Winter wheat planting in France surpasses historical pace: Grain market daily

Friday, 22 November 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £180.35/t yesterday, rising £0.30/t from Wednesday’s close. The May-25 contract also rose £0.30/t over the same period, to close at £193.25/t. Today is the last trading day for the November 2024 contract.

- European wheat markets rose yesterday in response to escalating tensions between Ukraine and Russia, however there has been no immediate impact on grain exports from the Black Sea which is limiting gains. In addition, the International Grains Council cut its 2024 EU wheat harvest by 1.5 Mt to 120.3 Mt, 10% lower than last year.

- Paris rapeseed futures (May-25) closed at €505.75/t yesterday, falling €19.00/t from Wednesday’s close. The Aug-25 contract fell €16.25/t over the same period, to close at €467.00/t. After the largest fall in one trading session in 16 months, Paris rapeseed futures have fallen back to values seen a month ago.

- Continued fears of a trade war between the US and China following the Republican US election win weighed on Canadian rapeseed futures, spilling pressure over to Paris rapeseed futures. Also, weaker demand for palm oil weighed over the vegetable oils complex for a consecutive day.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Winter wheat planting in France surpasses historical pace

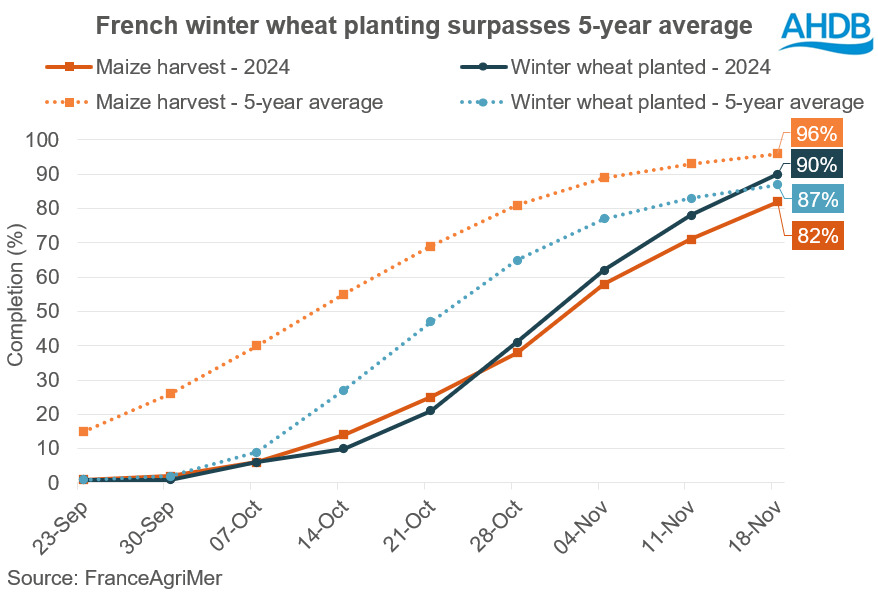

Earlier today, FranceAgriMer reported the winter wheat (exc. durum) planting campaign at 90% complete as at 18 November, surpassing the five-year average for the same time of 87%. France’s winter wheat planting campaign had been delayed significantly due to considerable rainfall during September and early October, however subsequent abnormal dryness has led to a notable acceleration in planting pace.

Planting pace

Before most farmers in France had begun winter cereal planting, heavy rains were delaying the maize harvest, which then partly delayed the opportunity to plant winter wheat. By mid-October, the maize harvest was only 13% complete (42 percentage points behind the five-year average), while wheat planting was 10% complete (17 percentage points behind the five-year average).

However, drier conditions since the latter half of October improved conditions for planting, and so the harvest of maize and planting of wheat has accelerated. The winter wheat planting campaign has now surpassed the five-year average for the first time.

Though, as would be expected, while planting pace of wheat has improved, emergence is lagging behind the five-year average by 10 percentage points at 65%. In the coming weeks, currently, weather in France is not expected to be abnormally dry or wet and therefore this is likely to encourage favourable crop development.

French new crop and old crop wheat spread

As the planting pace for winter wheat improved and the weather outlook appears more favourable, there are expectations of a larger French wheat crop after harvesting the smallest crop in 40 years in 2024. This has been a key contributing factor towards the discount between old and new crop for Paris milling wheat futures, which has remained extended since October.

_discount_to_old_crop_(May-25)_remains_extended.jpg)

Looking ahead

As weather conditions have turned more favourable in France, and the planting pace of winter wheat has returned to the historical average, concerns regarding lower wheat production for the second consecutive year have calmed. While the crop remains at risk to unfavourable weather conditions, it will be key to monitor the progression of upcoming development stages, however the current outlook for the historically largest wheat producing and exporting country in the EU has become more positive.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.