Key takeaways from the final Defra production estimate: Grain Market Daily

Thursday, 19 December 2019

Market Commentary

- UK feed wheat futures (May-20) closed down £0.35/t, at £151.15/t. New crop (Nov-20) futures continued to rise, closing yesterday at $159.35/t, a previous high last reached on 7 November.

- Sterling continued to weaken against the dollar yesterday, as the US House of Representatives voted to impeach President Donald Trump. In response, the value of US soyabeans (May-20) continue to firm.

- Old crop Paris rapeseed futures (May-20) have continued to rise above €400.00/t. Futures have been climbing on the back of reduced supplies of rapeseed and tighter vegetable oil fundamentals.

Key takeaways from the final Defra production estimate

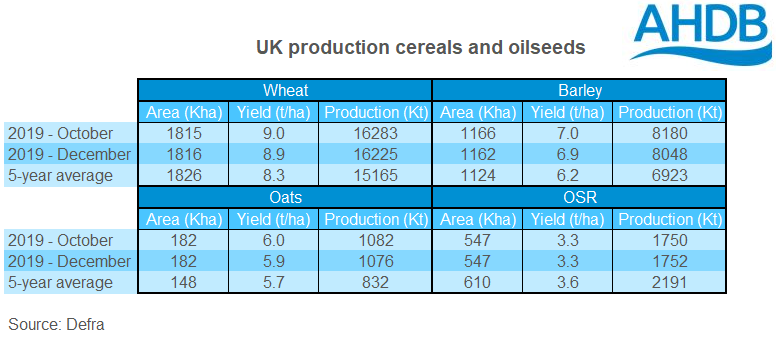

This morning Defra released the final estimates of 2019 production, including regional results. On a UK scale the results are largely unchanged versus the previous release in October. UK wheat, barley and oat production have all seen minor downward revisions, largely on the back of lower yield estimates. Meanwhile, oilseed rape production has been revised up all be it by just 2Kt.

OSR yields down in the South, up in the North

The regional picture for oilseed rape area reflects the pattern seen in the AHDB Planting and Variety survey results, albeit to varying degrees. When we look at the production figures however we can see the increasing challenges faced in the domestic market.

The largest drop in OSR production year-on-year, is seen for the East Midlands. Yields in the East Midlands reportedly declined by 12.6% versus 2018, this has resulted in an 110Kt drop in production. Similar yield challenges were seen in the South East, another region typically dogged by Cabbage Stem Flea Beetle. Regions further to the north saw yield increases according to the results of the survey, but, the declines in area fundamentally drove production losses in all regions except Wales.

Oat production up in low demand regions

As Alice and Anthony discussed in last week’s Analyst Insight, the increase in oat production provides a significant challenge for the domestic market. This is especially true when we start to get into the detail of where the increased oat production is. Oat production is up 93.7% in the East Midlands an area where demand is limited. Similar increases have been seen in the South East and South West, areas that will likely be heavily reliant on exports to shift the surplus.

The rise in oat production in the South goes someway to explain the supressed feed oat ex-farm price. The average ex-farm price of oats in trade to 12 December was just £104.80/t.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.