US crop condition scores trimmed, but rain is on the way: Grain market daily

Tuesday, 15 June 2021

Market Commentary

- UK feed wheat futures (Nov-21) fell £1.85/t, to close yesterday at £173.15/t. This is the 4th consecutive fall for the contract. The recent fall has been driven by a series of supply news boosting production forecasts in the EU and Russia particularly. The Nov-22 contract fell slightly less, down £1.40/t to £166.60/t.

- Falls in UK feed wheat followed global grain futures yesterday. Price weakening was in response to forecast US rains, easing US supply concerns for 2021/22. Though crop condition scores, released yesterday by the USDA, saw further cuts across the board.

- The European Commission has said EU soft wheat exports for 2020/21, up to 13 June, totalled 24.88Mt. This is down 9.06Mt from the same week last season, though French data only runs until 2 June.

US crop condition scores trimmed, but rain is on the way

Over recent weeks and months, dry weather in the US has been causing new-crop supply concerns. Though recently, forecasts for cooler and wetter weather next week have been leading to price losses in global markets.

Improved weather will be important for US crop development. The latest USDA crop progress report released last night after UK markets closed made further cuts to US maize, soyabeans, winter wheat and spring wheat crop conditions.

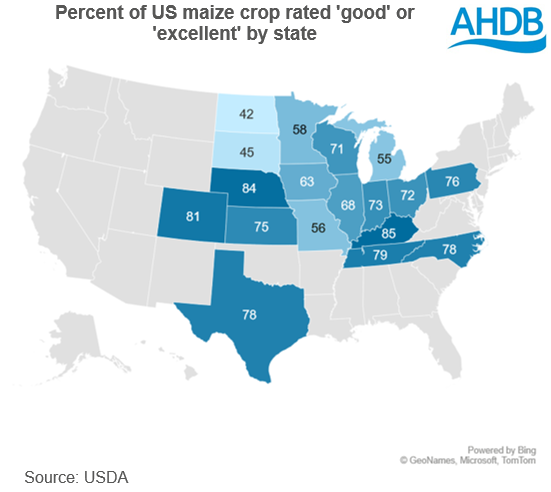

As at Sunday 13 June, US maize rated ‘good’ or ‘excellent’ fell 4 percentage points (pp) to 68%, below trade expectations of 69% (Refinitiv). This figure also falls 3pp below this time last year, and down 8pp from 30 May (the first report on US maize conditions).

Though, the devil really is in the detail in this report. Key states of Iowa and Minnesota saw substantial falls to their ‘good’ or ‘excellent’ ratings, falling 14pp to 63% and 11pp to 58% respectively. Collectively, these two states represent 27.5% of the US maize crop (5-year average). For Iowa, this is the largest fall in crop conditions since the drought afflicted 1988.

For soyabeans, the proportion of the crop rated ‘good’ or ‘excellent’ cut by 5pp, to 62%, as at 13 June. This is 10pp below this time last year, and below trade expectations by 3pp (Refinitiv). The largest falls were seen in Iowa, Mississippi, Arkansas, and Illinois.

For winter wheat and spring wheat, crop condition scores took small cuts of 2pp to 48% and 1pp to 37% respectively. Winter wheat harvest has been slower than trade expected, with harvest 4% complete, up 2pp from last week. Trade estimates pegged progress at 10% (Refinitiv).

Where next?

US crops have so far endured hot and dry conditions, though growers are hopeful for reasonable production according to Refinitiv. For the US plains, weather will remain hot this week. Though the Midwest (Iowa, Minnesota) weather is set to cool slightly, with temperatures at or slightly below average.

Looking ahead to next week, 30-60mm of rain is forecasted for the North and Midwest which should benefit crops in the short term, this capped prices yesterday and is currently a large factor in price falls across global gains.

With areas in the Northeast and high plains abnormally dry or in severe drought, the question remains, will the rain be enough to ease further concerns?

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

15 06 2021.PNG)