Prospects for new crop UK feed wheat futures: Grain market daily

Friday, 16 May 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £181.75/t yesterday, up £1.70/t from Wednesday’s close. The May-26 contract gained £0.75/t over the same period, to close at £191.60/t.

- UK feed wheat futures closed higher yesterday, in line with the global wheat market. Chicago wheat and Paris milling wheat futures (Dec-25) rose by 1.3% and 0.6% respectively. Wheat prices were supported by weather-related risks and the activation of new tenders by importers.

- Paris rapeseed futures (Nov-25) closed at €482.50/t yesterday, down €5.25/t from Wednesday’s close.

- Chicago soyabean and Winnipeg canola futures (Nov-25) were down by 2.5% and 3.5% respectively. The upward trend in global vegetable oil prices seen at the start of the current week was extinguished, with falling crude oil prices and low demand for imported vegetable oils from India being among of the main reasons for this.

Prospects for new crop UK feed wheat futures

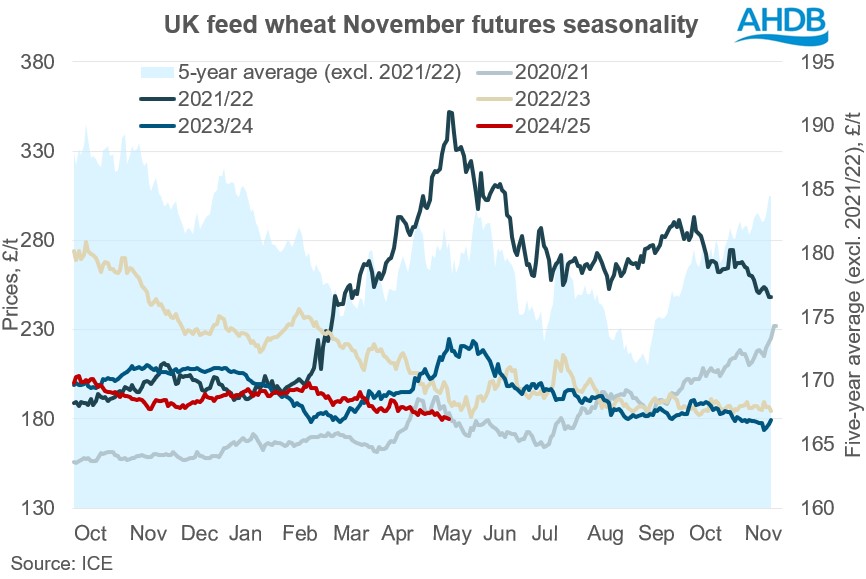

The current week is very active in terms of reports that could influence grain and oilseed prices in both the short and longer term, including domestic prices for the coming harvest. UK feed futures prices for November are currently at their lowest level at this point ahead of harvest in three years.

What could shape price prospects?

Monday's USDA World Agricultural Supply and Demand Estimates (WASDE) report provided a first look at expectations for the 2025/26 season. The forecasts continue the trend from the last five seasons of falling global ending stocks for wheat and maize, which has the potential to be supportive to prices if we see production issues.

However, the macro-economic environment and concerns about demand could still overshadow the low stocks. Also, the USDA showed improving US winter wheat crop conditions and good planting for the spring crop. US crop conditions will continue to remain a watch point heading towards harvest and any further improvements will likely have a bearish influence on markets.

Yesterday, Stratégie Grains showed EU-27 soft wheat production at the 2025/26 season at 129.8 Mt, up from the 128.1 Mt forecast in the April report. Better prospects for Romania, Bulgaria and Spain outweigh dry weather risks in northern Europe. This could put pressure on wheat prices for the 2025 crop in the EU, with knock-on impacts for UK prices.

Turning to the domestic market, a UK-US trade deal could negatively impact demand for UK feed wheat. If demand for bioethanol dropped, the market may need to also consider exporting more grain.

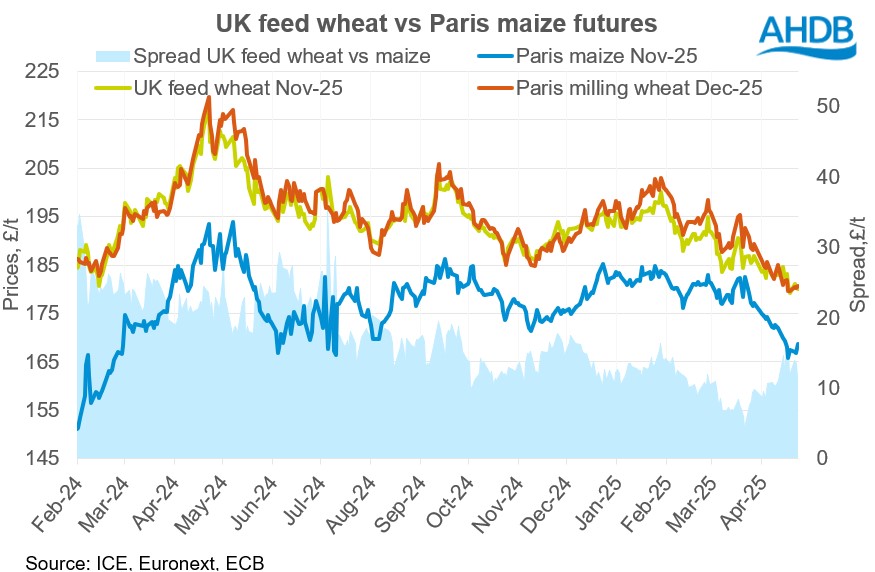

On the other hand, a low level of difference to Paris maize futures could be a supportive factor for the domestic feed wheat. The spread between Nov-25 UK feed wheat and Paris maize futures reached its lowest level of £4.29/t in April 2025. The futures price spread has since corrected, reaching £11.3/t as of 14 May 2025, though it remains well below the levels seen last spring and summer.

Looking ahead

The approaching wheat harvesting period in the Northern Hemisphere could put pressure on the market. Harvesting usually starts in late May in the US and is also rapidly approaching in southern Europe.

However, the risk of adverse weather conditions is still a key concern for market participants. Also, low global maize stocks, combined with a low-price difference between UK feed wheat futures and Paris maize futures, could provide some support for the domestic feed grain.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.