What’s the current situation regarding the UK’s RED II recognition?

Wednesday, 18 December 2024

Stakeholders are awaiting clarity from the European Commission regarding the recognition of the reclassified UK NUTS 2 values, as well as UBD and recognition of UKAS.

Earlier this year, with substantial support from Red Tractor, SQC, and AIC, UK growers were able to continue supplying UK-grown grains (e.g. wheat) as a biofuel feedstock under the Renewable Energy Directive (RED) II. While 2024 was a year of lower domestic wheat production, the two main bioethanol plants (Ensus and Vivergo), situated along the northeastern coastline, remain key demand centres of UK-grown wheat. Both plants have a capacity of one million tonnes of feed grains per year, supporting the demand, and thus prices, of UK-grown wheat.

Reported earlier this year, for UK-grown grains to remain compliant with RED II, there have been three ongoing issues that stakeholders have been managing:

- Recognition of the recalculated NUTS 2 values by the European Commission.

- Implementation of the European Commission’s Union Database for Biofuels (commonly referred to as the ‘UDB’).

- Recognition of the United Kingdom Accreditation Service (UKAS), and the accreditation of Certification Bodies undertaking assessments on behalf of the voluntary assurance schemes.

While communication from the European Commission has been thin, the latest developments regarding these aspects are as follows:

- For grain from harvest 2024 (and onwards) to be used as a biofuel feedstock, it needs to have a newly approved NUTS 2 value. The Department of Transport submitted recalculated values in May, however the UK is still awaiting confirmation of acceptance regarding the recognition of reclassified UK NUTS 2 values from the European Commission. Evidence shared by EU Member States has suggested that they are being prioritised ahead of the UK, which is contributing to the delay.

- Voluntary schemes and stakeholders have been liaising with the European Commission on the roll out of its Union Database for Biofuels (UDB). There have been ongoing challenges with the rollout of the interface designed for merchants and the biofuels refineries, with some suggesting the current format exceeds the mandate within the recast RED II. In response to feedback from stakeholders, the previous deadline of November 2024 was, and continues to be, delayed until further notice.

- Following the UK’s exit from the European Union, within the supporting regulations around Article 11(1), the European Commission does not recognise UKAS as a national accreditation body, as the subtext establishes that this should be in an EU Member State. Currently a solution on this needs to be in place by January 2025, however, there is some anticipation this will be postponed to January 2027.

While all three aspects are of significance, currently, the most pressing challenge is regarding the approval of NUTS 2 values. Without approved values, UK bioethanol plants cannot demonstrate that UK-grown grain is renewable against RED II, potentially preventing its supply into the EU biofuel market and reducing its marketability. While the EU biofuel market is not the sole market UK-produced biofuel can supply (e.g. the domestic market through the RTFO remains a marketing option), the historical reliability of the market and future outlook limits the attraction of alternate markets.

In the event that UK-grown wheat became non-compliant, UK bioethanol plants can still produce RED II compliant biofuel from imported grains, however the feedstock would need to be from an alternate compliant origin.

Domestic biofuel production using wheat falls below average

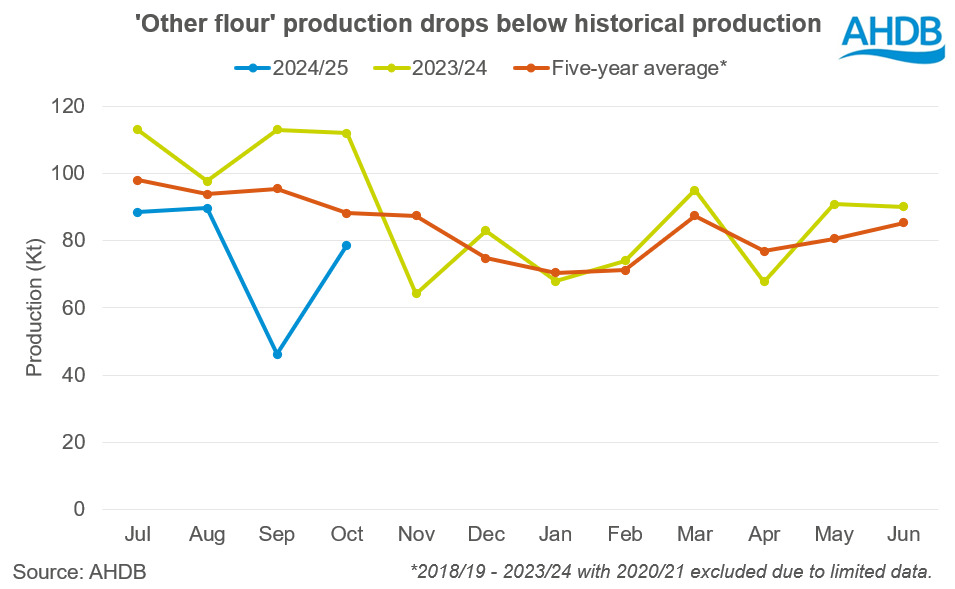

To analyse the volume of wheat used for UK bioethanol production, this is included in 'Other flour’ production as part of AHDB’s UK human and industrial (H&I) usage figures. While the 'Other flour' category does also include starch for H&I consumption, it can be used to broadly assess wheat usage by the bioethanol industry due to its significant weighting.

