Prices fall on a more bearish WASDE: Grain market daily

Wednesday, 13 July 2022

Market commentary

- UK feed wheat futures retreated yesterday, with the Nov-22 contract settling at £276.70/t, down £10.45/t from Monday’s close.

- UK markets followed the downward move of US markets, following a more bearish WASDE report – read more below.

- Paris rapeseed futures (Nov-22) closed at €678.75/t on Tuesday, down by €21.25/t from Monday.

Prices fall on a more bearish WASDE

Global grain and oilseed markets retreated yesterday, following the publication of the latest USDA World Agricultural Supply and Demand Estimates (WASDE). The latest report gave a more bearish outlook for global grain supply and demand for 2022/23 than the June estimates and in some cases than pre report expectations.

Wheat

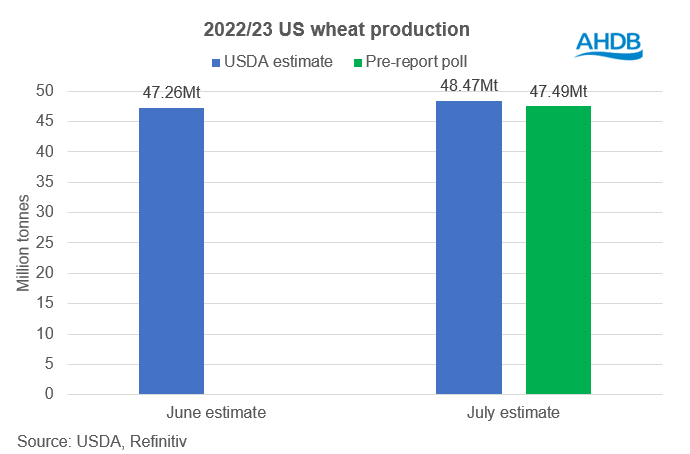

Drier than usual weather conditions across the EU and Argentina, alongside the conflict in Ukraine, prompted the USDA to lower its latest wheat output projections in those countries by a total of 4.5Mt for 2022/23. However, this was partly offset by upward revisions to US (+1.2Mt), Canadian (+1.0Mt) and Russian (+0.5Mt) wheat production on the back of higher yields and harvest area. Initial market expectations were for a more modest US output increase, of circa 230Kt, to 47.5Mt, according to a Refinitiv pre-report poll.

Despite a cut to global wheat production, a projected rise in carry in stocks and a fall in domestic feed usage has led to an uptick in end-season stocks. 2022/23 world wheat end-season stocks are now pegged at 267.52Mt, up from 266.85Mt in June.

Maize

Chicago maize futures (Dec-22) hit a one-week low yesterday amid WASDE projections for higher global ending stocks as a result of larger carry in stocks and lower demand.

Global maize ending stocks are now projected at 312.94Mt up from 310.45Mt forecast in June. Maize consumption is forecast down by 1.04Mt, while 2022/23 opening stocks have been revised up by 1.36Mt.

Soyabeans

Soyabean markets were pressured yesterday by weaker import projections from China (-1.0Mt) in the WASDE. However, overall losses where capped by trimmed global output projections (-4.0Mt) on June estimates, to 395.37Mt for 2022/23

China is now expected to draw down more of its domestic soyabean inventories than import as high volumes, which will likely add pressure to global markets. The country this week released 500Kt of product from inventories to sell on the domestic market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.