How will the 2019/20 usage figures affect closing stocks? Grain Market Daily

Friday, 7 August 2020

Market Commentary

- London wheat futures (Nov-20) closed down £0.45/t yesterday at £163.55/t. The day’s low was £162.60/t, the lowest it has traded since 25 June.

- Wheat prices globally have come under pressure this week with Chicago wheat closing yesterday at $186.73/t down $11.21/t from Friday’s close. Paris wheat closed at €179.50/t, a loss of €3.25/t since last Friday.

- The Russian Ministry of Agriculture stated yesterday that their harvest was 49.4% complete with good yields reported.

How will the 2019/20 usage figures affect closing stocks?

Yesterday AHDB published the latest cereal usage statistic for both GB animal feed and UK human and industrial uses, which was the last month of data for the 2019/20 season. Below we explore the latest figures and what they could mean for 2019/20 closing stocks.

Animal Feed

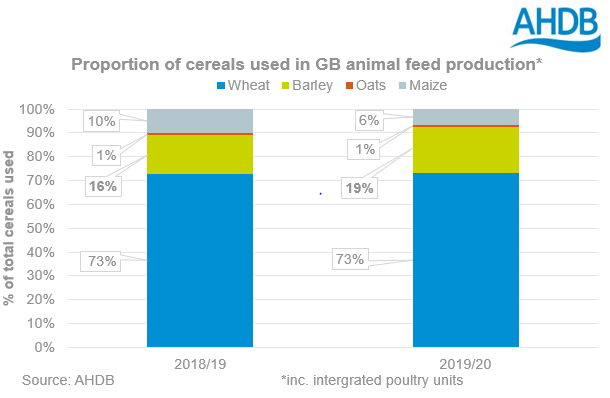

In 2019/20 wheat usage for GB animal feed was relatively stable year on year, up just 1.9% despite the largest wheat production since 2015/16 at 16.225Mt. The capped growth in wheat usage last season was partly due to a fall in overall animal feed production, as well as competition from barley. In 2019, UK barley production reached the highest level since 1988. For much of the season, barley was priced at a substantial discount to wheat, leading to increased barley inclusions in the animal feed ration, at the expense of wheat. Full season barley usage was 22.6% higher than in the 2018/19 season.

Human and Industrial

Total wheat usage by UK millers (including starch and bioethanol) for the 2019/20 was also very similar to the previous season’s levels, down just 0.4%, despite the impact of COVID-19. While demand for wheat by the milling industry dipped in the last quarter of the season, this was outweighed by a rise in wheat demand this season from the bioethanol sector. Looking at the split of wheat usage, home grown wheat milled was up 5.2% year on year while imported wheat milled was down 27.3%. This was largely due to the larger domestic crop, limiting the need for higher proportions of imported grain.

As Helen discussed yesterday, barley used for the brewing, malting and distilling sector was 6.4% lower than last year at just 1,769Kt. This shows the impact that coronavirus had, and is likely to continue having well into the 2020/21 season, on the industry.

What could this mean for carry-over stocks?

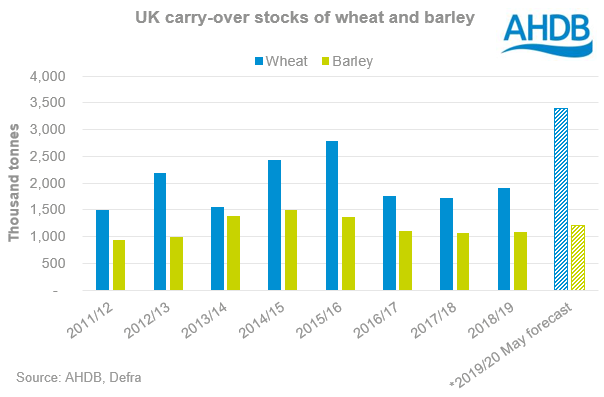

In May, carry-over stocks were forecast at 3,396Kt for wheat in the third official 2019/20 supply and demand estimates, which is the largest on record. Barley stocks were estimated at 1,216Kt, which is just under the 2014/15 – 2018/19 average of 1,227Kt.

The full season data for both GB animal feed and UK human and industrial usage is broadly in line with what was forecast for the balance sheets in May. However, it is important to remember that GB animal feed and UK human and industrial consumption are only a small part of the much larger complex driving UK supply and demand.

Other factors such as import, exports and Northern Ireland figures could play a large part in determining final carry-out figures. In the scenario that all other factors stay the same, it looks like we are still on track for a huge wheat carry out. This will help ease some of the tightness of supply going into a much smaller crop year.

Looking at barley, there is likely to be average closing stocks going into a large production year, which is expected to continue weighing heavily on both feed and malting barley prices.

We will publish the final balance sheet in the latter half of September when there will be actual figures for closing stocks of wheat, barley, maize and oats.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.