Why isn’t UK rapeseed worth more? Grain Market Daily

Friday, 13 December 2019

Market Commentary

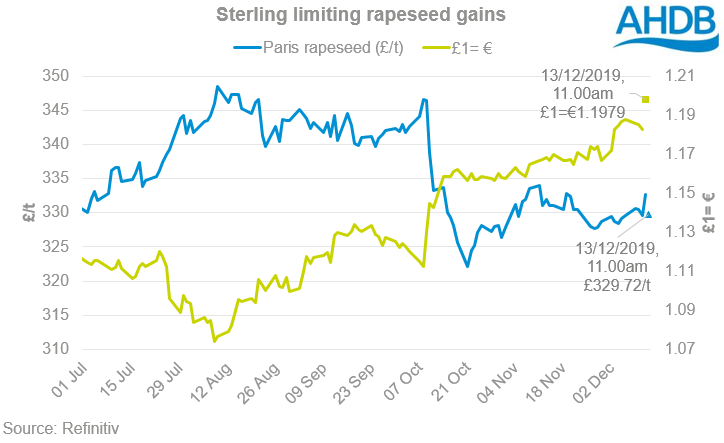

- Following the results of yesterday’s General Election, the value of sterling has firmed. At 11.00am, sterling was worth £1=€1.1979 and £1=$1.3391, the highest point against both currencies since July 2016 and June 2018 respectively.

- The firming of sterling has pressured domestic markets this morning. UK feed wheat futures (May-20) were worth £146.65/t at 11.00am, a drop of £0.85/t on yesterday’s close. Nov-20 futures have fallen to a lesser degree, sitting at £154.25/t, although they face a test at £154.00/t having closed on or marginally above this level every day this week.

Why isn’t UK rapeseed worth more?

This season, UK rapeseed production has fallen to its lowest level since 2004, at 1.75Mt. Furthermore, EU production also hit fresh lows and new crop prospects in both the UK and the EU look limited. With that in mind we may have expected domestic rapeseed prices to be showing more support than they presently are.

One of the major limiting factors for domestic rapeseed prices currently is the path of currency. The rise in the value of sterling since October has seen UK rapeseed prices struggle to replicate the gains seen in Paris rapeseed futures. Since 21 October, May-20 Paris rapeseed futures have gained €19.00/t, on the back of the tight supply outlook and support from vegetable oils. However, in sterling terms rapeseed futures have gained just £10.50/t.

The struggle of UK prices to replicate gains seen elsewhere in Europe reflects the relative cost of importing. As sterling gains strength importing becomes cheaper, as such the ceiling for domestic prices falls.

From conversations with trade, the domestic market is very much in a stalemate with limited selling and limited purchasing. The lack of purchasing is being driven by the large volume of imports seen so far this season in the UK. Import data released earlier this week shows that just short of 200Kt, a 290% rise on the same period last year. A large volume of these imports have been of Ukrainian origin (96Kt) into Liverpool, capping domestic demand in the North West.

Looking ahead there may be some further support for domestic prices. Ukrainian old-crop supplies are due to reduce in the New Year, and there are supply concerns for other major rapeseed producers. Furthermore, vegetable oils have seen considerable support of late. It is worth remembering, however, that sterling will remain an important factor in domestic pricing.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.