Imports to set the tone for UK feed grains: Grain Market Daily

Wednesday, 3 June 2020

Market Commentary

- New-crop UK feed wheat futures continued their retreat yesterday, with no new news to sustain their recent rally. Nov-20 futures fell a further £2.25/t yesterday, closing at £169.25/t.

- Global wheat futures have also seen declines this week, with recent weather drivers seemingly priced in. Movements in UK markets have been more erratic over the past week with large changes in sterling affecting the UK’s relationship to global futures.

- Looking ahead, the weather picture for key wheat regions in Russia and Ukraine is trending drier again over the coming fortnight. This dryness could offer further weather support if realised.

Imports to set the tone for UK feed grains

As we move towards harvest 2020, the value of imported grains and oilseeds will play a key role in setting the price of domestic supplies, the value of imported maize will prove pivotal to setting values in feed markets.

Over the past couple of seasons, we have seen increased usage of imported maize in animal feed and human and industrial use. The comparatively low cost of maize has made it an attractive option for domestic consumers.

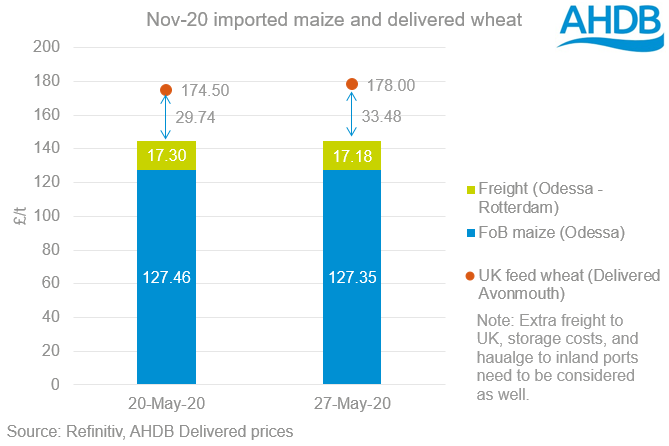

Last week, Black Sea maize (CIF Rotterdam, Nov-Dec) at port in the EU was quoted at £142.07/t - £144.52/t, by comparison UK feed wheat (Delivered Avonrange, Nov) was worth £178.00/t.

Obviously this is not a direct reflection of the cost of importing maize into the UK as we need to include extra freight to the UK, related costs and haulage to inland demand points, but can give a good indication of its competitiveness.

At the discounts we are seeing, imported maize may ease some of the pressure of a tight domestic wheat crop.

We have seen the impact of cheap maize previously, last season a large volume of maize was booked for import without a direct home, this maize stock then weighed heavily on the market pressuring domestic grain prices. This is a price risk we need to be aware of next season.

Finally, it is important to consider where next for maize values. Global maize stocks are anticipated to be heavy next season, with large production in South America, Ukraine and the US, combined with poor demand.

However, the return of demand from the ethanol sector and the large short position currently held by managed money funds in Chicago corn futures could signal a firming of markets, narrowing the spread between wheat and maize.

At AHDB we will continue to monitor the relative import parities.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.