- Home

- Dairy market outlook

Dairy market outlook

February 2026

Overview

- GB milk production is forecast to stabilise in 2026, with only marginal growth for the calendar year in the region of 0.3% expected. But this is still a record-breaking amount of milk which keeps pressure on processing capacity, especially around the flush

- Commodity prices may have possibly found a floor, but face a slow rebuilding until milk supplies come under control

- Farmgate prices will continue to fall until milk supplies stabilise, potentially beginning after the Spring flush but will remain low until the second half of the year at the earliest

- Global dairy demand is likely to remain challenged by low economic growth, and GB dairy is less competitive in the global market than the USA. Whey is still seeing strong growth potential globally in response to consumer demand for protein, driven by GLP-1 weight loss medicines

- Domestic demand in retail is expected to remain steady, maintaining the longer-term trend of a shift away from liquid consumption towards added-value products like cheese and yogurt. Protein remains a popular trend. Consumer demand could increase as retail prices soften

Supply

Domestic milk production

GB milk production for the 2025/26 season is forecast to reach 13.05 bn litres, 4.9% more than the previous milk year, according to our December forecast update.

This milk year has seen incredible volumes, with deliveries surpassing record highs. A 20-year high in the milk to feed price ratio has been in play for all of 2025 which has boosted yields, thereby supporting overall milk volumes.

So far this milk year (April–January), deliveries are ahead 5.3% compared to the previous year. We are also annualising against a period of high growth which began in September 2024. January supplies to date have slowed marginally to 3.1% growth.

This growth is estimated to continue until the spring flush, despite recent falls in milk prices. Even though most milk prices have been cut substantially, some (such as retail aligned or organic) have not. Some of the worst performing contracts have lost as much as 15 pence per litre (ppl) including February announcements, although some declines have been more restrained. However, those with stable prices will have less incentive to reduce production while feed prices remain cheap, which will slow the rate of total production decline.

Even though the rate of growth will slow, because we are annualising on a period of very high milk supplies, processing capacity (particularly during the spring flush) will continue to be under pressure.

For all, high constituent levels in the milk will compensate for some of the headline milk price falls and soften the impact; this will keep milk supplies elevated for longer than the lower headline milk prices would suggest.

Beginning in the next milk year (from April 2026), the momentum is likely to cool down as prices fall further and the impact of punitive B-price mechanisms is felt. We don’t expect to see a ‘cliff edge’ at this stage, rather a gradual decline. However, if commodity markets were to fall further than expected (possibly as a result of global geopolitical disturbance or other market shocks) we could see a steeper production decline, with more farm exits and a higher degree of culling.

The availability of cheaper feed remains a factor, with record levels of compound feed being produced this season. Feed costs have continued to decline, standing at 3.5% lower year-on-year (as of October 2025) and are at the lowest levels seen since March 2022. The outlook remains fairly dismal for crop pricing, which should continue to keep feed prices in check through 2026.

Forage availability due to last summer’s drought will have a been a pressure for many farmers but the additional compound feed given to compensate has ironically boosted production; this could remain a factor until grass growth kicks in again in the spring. Conversely, farmers in parts of the country (such as Scotland and the far South West) reportedly have good forage stocks and may be able to sell some, proving a welcome boost to cash flow. The lack of forage stocks as a ‘cushion’ will be a risk to the outlook, meaning that weather conditions will be important.

A very wet spring or very dry summer could force farmers to make different herd management decisions and accelerate the culling rate. We have assumed a year of more ‘normal’ grass growing conditions, but this is subject to change.

The trend towards autumn-block calving has also boosted milk flows in the autumn and winter months. We expect to see this trend continue in 2026 based on contractual seasonality payments on offer.

Key input costs (apart from feed) have become more expensive which will put more pressure on margins. Forage costs for those having to buy in could be very considerable indeed, adding as much as 8ppl to costs. Straw, fertiliser, fuel and labour costs have all risen although to a less extent than the galloping inflation seen in 2022. The risk is that some may be tempted to chase marginal litres to make up for margin pressures, which could compound the situation.

We will explore prospects for farm inputs in more detail in our dedicated inputs outlooks, which are due to be published on our main Agri Market Outlook page in mid-February.

