Rapeseed maintains strong premium over soybeans: Grain market daily

Wednesday, 23 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £184.60/t yesterday, up £1.50/t from Monday’s close. The May-25 contract lost £0.10/t over the same period, to close at £198.00/t.

- Support for UK feed wheat nearest futures came from Chicago wheats futures (Dec-24), which saw a marginal increase of 1% over the same period. The Chicago wheat futures gained strength from higher US maize exports and as markets adjust to Russia’s steps to regulate wheat exports. In contrast, Paris milling wheat nearest futures were pressured yesterday due to competitive exports from Russia.

- Paris rapeseed futures (Nov-24) closed at €511.50/t yesterday, gaining €7.00/t from Monday’s close. The May-25 contract gained €4.25/t over the same period, to close at €512.25/t.

- European rapeseed gained support from Winnipeg canola and Chicago soybean futures yesterday. Current soyabean prices in the US are incentivising demand in the physical market. US exporters are racing to ship soybeans as the looming US election is stoking tariff worries.

Rapeseed maintains strong premium over soybeans

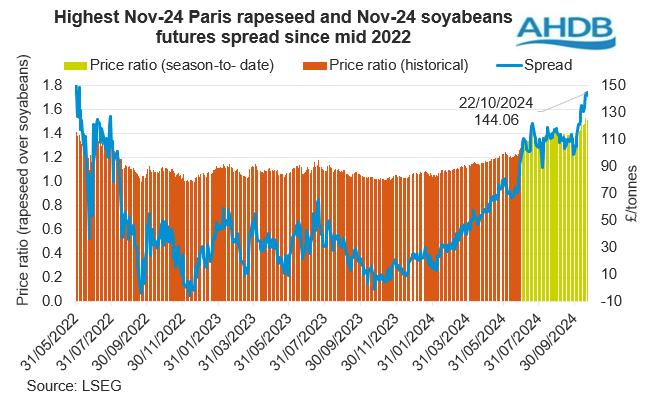

In recent weeks, Paris rapeseed futures (Nov-24) have kept a strong premium over Chicago soyabeans futures (Nov-24), even though both have seen gains. The strong support for rapeseed is largely driven by fundamental supply and demand dynamics, including lower harvest estimates this year and increased demand.

Typically, rapeseed and soyabeans prices move in the same direction and fluctuate within a certain range. However, the sharp increase in rapeseed prices recently has further widened the price gap between the two crops. From July to yesterday’s close, Nov-24 Paris rapeseed futures gained £19.33/t, while Nov-24 Chicago soyabeans futures lost £40.32/t.

.png)

What is the impact on price spread?

The price spread between Nov-24 Paris rapeseed futures and Nov-24 Chicago soyabeans futures reached £144.69/t yesterday, the highest level since mid-2022. This season (July-to-date), the average price ratio between the two commodities has risen to 1.39, compared to the previous ratio of 1.12 since May 2022.

Could the spread widen further?

The expectation of lower global production this year is likely to keep rapeseed prices elevated. Both yields and planted areas for rapeseed are expected to be significantly lower in the UK and EU-27, with potentials for further declines. According to the latest USDA estimates, production cuts are projected in the EU (-13%), Ukraine (-24%), and the UK (-28%) compared to last year.

In the short term, further support for rapeseeds could come from strong Canadian canola exports. Winnipeg canola was supported yesterday, with further support possible following Canada’s recent announcement of a temporary remission of tariffs on certain Chinese imported goods. Increased Chinese purchases of Canadian conola could positively impact rapeseed prices.

Another factor limiting the upward movement of soybean prices is the ample supply expected this year. This has capped gains in recent weeks despite strong support from the broader oilseeds complex.

What does this mean back home?

The UK will be more reliant on rapeseed imports this season due to a significant reduction in domestic production. However farmers could benefit from higher prices potentially balancing the increased risks and potential weather and pest related losses associated with growing the crop in recent years.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.