Old crop support and new crop pressure, mixed signals for UK grain: Grain Market Daily

Tuesday, 5 November 2019

Market Commentary

-

Sterling has continued to remain supported over the last three weeks, with the inter day volatility decreasing following previous gains, at £1=€1.1578 by 3pm yesterday.

-

Gains in Brent crude oil have lent support to the oilseed complex, increasing over 3% from 31 October to yesterdays close, a five week high. Paris rapeseed (May-20) gained €4.75/t in response over the same time period.

-

New crop UK feed wheat futures have failed to continue to record gains over the last week. Until information on how winter planting has been affected is available, then further gains may be limited.

Old crop support and new crop pressure, mixed signals for UK grain

Further mixed messages for global grain markets were released in yesterday’s USDA crop progress report, with additional supportive factors for the current crop year, but a somewhat bearish tone for new crop wheat.

Old crop sentiment

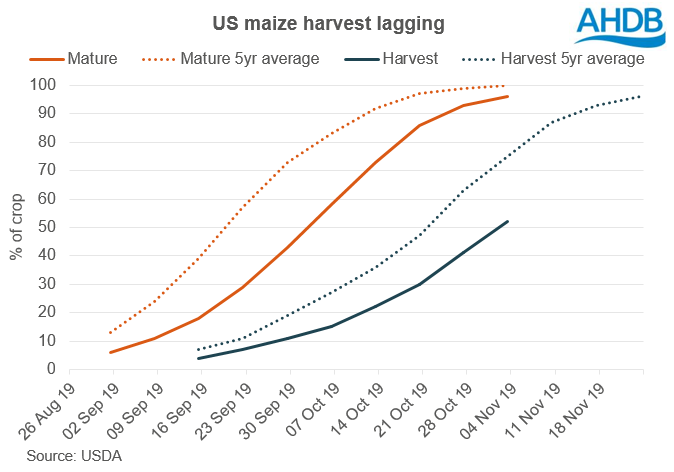

Further support to old crop global grain markets was provided as the harvest of US maize only just ticked past the half way mark by 3 November. This is well behind the average for this point in the year. A clear geographical north/south divide has taken place, with the northerly states the most delayed. Further support may also be provided by downgrades to the Argentinian and Australian wheat crops once harvest progresses and yields are better known.

A combination of these factors are likely to be borne out in the November USDA WASDE, due out on Friday. Yet although there has been a potential month on month decrease in the “on paper” grain supply for 2019/20, the exportable wheat surplus across the EU, Black Sea and US will keep a lid on potential major gains.

New crop prospects

The prospect for next year’s wheat crop in the UK has been deteriorating amid planting delays. This has led to a rally in Nov-20 futures and gaining relative to global markets. However, as I’ll cover on Thursday, the UK can only price up to the point at which imports are price competitive.

On a global level, the early prospects for next year have a somewhat bearish tone. In contrast to the UK, winter wheat planting in the US has been ahead of average, with the condition of the early emerged crop in better condition year on year.

With a potential domestic shift from net exporter to importer, the direction of global markets may appear contradictory, supporting a well-supplied UK market but capping the potential gains in a tightening outlook.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.