As seen in the chart below, usage has fallen back since the start of the 2024/25 marketing year in comparison to both last year and the five-year average. This is partly due to ample availability of competitively priced maize of which one of the two bioethanol plants can use in substitution of alternate grains. This is also linked to the smaller availability of the UK-grown wheat crop, although imports from nearby origins have been pricing competitively which has partially supported the availability of wheat for domestic biofuel production.

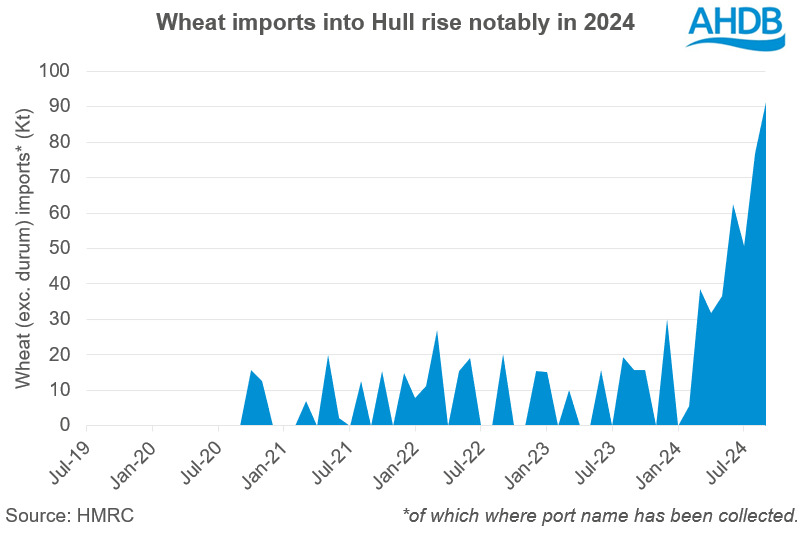

In review of the latest UK trade data, imports of wheat to Hull have been elevated. While farmer selling has been lighter since the turn of the 2024/25 marketing year, the significant volume of wheat imported highlights the role of imports increasing the total availability of wheat to satisfy domestic biofuel demand; in response to the tighter domestic availability.

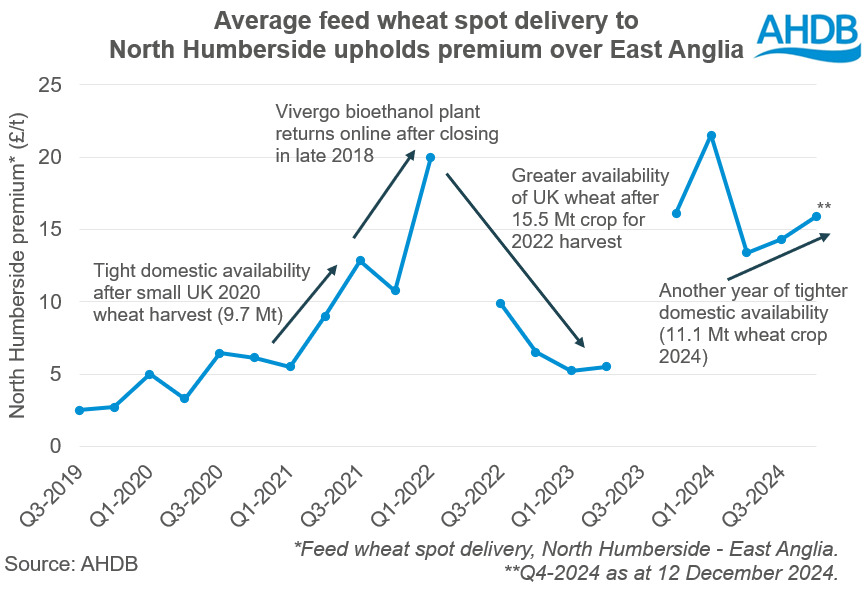

The premium for the spot delivery of feed wheat to North Humberside over East Anglia has widened notably since the 2023/24 marketing year partly due to the tighter domestic availability and robust demand in the northeast. Though the delivery of domestic wheat into North Humberside is not implicitly for biofuel production, it will be a notable contributing factor towards this strength; thus, demonstrating the importance of the sector to the UK domestic wheat market.

Outlook

For domestic biofuel production, the smaller availability of UK-grown wheat has encouraged greater use of imported wheat, while the relative competitiveness of global maize prices supports the opportunity to use maize. Looking ahead, for feed wheat, the premium of North Humberside spot delivery over East Anglia could subside should the availability and price of imports remain competitive.

As a further matter, crude oil markets have been in a relatively weakened state following sluggish demand and ample supply. This trend is expected to continue into 2025 and is likely to wane on the biofuel market. This could encourage the attractiveness of supplying biofuel to the EU under RED II as returns from alternate markets may not be as favourable.

Stakeholders are awaiting clarity from the European Commission regarding the recognition of the reclassified UK NUTS 2 values, as well as UBD and recognition of UKAS.

In May 2025, the RED III is due to come into effect. While this does involve revisions and updates to the current RED II policy which Red Tractor, SQC and AIC will review accordingly, the changes largely regard factors that do not relate to how UK-grown wheat could be used as a compliant biofuel feedstock under RED III.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.