Pressure continues on wheat: Grain market daily

Friday, 2 February 2024

Market commentary

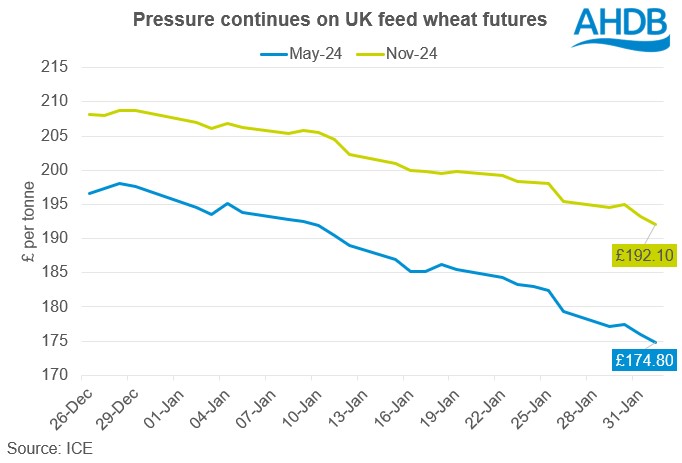

- May-24 UK feed wheat futures closed yesterday at £174.80/t, down £1.15/t on Wednesday’s close. New crop (Nov-24) futures closed at £192.10/t, also down £1.15/t over the same period

- Old crop (May-24) Paris wheat futures rose slightly, while new crop (Dec-24) futures dipped slightly. Chicago wheat futures closed higher yesterday on technical buying and short coverings. But, worries about weak demand and competition from Black Sea supplies continue to keep the sentiment pressured. See below for more details

- Paris rapeseed futures (May-24) closed at €422.50/t, down €5.75/t on Wednesday’s close. Rapeseed markets were pressured by Chicago soya bean futures, which fell from disappointing US export sales. Net US weekly soya bean export sales (to Jan 25) in 2023/24 were pegged at 164.5 Kt (USDA), the lowest so far this marketing year and well below trade expectations

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Pressure continues on wheat

UK feed wheat futures continued to drop this week. Yesterday, the May-24 contract closed at £174.80/t, down £1.15/t on Wednesday’s close and another new low for the contract. New crop futures (Nov-24) closed at £192.10/t and are now approaching the contract’s lowest price (£189.40/t).

Global grain prices have been under significant pressure recently from weak demand and falling export prices in Russia. For example, Russian spot feed wheat for export (FOB, Novorossiysk) was quoted at $202.50/t (£159.80/t) yesterday (UkrAgroConsult, ECB).

This bearish sentiment could continue as the Russian Agriculture Minister projects that the total 2024 grain area will increase by 300 Kha, to 84.5 Mha. An estimated 20 Mha of the area is winter crops and as of December, 96% of crops were in a good or satisfactory condition.

European prices need to track Russian prices to stay competitive on the export market, and UK prices follow European price trends. So, any further falls in Russian prices will likely feed into domestic ex-farm wheat values.

It’s not only Russian crops faring well; winter wheat in the USA is also experiencing significantly better conditions than last year. In a weekly drought update, 17% of US winter wheat was growing in drought conditions, as of 30 January 2024 (USDA). This is down from 22% from the previous week and a significant improvement on this time last year (58%).

With competitive Black Sea supplies dominating wheat markets currently, the absence of any large international tender is pressuring grain markets. As prices decline, it gives large global consumers little incentive to buy more than their minimum requirements.

For wheat markets to be significantly supported we are going to need a major weather event. Currently, the rapid progression in the plantings of Brazil’s second maize crop is not offering any support.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.