Grains vs Oilseeds crop 2025: Grain market daily

Tuesday, 26 November 2024

Market commentary

- UK feed wheat futures (May-25) closed at £190.15/t yesterday, falling £3.30/t from Friday’s close. The Nov-25 contract also down £3.35/t over the same period, to close at £187.10/t.

- UK feed wheat futures followed Paris wheat futures yesterday. The European wheat market was under pressure from a strengthening euro against the US dollar and low export demand for EU wheat. The Black Sea region remains more competitive in the global wheat market. The EU crop report MARS said yesterday that favourable weather in most countries helped farmers to speed up the winter sowing campaign. Yesterday's USDA Crop Progress report showed that 55% of the US winter wheat crop was in good to excellent condition as of 24 November (up from 49% last week).

- Paris rapeseed futures (May-25) closed at €509.25/t yesterday, gained €4.50/t from Friday’s close. The Aug-25 contract up €0.25/t over the same period, to close at €469.00/t.

- Paris rapeseed, Chicago soyabean and Canadian canola futures made some corrections yesterday after falling last week. Meanwhile, crude oil plummeted as geopolitical tensions in the Middle East eased.

Grains vs Oilseeds crop 2025

Last Thursday, AHDB published its Early Bird Survey. The survey provisionally projects the UK wheat area to rise, but the rapeseed area to fall, provisionally projecting a 17% fall in planted area in 2025. If confirmed, this would reduce the oilseed rape area to its lowest area in the UK for 42 years.

The eternal dilemma for farmers around the world is whether it is better to sow grains or oilseeds, many things need to be analysed to draw final conclusions. We are now focusing on analysing the price ratio.

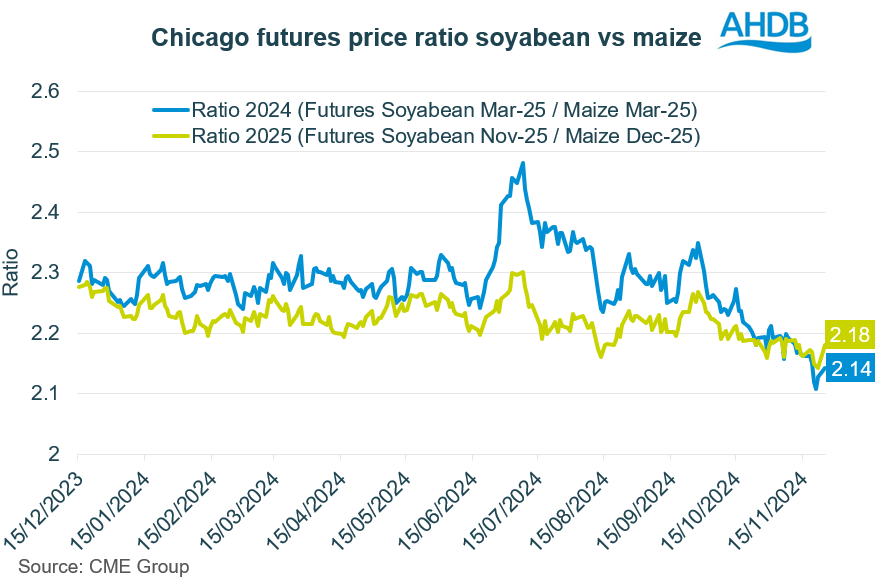

In the US, one of the most popular factors in deciding between soyabean and maize is the price ratio. Typically, if the ratio is higher than 2.5 (soyabeans prices 2.5 times higher than maize prices) it stimulates farmers to plant more soyabean. On the other hand, a ratio lower than 2.5 indicates that there will be a higher corn acreage in the US.

From 15 December 2023 to 25 November 2024, we could see that the Chicago soyabean/maize price ratio for the crop 2024 rebounded from its lowest level to reach 2.14. For the 2025 crop, it rebounded to 2.18 slightly above the lowest level for the same period. For now, we could conclude that corn looks preferable for planting in the US than soyabean.

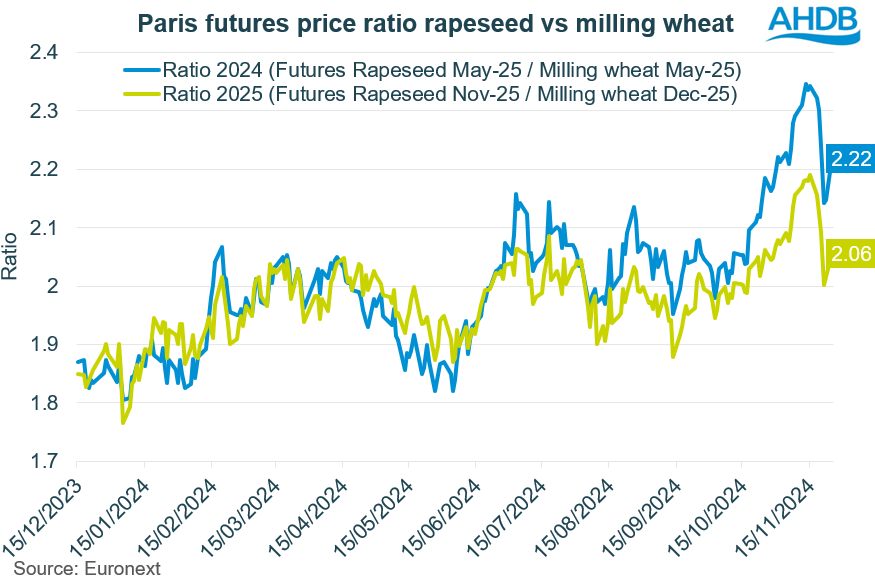

For the EU, it is more popular to compare the price ratio of winter rapeseed and milling wheat. Due to strong rapeseed futures price rally in October 2024 the rapeseed/milling wheat ratio reached the highest level in our data, 2.35 for 2024 crop and 2.19 for 2025 crop.

Looking ahead

In the competition between grains and oilseeds, grains are now more favourable. Indeed, the ratio between Chicago soyabean and maize futures (Crop 2025) shows the lowest level in our data. In contrast to Chicago the Paris rapeseed/milling wheat ratio peaked in October and the first half of November 2024 but has fallen sharply in favour of grains in recent weeks.

In Chicago soybean markets, speculators have a net short position in the week ending 19 November, while at the same date speculators have a net long position in Chicago maize. That put pressure on the ratio.

For the UK domestic market farmers planted more winter wheat for harvest 2025 and lower winter rapeseed areas. Traditionally higher average UK wheat yields compared to other producers are an additional factor in favour of grains.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.