day. The Nov-20 contrast was down £0.60/t to £165.80/t, while the Nov-21 contract lost £0.80/t to £151.65/t and Nov-22 declined by £0.95/t to £136.10/t.

- The EU Commission further trimmed its estimate of EU-27 wheat production by 0.6Mt, to 123.8Mt. The Commission also cut its barley forecasts by 2.0Mt to 51.4Mt but increased its maize forecast to 72.5Mt.

- The French wheat harvest is now in its closing stages, with spring barley past the half way point (FranceAgriMer). Hot, dry weather this weekend should further help harvest progress, but is a worry for maize crops which are in their critical ‘silking’ stage.

- The proportion of the French maize crop rated as good / excellent slipped from 80% to 77% Between 19 and 26 July, though still up from the same point last year (61%).

GB OSR and winter barley yields down sharply

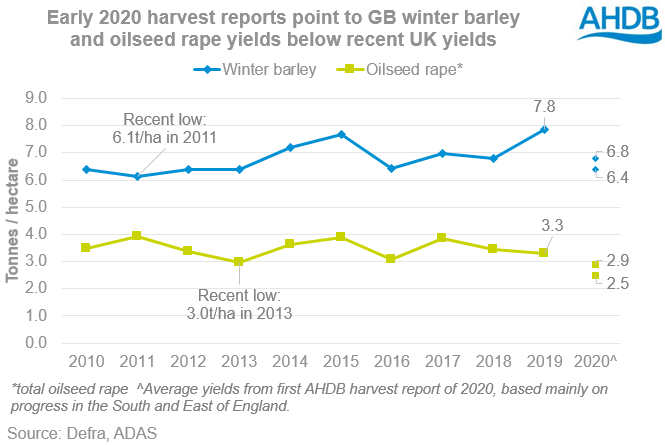

AHDB’s first harvest progress report of 2020 points to yields of both GB winter oilseed rape and winter barley being sharply down on both last year and the five year average.

Yields are also highly variable, both within and between farms. This is unsurprising given the extremely challenging season that crops have faced.

Nationally, early yield indications show that:

- Winter oilseed rape crops harvested to date are averaging 2.5-2.9t/ha, around 15-30% below the 5-year average (3.5t/ha). Oil content is reported to be typical so far.

- Winter barley yields to date have averaged 6.4- 6.8t/ha, around 4-10% down on the 5-year average of 7.1t/ha. There are also some reports of higher screenings and some higher N levels in the East, though it’s still early for quality data.

Especially for oilseed rape, it’s important to note that yields are calculated based on those fields that were taken to harvest; a high number of oilseed rape fields were written off by end-May. Where only part the field was harvested, the yield is calculated from the total field area.

The 2020 GB harvest is so far in line with typical progress for winter barley, and slightly ahead for winter oilseed rape. An estimated 56% of the GB winter barley area and 49% of the winter oilseed rape area was cut by 28 July. The wheat harvest has also started with small areas cut in the east.

What is the impact on price?

AHDB’s Planting and Variety Survey showed the English oilseed rape area at an 18 year low and small yields will compound the situation. UK prices are already positioned to stimulate imports to account for a small crop, so there’s unlikely to be too much room for further gains, unless the EU or world markets also lift. There could be potential for EU prices to lift later in the autumn but that’s dependent on the size of the EU and Ukrainian crops.

Given the surge in spring barley plantings this year, the UK will need to export barley onto the world market and ex-farm feed barley prices are some £40/t below feed wheat, reflecting that need.

The next AHDB harvest report is currently planned for Friday 14 August, depending on harvest progress.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.