Looking ahead to tonight’s trio of USDA reports: Grain market daily

Tuesday, 12 January 2021

Market commentary

- May-21 UK feed wheat futures rose £1.50/t yesterday to £205.00/t, while the Nov-21 contract rose £1.00/t to £168.00/t. These prices are the highest yet for the May-21 and Nov-21 contracts.

- European wheat futures were supported by reports that Russia may increase its tax on wheat exports. A tax of €25/t ($30/t) is currently planned for exports between 15 Feb and 30 June but there are reports it could be increased further.

- In contrast, US prices for wheat, maize and soyabeans all declined. More rain fell in South America over the weekend than forecast, which is beneficial for maize and soyabean crops. Profit-taking and a stronger US dollar also contributed to the declines.

- Paris rapeseed futures (May-21) fell €1.75/t yesterday to €428.00/t, following the decline in US soyabean prices and lower palm oil prices.

- China now expects to import 10.0Mt of maize and 98.1Mt of soyabeans in 2020/21. The Chinese Ag Ministry increased its forecast by 3.0Mt each due to the widening gap between Chinese and global prices. These forecasts are still well below those made by the USDA in December: 16.5Mt for maize and 100.0Mt for soyabeans.

Looking ahead to tonight’s trio of USDA reports

Tonight the USDA release three reports that have historically influenced prices. These are the monthly world supply and demand estimates, US stocks as at 1 December and the area of winter wheat planted for harvest 2021.

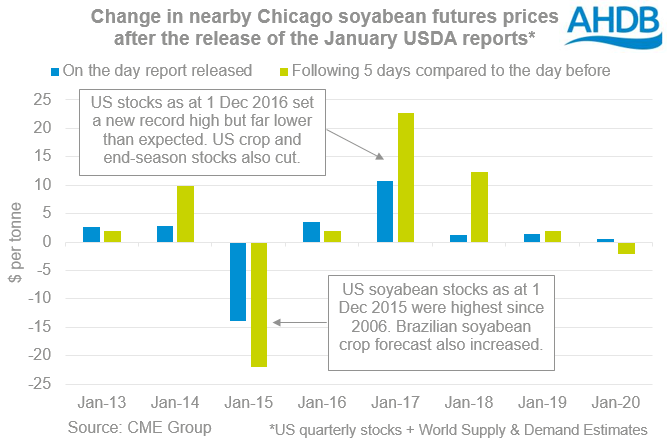

The impact on prices depends partly on the estimate but also what the market expects. In the last few years, the impact on prices from the release of these reports in January was limited. But there were far bigger reactions in previous years.

Some of the main things to look out for in tonight’s reports are:

World supply and demand estimates

- South American crop sizes. Crops in Argentina and Brazil are in poorer condition than last year because of dry weather in the region. The market expects the USDA to trim maize and soyabean production, according to an industry poll by Refinitiv.

- Global stocks. Lower South American crops are expected to result in lower global maize and soyabeans stocks at the end of the 2020/21 season. Global wheat stocks are also expected to be trimmed.

- Chinese imports. China is importing more maize and soyabeans this season and the extra demand is helping to push up prices. As such, the forecasts for Chinese imports are worth monitoring.

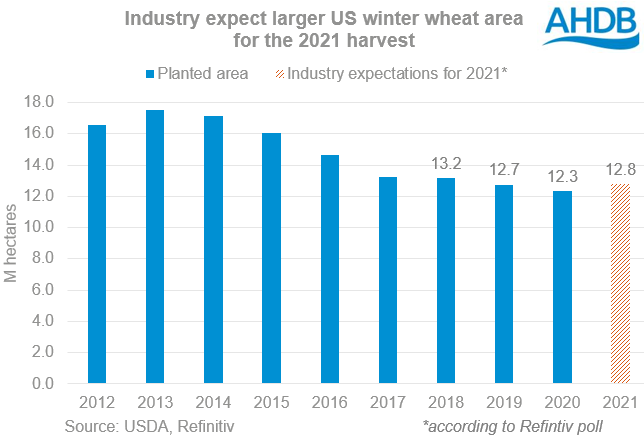

US winter wheat area

The US winter wheat area is expected to be larger than the record low planted for harvest 2020. But, the average area from a Refinitiv poll is still historically small.

A larger winter wheat area means a bigger crop than last year is more likely. This assumes the spring wheat area doesn’t fall and the rest of the growing season is kind. More US wheat next year could help offset lower stocks (this season) and help compensate for any problems in Russia and Ukraine.

US quarterly stocks

We will get more insight into the amount of wheat, maize and soyabeans used within the US from the data on US stocks as at 1 December 2020.

The market expects large drops in soyabean and wheat stocks from 1 December 2019 (average of a poll by Refinitiv). But the poll shows the market expects maize stocks to rise.

Exports of wheat, maize and soyabeans have all been rapid this season. But the amount of maize used as animal feed and to produce ethanol is less clear. Ethanol production is higher than it was after the first coronavirus lockdowns were announced. However, it is still not back to pre-pandemic levels.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.