Tighter US maize stocks ‘surprise’ market: Grain market daily

Wednesday, 11 December 2024

Market commentary

- UK feed wheat futures (May-25) fell £1.90/t yesterday, closing at £186.70/t. The Nov-25 contract ended the session at £189.00/t, down £0.40/t over the same period.

- Domestic wheat futures were down yesterday due to a strengthening of sterling. However, the US and EU wheat markets were up, with Chicago wheat futures (Dec-24) gaining $0.28/t to close at $199.15/t, while May-25 Paris milling wheat futures rose €1.75/t, closing at €232.75/t. Prices were supported by repositioning ahead of the USDA WASDE report and market expectations of a reduction in Russia’s wheat exports. More on the latest WASDE report below.

- Paris rapeseed futures (May-25) were up €4.00/t from Monday’s close, ending the session at €531.25/t. The Nov-25 contract rose €5.00/t over the same period to close at €478.75/t.

- Paris rapeseed futures followed Winnipeg Canola markets up with the USDA reducing Canadian Canola production in its latest report.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Tighter US maize stocks ‘surprise’ market

Yesterday, the USDA released its latest World Agricultural Supply and Demand Estimates (WASDE). The report shows a reduction in US ending stocks of wheat and maize in 2024/25, mainly driven by firmer exports, compared with the November estimates. Maize production estimates for Argentina were unchanged, while soyabean production is up slightly. Brazil’s production figures for soyabeans and maize remain the same as last month. As expected, Russia's wheat exports were moderately reduced.

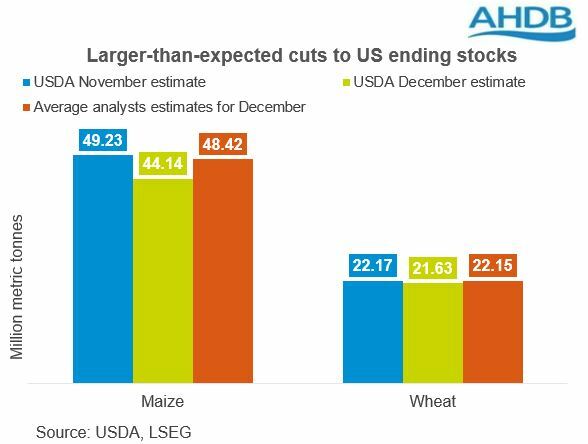

Reduction in US stocks

The latest estimates confirmed expectations of reduced US ending stocks for wheat and maize, albeit the cut to US maize stocks was greater than anticipated. US maize stocks were cut by 5.1 Mt from November to 44.1 Mt. This is over 4 Mt lower than the average analyst estimate in a Reuters pre-report poll, and over 3 Mt lower than the bottom end of the range in expectations. US maize stocks have been cut on the back of larger exports and greater demand for domestic ethanol production. US wheat stocks are estimated at 21.6 Mt, down 0.5 Mt from November’s estimate, also on the back of stronger projected exports. Wheat stocks are lower than the average analyst estimate in a Reuters pre-report poll and are towards the lower end of the range of pre-report estimates (21.4 Mt and 22.6 Mt).

Mixed update for South America

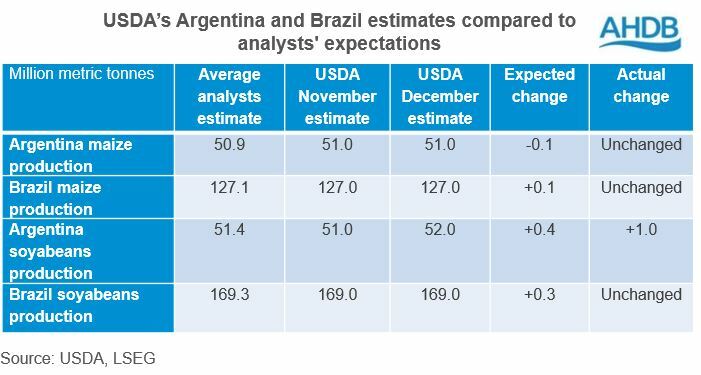

The USDA estimates for Argentina and Brazil’s maize and soyabean crops were relatively in line with the pre-report poll average. The USDA kept both countries’ maize production estimates unchanged from November, at 51.0 Mt for Argentina and 127.0 Mt for Brazil. For soyabeans, the USDA raised Argentina’s soyabean crop by 1.0Mt due to higher crush, while making no changes to Brazil’s 2024/25 crop estimates.

Black Sea region

As expected, following Russia's recent wheat export duty increase, the USDA reduced its 2024/25 wheat export estimate for Russia by 1.0 Mt to 47.0 Mt. Meanwhile, in Ukraine, the USDA raised the 2024/25 wheat export estimate by 500 Kt to 16.50 Mt in December, compared to November.

Summary

The estimated reduction in Russia’s wheat exports, along with lower-than-expected 2024/25 US ending stocks, will continue to influence grain markets in the short term. For soyabeans, the latest report highlights that the market will remain oversupplied this season.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.