Cow numbers are declining, with the size of the GB milking herd in October 2025 0.9% lower than a year earlier, indicating that production growth seen has been driven by yield increase. A fall was seen across all age groups, with the exception of over-4-year-old cows. With milk prices now falling and commodity prices under pressure, farmers are likely to remove older and underperforming cows over the coming months and take advantage of strong cull cow prices. This could aid a slowdown in milk production. Although herd expansion won’t be top-of-mind for most, heifer availability and cost could be a factor for those with ageing herds.

GB producer numbers have held steady over the past 6 months, with only 30 producers lost between April and October 2026. We would expect to see an acceleration of the downwards trend in 2026 in response to falling farm business incomes over the next 12 months. However, as with previous declines, cows have generally been sold to other farms so have not impacted on overall production levels.

.jpg)

Table 1. GB milk production forecast – January 2025

| m litres | 2024/25 | 2025/26 | 2025/26 | 2025/26 | 2026/27 | 2026/27 |

|---|---|---|---|---|---|---|

| Actuals | Actuals | Forecast | Yr-on-yr | Forecast | Yr-on-yr | |

| Apr | 1,076 | 1,140 | 6.0% | 1,135 | -0.5% | |

| May | 1,128 | 1,185 | 5.1% | 1,180 | -0.5% | |

| Jun | 1,042 | 1,102 | 5.8% | 1,095 | -0.7% | |

| Jul | 1,023 | 1,068 | 4.4% | 1,065 | -0.3% | |

| Aug | 991 | 1,039 | 4.9% | 1,035 | -0.4% | |

| Sep | 969 | 1,025 | 5.8% | 1,015 | -1.0% | |

| Oct | 1,030 | 1,100 | 6.8% | 1,095 | -0.4% | |

| Nov | 1,018 | 1,071 | -4.9% | 1,065 | -0.6% | |

| Dec | 1,052 | 1,103 | -4.6% | 1,090 | -1.2% | |

| Jan | 1,045 | 1,090 | 4.3% | |||

| Feb | 953 | 985 | 3.4% | |||

| Mar | 1,115 | 1,140 | 2.2% | |||

| Year | 12,443 | 13,049 | 4.9% | 9,775 | -0.6% |

Source: AHDB

Notes: A 28-day equivalent is used for Feb-24. Forecast numbers are in bold.

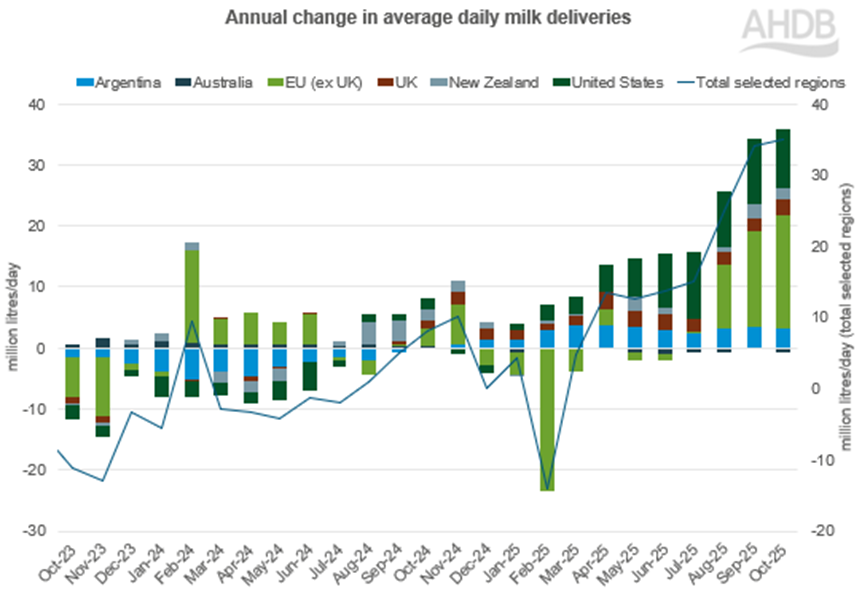

Global milk production

Global milk production came back to growth early in 2025 but accelerated sharply in the last third of the year. In October, the last available data period, we saw an increase of 35.1 million litres per day year-on year (+4.2%), with growth in most key dairy-producing regions.

