US weather watching continues: Grain market daily

Tuesday, 16 November 2021

Market commentary

- UK feed wheat futures (May-22) closed yesterday at £228.15/t, down £1.25/t from Friday.

- UK feed wheat followed a dip in Paris milling wheat futures, after Algeria launched a milling wheat tender for a nominal 50Kt over the weekend. This tender detailed relaxed insect damage standards, opening up Black Sea options, especially Russian wheat. This could mean increased competition for the EU in the short term from Russia before potential export quotas are introduced.

- Chicago soyabean futures (May-22) gained $4.41/t yesterday from Friday, to close at $469.35/t. Gains were made on expectations for higher Chinese demand for US supplies with talks between leaders taking place.

- The latest US crop progress report released last night reflected harvest progress with recent dry weather. Maize harvest was 91% complete and soyabean harvest 92% complete as at 14 November (USDA). This is up 7 percentage points (pp) and 5pp respectively, from the previous week. More from this report is explained below.

US weather watching continues

Recent dry weather seems to have boosted US 2021/22 harvest progress as explained above. However, for new crop US winter wheat, dry weather may remain a watch point for new season supply.

According to the USDA, new crop winter wheat plantings were 94% complete as at 14 November. This is up 3pp from the previous week, behind last year by 2pp, but directly in line with the 5-year average (2016-2020). Of the total, 81% had emerged as at 14 November, behind last year by 3pp and the 5-year average by 2pp.

Crop condition of the 2022/23 US winter wheat crop increased 1pp from the previous week, to 46% rated ‘good’ to ‘excellent’ to 14 November. This was a surprise to trade who expected no change (Refinitiv) but brings crop condition scoring directly in line with last year.

This is important with US conditions still very dry.

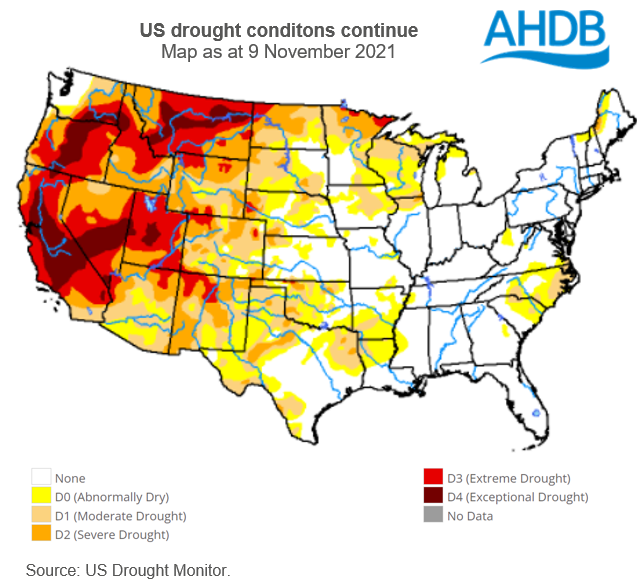

The latest drought monitor report shows dry conditions or drought continuing from last year.

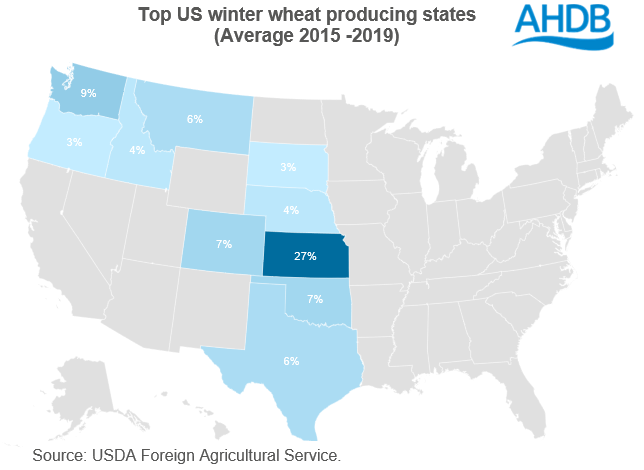

Importantly, dry conditions cover many key winter wheat producing states.

It is still too early to predict what the 2022/23 crop may look like, though dryness certainly remains a watchpoint for US wheat production next season.

Despite next season seeming far away, the market is looking for large crops to relieve low stocks after the tight supply and demand seen this season. As we move through this season, new crop news will increasingly impact old and new crop prices.

Why is US wheat so important to UK prices? This season we saw hot and dry weather in the US, Canada and Russia reduce global wheat availability. As a result of tight global supply and demand, we have seen significant support to UK feed wheat futures and ex-farm prices.

With dry conditions persisting in the Black Sea region and Canada, as well as the US, new crop weather will be a key watchpoint as we progress through the season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.