What could maize have in store for wheat in 2021? Grain Market Daily

Friday, 18 December 2020

Market commentary

- UK feed wheat futures yesterday closed on the May-21 contract at £195.10/t, up £1.85/t. New crops futures for Nov-21 closed at £158.00/t yesterday, down marginally by £0.25/t.

- Yesterday, the pound sterling strengthened against the US dollar, closing at £1=$1.1358. This is up from £1=$1.1351 on Wednesday due to chatter that an EU exit deal was looking more likely. Issues about a level playing field have come to arrangement, but fishing remains a sticking point.

- Before introduction of the new Russian wheat export tax of €25/t (15 Feb to 30 June), traders are beginning to see delays in obtaining export documents from Russia’s customs service. This is causing delays in shipments and doubts that exports will accelerate before February.

- Australia’s harvest is reported to be 75% complete, harvesting over 30Mt (Dairy Australia). Quality in New South Wales and Victoria is reportedly strong and shipping reports peg December’s wheat volume as the largest on record.

What could maize have in store for wheat in 2021?

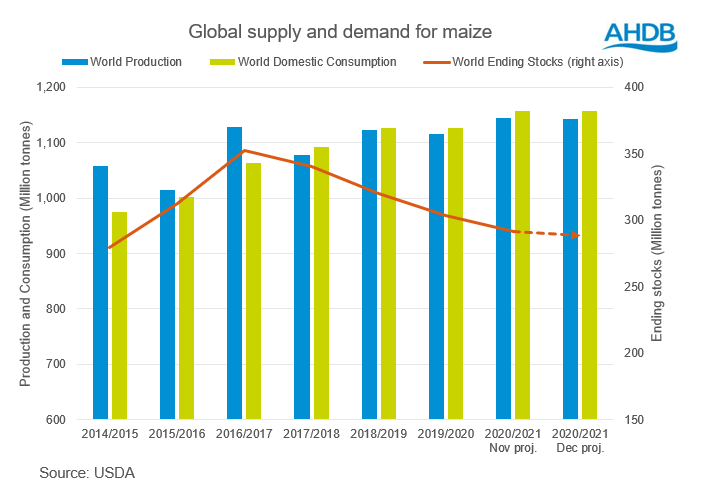

The global maize market is a key factor driving global grains prices, including wheat. The latest maize forecasts show falling maize stocks, which could support grain prices as we head into 2021.

Latest forecasts

Last Thursday, the USDA released their latest world supply and demand estimates (WASDE). The USDA forecast lower world maize production, increased world demand, and tighter maize ending stocks.

Global maize production in 2020/21 was lowered by 1.1Mt to 1,143.6Mt, due to falling production in Argentina, the EU and Canada. World demand is, however, predicted to rise by 1.5Mt to 1,143.6Mt in December’s figures.

As a result, world ending stocks are tightening. Ending stocks are down 2.5Mt on last month’s figures to 289.0Mt: the smallest ending stock figure since 2014/15. Brazil’s ending stocks alone were reduced by 0.5Mt to 7.5Mt in this month’s report.

What’s happened to global maize stocks over the last 10 years?

Global maize consumption rose 30% from 2010/11 to 2019/20. Further growth of 3% is expected from 2019/20 to 2020/21.

Higher animal feed demand in China is one of reasons for growing global demand. China is forecasted to use 286Mt of maize in 2020/21, equal to 25% of world demand. In the 10 years leading up to 2019/20, Chinese domestic demand increased by an estimated 38%.

Because of this higher global demand, global ending stocks have tightened. This year’s forecasts signify the fourth year-on-year fall in stocks. World stocks-to-use will equal 25%, the smallest number since 2014/15.

Weather concerns continue

Stocks could get even tighter in the New Year, if the South American maize crops are smaller than currently forecast.

Despite recent rains across South America, more is needed to support yields. This week into next, patches of rain are forecasted across some areas of Brazil and Argentina relieving some pressure on dryness.

However, into the New Year average rainfall looks unlikely across Brazil and Argentina. Temperatures are also forecast to remain higher. Brazil’s second round of maize planting is set to begin in February and dry weather would negatively affect crop establishment.

Weather patterns for South American maize crops play as a key factor in driving futures pricing. Smaller crops than forecast, or higher Chinese demand, could mean higher maize prices in 2021.

Why is this important to the UK?

AHDB forecast increased domestic maize consumption year-on-year, rising by 7.5% to 2.32Mt in 2020/21. This is due to 21% higher Human and industrial usage.

Imports are forecast to rise year-on-year by 3.2%, to 2.45Mt to meet this demand. Maize imports in the season to date (Jul-Oct) total 821Kt according to the HMRC. This leaves a further 1.63Mt to import this season if the current forecast will be met.

Narrowing global stocks may push up prices of grains across the board into the New Year. Any global price rises could mean higher UK prices too. Though currency movements and what trade deals the UK secures with the EU and others will also influence imports of grain and our prices in 2021.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.