Tight rapeseed supply keeps new crop prices elevated: Grain market daily

Friday, 18 March 2022

Market commentary

- UK feed wheat futures (May-22) closed yesterday at £299.00/t, up £1.50 from the day before. This ranks as the fourth highest settlement price for the contract. This said, the volume traded was the lowest since 17 February 2022.

- Paris rapeseed futures (May-22) closed at another record high yesterday of €928.50/t, up €29.00/t from the day before. The market remains volatile though, trading in a €53.25/t range yesterday.

- Chicago maize futures (May-22) almost regained its losses from Wednesday, closing yesterday at $297.05/t. This is up $9.65/t from the day before.

- Chicago wheat futures (May-22) gained $10.57/t yesterday to close at $403.41/t.

Tight rapeseed supply keeps new crop prices elevated

Due to the lack of a futures market in the UK, domestic rapeseed prices generally track the Paris futures market. Yesterday (17-Mar), the May-22 contract reached yet another record high of €928.50/t (c.£783/t). In sterling terms, the contract traded as high as c.£800/t yesterday, the highest ever.

The European market is extremely volatile recently though. Since the Russian invasion on Ukraine on 24 February, the average daily range of trade (May-22 contract) is over €42.00/t. It hit as high as a €79.25/t range on 8 March. For the 16 days prior to the invasion, the average was under €16/t.

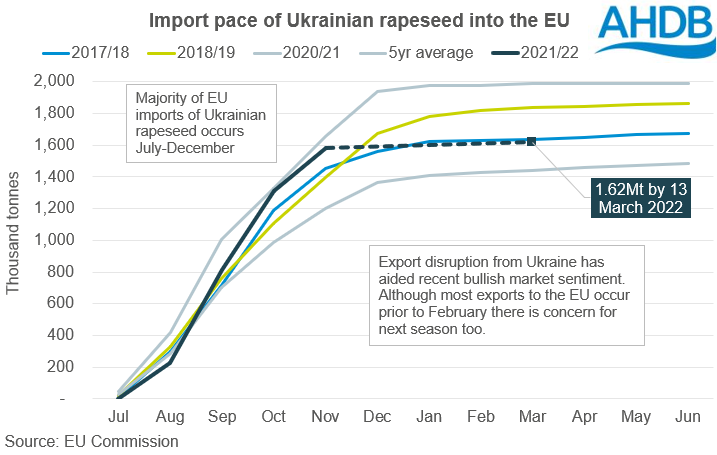

Ukrainian supplies accounted for 39% of EU rapeseed imports over the past 3 years (2017/18-2020/21). Although they are a key supplier, most Ukrainian rapeseed imports make their way into the EU in the first half of the marketing year (Jul-Dec). Therefore, disruption to exports may not have as much of an effect on EU supply this season as first thought on the surface.

This said, market sentiment is certainly being affected.

New crop impacts

New crop prices are also reacting to the Russian war, although to a lesser extent than old crop prices. Yesterday (17-Mar), the Nov-22 Paris rapeseed contract closed at €722.75/t (c.£610/t), not a record but still historically high.

Volatility in new crop pricing has eased a little recently, although Nov-22 still traded in a €14.25/t range yesterday. The daily average range (Nov-22) since invasion (24-Feb to 17-Mar) sits at almost €24.00/t. This is down from €77.75/t on day one of the invasion but is still up from the 16 days prior, when the range averaged less than €9.00/t.

In domestic trade, November delivered rapeseed into Erith hit an all-time high last week (11 March) at £640.50/t. At the same time last year the average quote was £395.50/t, and this was deemed a strong price at the time.

As the futures market has tracked back on last week, it is likely that domestic prices may do the same. But support will remain in rapeseed markets in the short-term at least, whilst the war continues potentially affected global oilseed supplies.

Our delivered price survey will be published later today with up-to-date quotes.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.