Sentiment and weather driving grain markets: Grain market daily

Tuesday, 18 May 2021

Market commentary

- Nov-21 UK feed wheat futures fell £4.45/t yesterday to £178.55/t due to rain in key global growing areas (see below) and stronger sterling. This is the lowest price since 20 April.

- Spot ex-farm feed barley in England & Wales averaged £177.00/t in the week ending 13 May. This is £3.30/t more than the previous week as feed barley is reportedly getting harder to source. The latest price is also just £22.70/t below the average for feed wheat, the smallest discount since March 2020.

- In April, members of the US National Oilseed Processors Association (NOPA) crushed 7% fewer soyabeans than in April 2020. The market had expected a fall of 2%, according to a poll by Refinitiv. The weaker than expected demand contributed to a fall in Nov-21 Chicago soyabean prices.

Sentiment and weather driving grain markets

Weather and crop conditions continue to drive day-to-day movements in grain markets.

Stocks of grain held by major exporting countries are thin. Last week’s USDA report showed more potential for stocks to recover next season than some in the industry expected, pushing prices lower. But, that potential for recovery is still only small, so any threat to global crops is still causing swings in market sentiment and so prices.

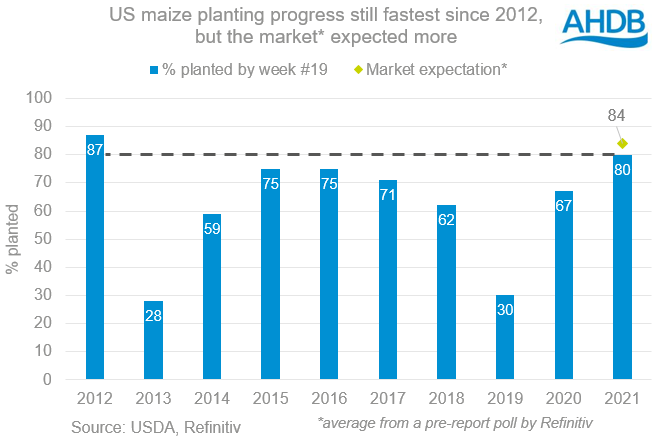

Slow planting bolstered maize futures…

US farmers planted less maize than the market expected by 16 May. Any delays to the US crop will have implications for US supplies in the last days of the season because of low stocks. The planting progress data, and new export demand, offered some support to old crop maize prices. Chicago maize futures for Jul-21 rose $3.45/t to $256.89/t yesterday.

Private exporters reporting another 1.7Mt of sales of maize to China for 2021/22 delivery. This reminded the market that Chinese demand remains historically strong. So although the Dec-21 contract declined by $2.16/t yesterday to $211.52/t, it is trading higher today (as at midday).

…while wet weather weighed on wheat

Wheat futures prices on both sides of the Atlantic fell yesterday due to rain in key wheat growing areas. Paris wheat Dec-21 futures fell €3.75/t to €214.00/t, while Chicago wheat futures fell $2.57/t to $258.19/t.

Northern US states and parts of Canada are expecting rain this week. Soil moisture is low in these areas, which grow mainly spring wheat, so rain would be very welcome. Spring wheat planting is well ahead of average in the US and the top Canadian wheat growing province, Saskatchewan. However, cold temperatures are slowing planting progress in the other Canadian Prairie provinces, Manitoba and Alberta.

Rain also fell over the weekend in Germany, and more is expected this week. Crops are behind typical development and the rain may help them to catch up. Rain is also forecast for France.

However, it’s not one-sided for wheat. Over half (53%) of the US winter wheat crop is now at ear emergence (5 percentage points back on the 5-year average) and so more sensitive to adverse weather. Coupled with this, the proportion of the crop rated as good or excellent slipped slightly from 49% last week to 48% as at 16 May.

With demand remaining strong, fundamentals and the sentiment surrounding these may well continue to cause price swings as the season continues. As such, they will remain key watch points for all major grain exporters.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.