Still confidence in Brazilian soya bean crop: Grain market daily

Friday, 24 November 2023

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £196.25/t, down £0.05/t on Wednesday’s close. New crop futures (Nov-24) closed at £206.00/t, down £0.25/t over the same period

- Old crop Paris wheat futures ended down slightly from a lack of direction from the US market with markets closed for Thanksgiving. Also, the euro strengthened, which will not help EU exports, especially in a time when significantly cheaper Black Sea origin-grain is being exported

- Paris rapeseed futures (May-24) closed yesterday at €441.50/t, down €3.50/t on Wednesday’s close. ICE canola futures also dropped, with US oilseed markets closed. Forecast rains in parts of northern Brazil could have added to pressure on rapeseed markets

Still confidence in Brazilian soya bean crop

November has seen volatility for oilseed markets on the back of the ongoing dry weather in Brazil, which has impacted the plantings and early development of their record soyabean crop. Conab reports that 65.4% of the record crop is in the ground to 18 November. Although plantings have progressed week-on-week, they are still behind the same point last year of 75.9% complete.

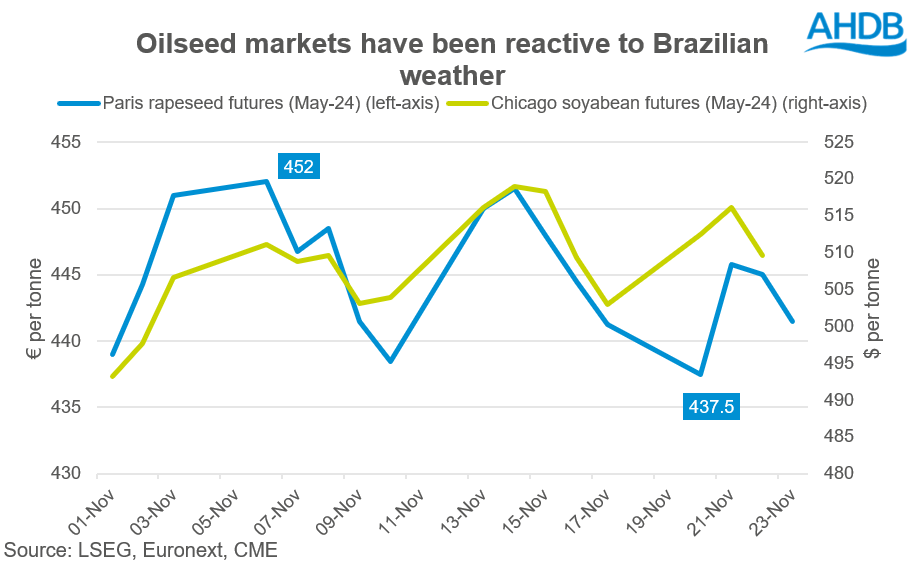

Over the past four weeks, moments of dryness have supported oilseed markets, then forecast rains have in turn pressured the market. In November, Paris rapeseed futures (May-24) closed between €437.50/t to €452.00/t, this has been due to movements in Chicago soyabean futures, too.

In spite of the volatility, there is still a huge amount of confidence in this Brazilian soya bean crop being a record.

Last week, agribusiness consultancy AgRural marginally revised its Brazilian soya bean crop down by 1.1 Mt, but still estimated the crop at a record 163.5 Mt.

On Wednesday, Agroconsult reported that despite the weather issues in Brazil, it is also still estimating a record crop of 161.6 Mt. Despite irregular rainfall in centre-northern regions of Brazil hindering production, a larger sown area combined with yields improving in the south (Rio Grande do Sul) due to on-going rains, will shelter some of the losses.

Despite marginal revisions so far, the USDA estimates Brazilian soyabean ending stocks for 2023/24 at 39.7 Mt – a record. So, how much impact would downward revisions make to the global market?

We have a rapeseed market that has been finding some support from Brazilian dryness concerns. However, evidence and information available currently shows that plentiful supplies are still expected to be produced in Brazil at the moment. However, markets will remain reactive to news on Brazilian weather, keeping some market volatility short term, as US soyabean ending stocks for this marketing season are forecast to be the tightest since 2015/16, due to strong domestic consumption.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.