Market Report - 25 October 2021

Monday, 25 October 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

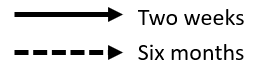

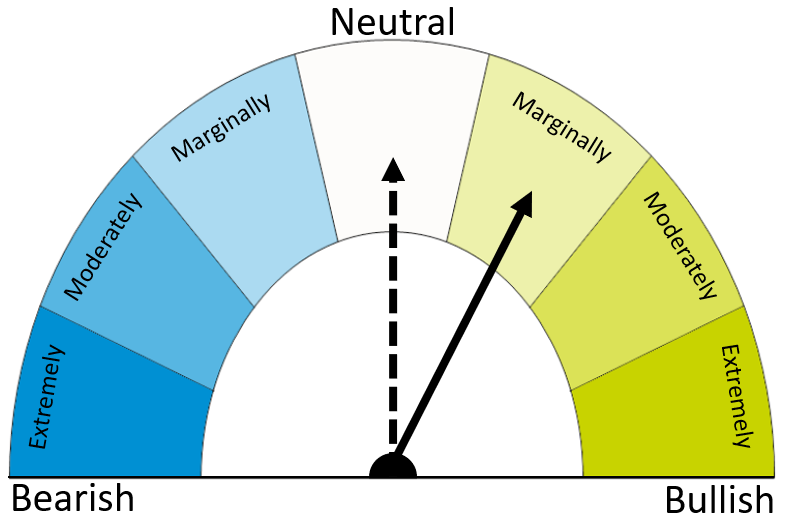

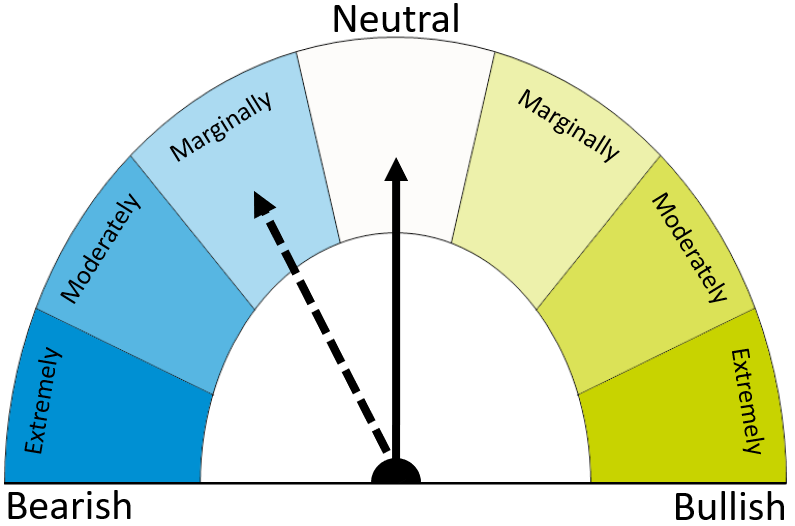

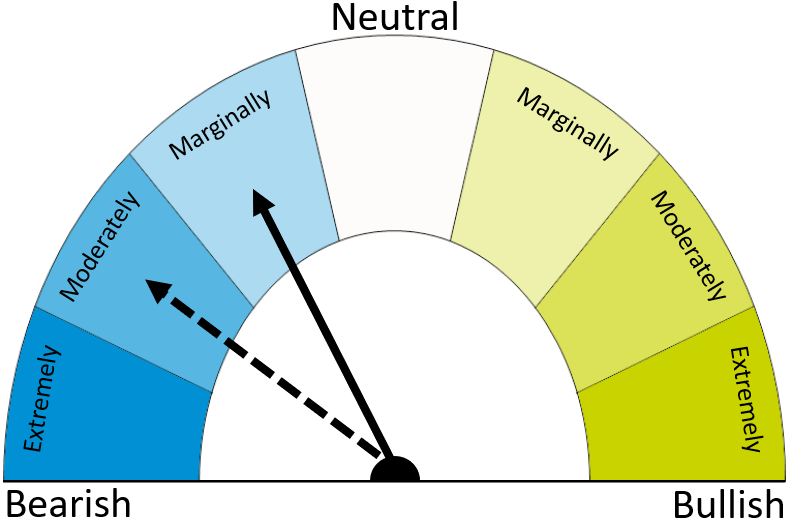

Following requested feedback earlier in the year, we have amended our dials. The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Whilst still awaiting southern hemisphere grain crops, there could remain support due to the tight outlook. However, depending on what Australian yields are realised, the market could swing either way.