US production rose by 3.6%, driven by one quarter of a million extra cows and a boost to cheese production facilities, and New Zealand by 1.7%. The EU returned to strong growth (+5.1%) following last year’s bluetongue outbreak which had the effect of delaying cow fertility and producing a late flush in afflicted countries, particularly France, Germany and the Netherlands.

Rabobank estimate that milk supply growth for 2026 will be 0.12% before slowing to 0.7% decline in the first half of 2027. They estimate that all major exporters will remain in production growth for Q1 of 2026, with most slowing down into Q2. They anticipate decline for the EU after Q1 2026 while the USA and South America will continue to grow.

Emerging economic challenges around global trade, particularly regarding uncertainty around the USA and tariff arrangements which had seemed more settled, could destabilise this outlook.

Product availability

Record milk volumes have favoured increasing supplies of dairy products.

In the latest quarter (Q3), cheese supplies built up following a 5% gain in production (6,500 tonnes) year-on-year. Imports from New Zealand following the trade deal have also increased earlier in the year by 2,000 tonnes, and Q3 saw an increase in imports from the EU (France, Germany and Belgium). An increase in Q3 exports by 3% (1,500 tonnes) limited cheese supplies to only 3% growth (6,400 tonnes).

Butter production increased by 8% (3,400 tonnes) year-on-year in Q3 and imports declined by 24% (3,900 tonnes). Exports picked up by 8% (900 tonnes) during the period but exports were limited by uncompetitive prices. On balance, butter stocks weakened by 3% in Q3 (1,400 tonnes).

Prices

British consumer demand is expected to be stable in 2026, with some damage to consumer confidence due to continued cost of living pressures. Affordability will be a key theme, but this outlook is dominated by supply trends rather than demand which is broadly steady.

Internationally, export demand is not expected to be buoyant enough to manage heightened supplies, although there are some signs of buyers returning to the market. Economic growth has been subdued in most regions. US dairy products, including butter and cheese, have been selling at a considerable discount to Europe, meaning that GB exporters may find it a tougher market.

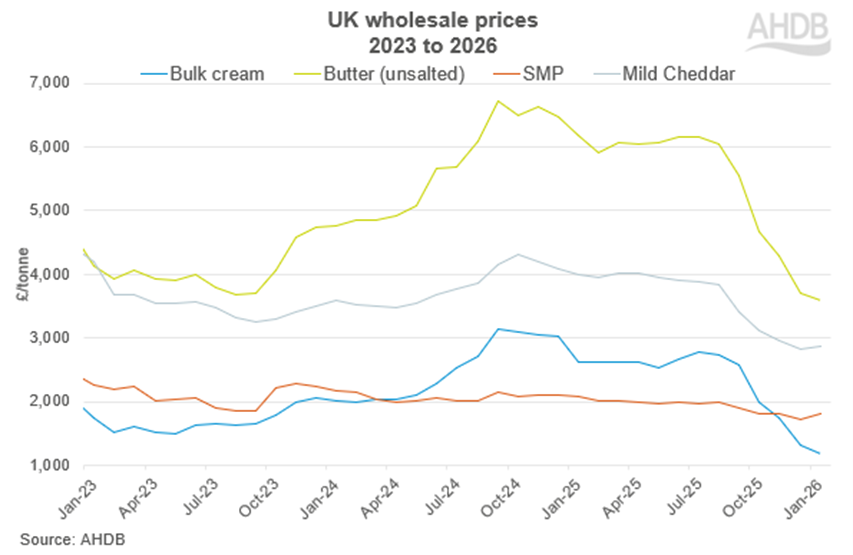

January 2026 brought slight recovery on Skimmed Milk Powder (SMP) and mild cheddar. However, pressure on fats remains due to high milk supplies here and on the continent, leading to a fall in price for butter and cream.

