Where now for barley prices? Grain Market Daily

Wednesday, 20 January 2021

Market Commentary

- London wheat futures took a breather yesterday, falling back from Monday’s highs. Old crop (May-21) closed at £213.75/t, down £0.65/t. New crop (Nov-21) lost £1.40/t to close at £170.00/t.

- At midday today, the May-21 contract had lost a further £3.25/t and was trading at £210.50/t. Nov-21 was at £167.20/t, down £2.75/t.

- Chicago soyabeans (May-21) closed at $508.26/t, down for a second consecutive session. This is $16.35/t lower than Thursday’s close and the lowest the contract has been since 11 January. Rains in South America as Brazil begins its soyabean harvest are putting downwards pressure on prices.

- China imported 52.8% more US soyabeans in 2020 than in 2019 at 25.89Mt, however it was not enough to fulfil the 40Mt target as part of Phase 1 of the US-China trade deal.

Where now for barley prices?

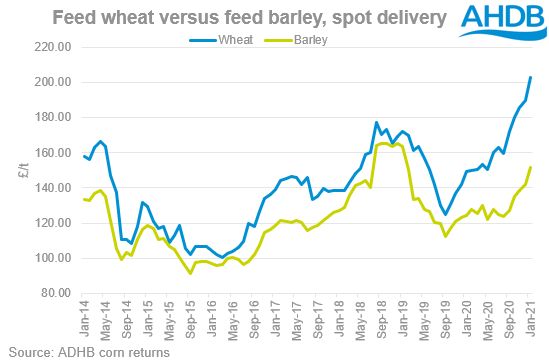

The feed barley discount to feed wheat has been gradually increasing throughout the season, as wheat prices have rallied. While the wheat rally has provided support for barley, prices have not been increasing at the same rate, therefore the wheat-barley spread continued to widen to record levels.

.

According to AHDB’s corn returns, spot feed barley started the season at a £36.20/t discount to wheat, this has widened to a maximum of £54.30/t in the week ending 31 December 2020 but has since started to narrow.

In the latest corn returns, barley bought for January delivery was at a £51.60/t discount to wheat, however, the discount in the February position has narrowed to £47.10/t. Furthermore, in last week’s delivered cereals survey, feed wheat (Feb-21) in East Anglia firmed by £5.50/t on the week, however feed barley (Feb-21) prices were up £6.00/t over the same time period, indicating greater support for barley.

Why do we have such a large discount?

Harvest 2020 was the second consecutive year of over 8Mt barley production, whilst wheat production at 9.7Mt was down, 6.6Mt on the year. As result wheat imports have needed to grow significantly to satisfy demand, whilst barley has had to fight for export trade.

How has the discount of barley impacted demand?

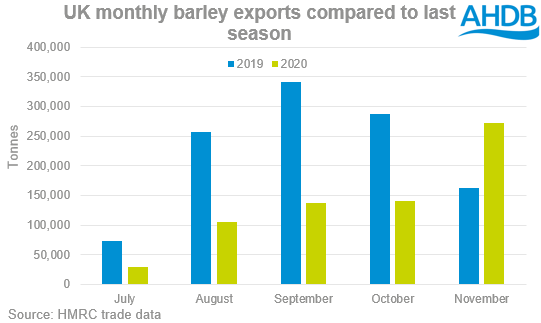

Barley exports so far this season (Jul-Nov) are 38.9% lower than the same period last year, at 684.6Kt. With the most recent Balance Sheet estimating the surplus of barley for free stock or export at 2,278Kt, there is still some way to go for exports this season. Despite this barley exports appear to have picked up the pace towards the end of 2020, with November the first month of the 2020/21 season where exports exceeded the same month in 2019/20.

From an animal feed perspective, with wheat and maize prices high, the discount of barley has kept demand strong. Barley usage by GB feed compounders and integrated poultry units so far this season (Jul-Nov) is 653.5Kt, 34.4% ahead of the same period last year. Furthermore, in Sep-Nov barley consumption in animal feed was up an average of 42.7% year-on-year. Conversely, wheat usage is down 10.9% season-to-date on the 2019/20, at 1,745.2Kt.

Where next for barley demand and the discount?

With barley continuing at a strong discount to wheat, we can expect to see increased inclusions of barley in rations at the expense of other grains, subject to diet composition constraints. Whilst increased domestic demand should continue to narrow the discount of feed barley to feed wheat, the ability of prices to do so may be limited by the need for barley to compete in a well-supplied global export market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.