Record Brazilian crops are still anticipated as early soyabean planting should allow optimum planting for the safrinha crop, but demand is unknown still. Short-term pressures come from the US and EU harvest progress.

Barley continues to track wheat markets. With a tight outlook, there is no need for extended discounts to wheat.

Global grain markets

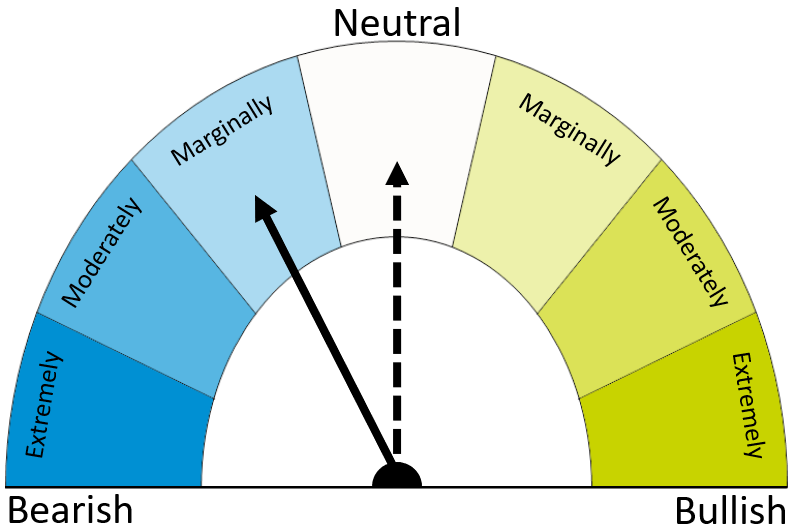

Global grain futures

Another mixed week for global grain markets last week. Chicago wheat and maize markets (nearby) gained Friday-to-Friday $8.08/t and $4.82/t respectively. The Paris milling wheat nearby contract also ended the week higher (+€4.00/t), closing Friday at €280.00/t, yet another contract high. UK futures bucked the trend though. UK feed wheat (nearby) lost £1.85/t from Friday-to-Friday, closing the week at £206.65/t. The Nov-22 contract also slipped last week losing £2.65/t on the week, closing at £191.10/t.

On the back of high fertiliser prices, there are rumours that US corn acres may be dropped with soyabeans planted in their place. However, despite a La Niña alert now in place, Brazil has experienced better planting conditions from last season. September/October rains have aided soyabean planting which was 45% complete last week in the state of Mato Grosso (the largest state producer). Early soyabean planting should result in the safrinha (second) maize crop being planted in the optimal window. The safrinha crop contributes c.75% of Brazilian maize production and this year Brazil is anticipating record crops. EU harvest is also progressing well now, with Stratégie Grains increasing their maize forecast to 67.5Mt last week.

Despite a slightly bearish sentiment in maize markets, wheat finds continued support from a tight global outlook. Tightening supplies in Russia, the world’s biggest exporter, set a bullish tone across the world. Wheat markets are awaiting Australian yield confirmation to confirm or deny another bumper crop, which could ease global supply pressures. Sources suggest Australian ports are fully booked in December and nearing full in January. ABARES are predicting 2021/22 Australian wheat exports at 23Mt, 3% down from 2020/21 estimates, but 33% higher than the ten-year average. If Australian yields don’t match expectation, we could see another boost to global wheat markets.

UK focus

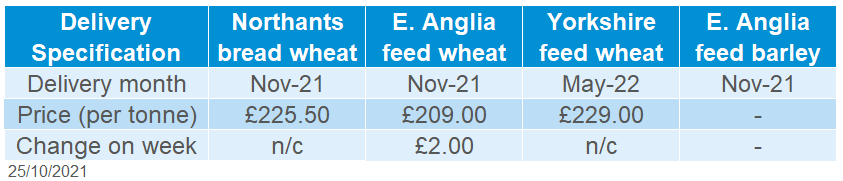

Delivered cereals

UK feed wheat futures (Nov-21) slipped last week to close Friday at £206.65/t, but remains £4.40/t higher across the fortnight.

Physical prices saw a similar pattern with feed wheat delivered into Avonrange (November 2021 delivery) dropping £0.50/t across the week, but still up £3.00/t across the fortnight. Bread wheat prices have gained much more across the fortnight. Quoted at £255.50/t for November delivery into Northampton last Thursday, this is up £11.00/t from two weeks prior.

