IGC predicts first global grain surplus since 2016/17: Grain market daily

Friday, 25 June 2021

Market commentary

- Global grain and oilseed prices mostly moved lower yesterday, due to rain in the US and selling by speculative traders in the Chicago markets. The rain is likely to help US crops ahead of critical growth stages in July for maize and late-July/August for soyabeans.

- UK feed wheat futures for Nov-21 fell £2.25/t to £169.20/t, while the Nov-22 contract fell £1.85 to 164.70/t.

- Winter barley harvesting is underway in France and Russia. As these crops will soon be secured, we may start to see some risk premium come out from prices. This is if the results are as expected and/or crop estimates are not reduced.

- Paris rapeseed futures for Nov-21 fell €0.50/t to €501.75/t yesterday.

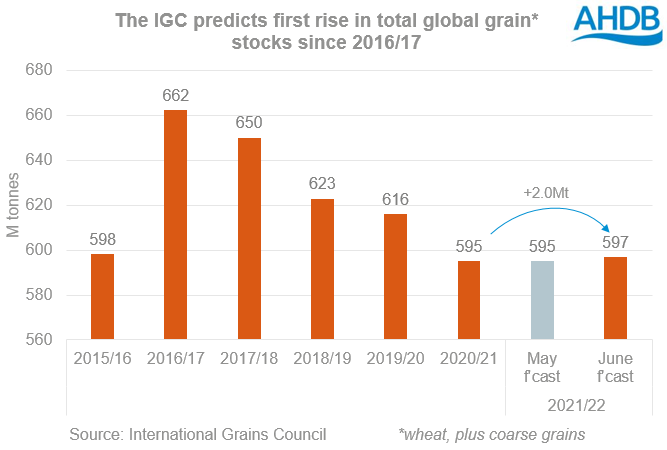

IGC predicts first global grain surplus since 2016/17

The International Grains Council (IGC) increased its forecast for global grain supply in 2021/22 by 9.0Mt yesterday, to 2,301Mt. This is a new record.

Demand also increased by 2.0Mt to 2,299Mt. The big increase in the grain crop shifts the global grain market from another deficit, to a tiny surplus (+2.0Mt). This would be the first global surplus and year-on-year rise in stocks since 2016/17.

The key change is a big (+5.5Mt) increase in Chinese maize production. But, Chinese maize imports in 2021/22 are only trimmed by 1.0Mt.

The global wheat crop in 2021/22 is pegged at 789.4Mt, 0.7Mt lower than in May. There are increases to the wheat crops in several top exporting countries, including Russia (+2.2Mt), Australia (+1.7Mt), the EU-27 (+1.4Mt), and Ukraine (+1.0Mt). But, there were more than offset by decreases for others, such as India (-2.0Mt) and Kazakhstan (-1.1Mt).

It is worth noting that the estimate of total grain stocks level at the end of 2020/21 is 595.0Mt. This is 4.0Mt lower than in the May report, due to tighter grain supplies in 2020/21. The Brazilian crop is -3.5Mt lower, plus there is higher domestic and export demand for US maize.

The impact on prices?

The predicted stocks are still very low. This leaves little room for error if supply gets disrupted. Overall, the IGC forecasts add to the picture that the supply might just be enough in 2021/22.

The critical weeks for US maize crops are beginning and the US maize crop accounts for more than 16% of total global grain output. So, the weather across the Midwest in the weeks ahead could have a considerable bearing on where prices go next. Hot weather in July would threaten the tiny global grain surplus and likely push up prices once more.

But, if there isn’t challenging weather, especially in the US, global grain prices are likely to drift lower in the coming weeks.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.