The UK market is relatively volatile and often quotes into our delivered cereals survey don’t meet the data validation criteria that we have in place. In some cases, we have seen spreads of more than £10/t between the high and low quotes. Producing a price from such a range would skew the market in one direction or another, leaving prices unable to be published.

Oilseeds

Rapeseed

Soyabeans

Short-term, rapeseed remains top of the oilseed complex. Inelastic demand means that its premium has widened to soyabeans. A bumper Australian crop is welcomed, but is still feared not enough to fulfil demand.

US harvest is currently underway, with better-than-expected yields. Large South American crops anticipated in 2022 sets an increased bearish tone, although this relies on no significant negative weather event.

Global oilseed markets

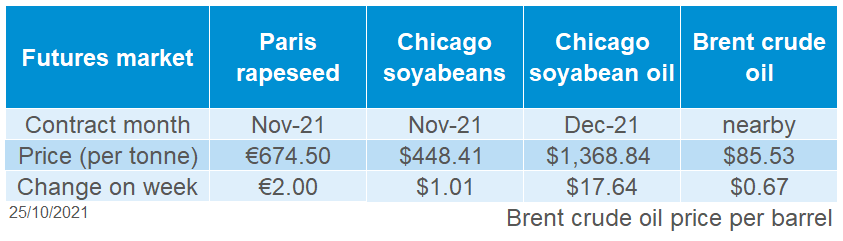

Global oilseed futures

Chicago soyabeans (Nov-21) gained 0.23% last week, after dropping to their lowest price since the end of March 2021 during the week before.

Soyabeans were supported at the beginning of the week, underpinned by firming crush margins. The strengthening of Chicago soyoil futures (Dec-21) (+1.31%) across the week helped improved crush margins.

Although gaining slightly across the week, larger increases were constrained by better-than-expected yields from the US harvest and a slip in veg oil markets at the end of the week. Malaysian palm oil futures (+3 months) were down 0.75% across the week.

Malaysian palm oil exports (1 – 25 October) were estimated at 1.20Mt. This is down from September’s (1 – 25 Sep) revised figure of 1.31Mt (AmSpecAgri).

Chicago soyoil was lifted by gains encapsulated in crude oil markets; Brent crude oil (nearby) gained 0.79% across the week, to close Friday at $85.53/barrel.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-21) followed a similar pattern to soyabeans with support at the start of the week, followed by slight pressure. However, the contract closed Friday at €674.50/t, gaining €2.00/t across the week.

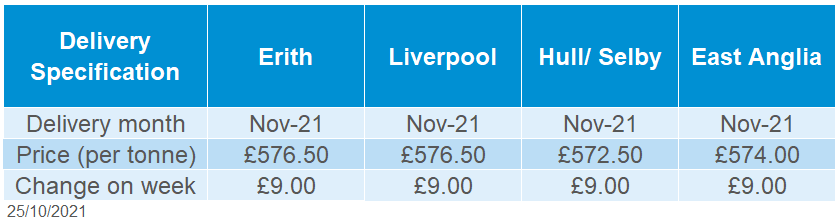

Delivered rapeseed (into Erith, Nov-21) was quoted at £576.50/t, gaining £9.00/t on the Friday before.

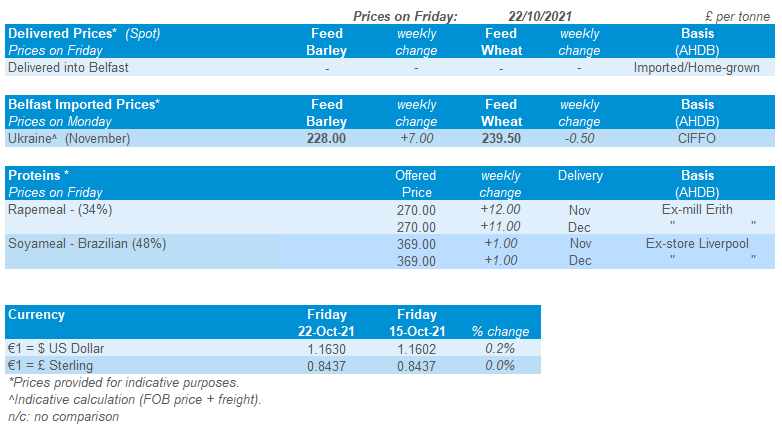

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.