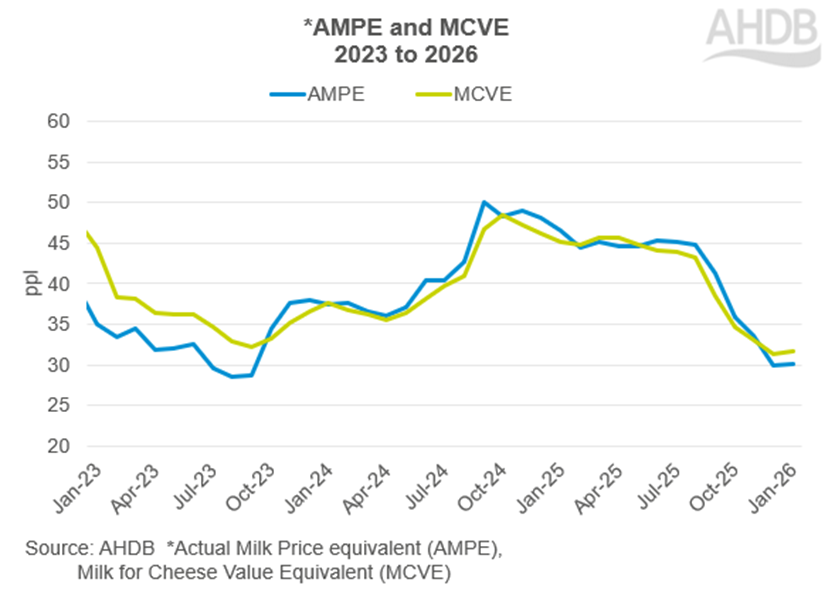

As a result the market indicators, AMPE (Actual milk price equivalent) and MCVE (Milk for Cheese Value Equivalent) have risen slightly to 30.1 and 31.8ppl respectively. This would indicate an arrest in the fall of milk prices beginning in April. The longevity of that depends on what happens in commodity markets in the run up to the flush.

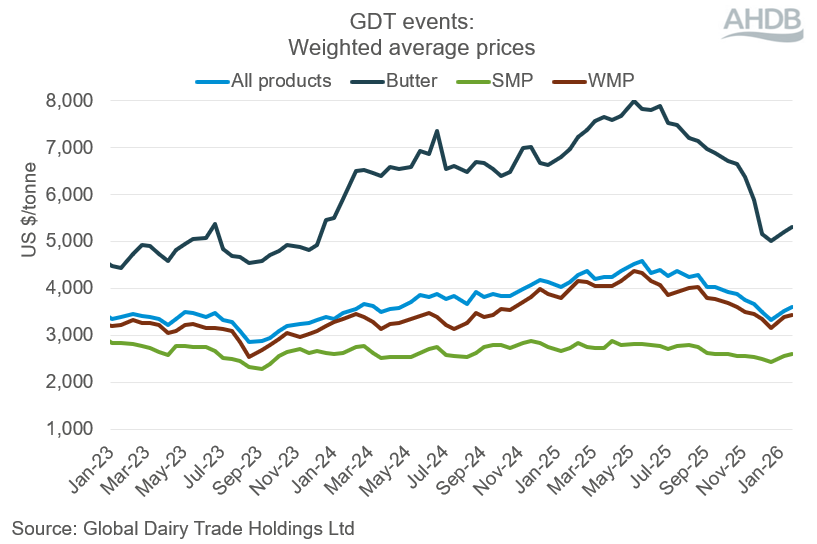

An unexpected upward movement in the Global Dairy Trade (GDT) auction in the first auction of 2026, followed by a second smaller positive movement in the second, may be an early sign that a floor has been reached. Buyers in South East Asia and the Middle East are reportedly returning to the market, adding to the positive signals that the market has bottomed out for now and may regain some value.

Commodity prices are currently well below the 5-year average. Commentators expect commodity pricing to recover through 2026 to a moderate extent, with prices coming back to a longer-term average towards the third quarter of the year. This will be reliant on milk supplies reducing globally and stocks to be depleted.

Futures analysis reported by Vesper indicate that butter will recover through 2026 but will only regain about one-third of the lost value by year end. Cream will follow butter but may be impacted by new Chinese anti-dumping tariffs on EU cream and cheese. SMP should also recover in Q2, but again only regaining about half of the value lost.

The 4-year decline in Chinese dairy import demand stabilised in 2025, with higher imports for whey powder, butter and cheese. However, new EU tariffs could change their sourcing arrangements.

Cheese prices have the potential to recover more quickly as global demand continues to grow. China is not a major export market for cheese, so its new tariffs on the EU will be less disruptive. Continued over-production in the USA could keep a lid on prices globally and, with threats to US domestic consumption from greater GLP-1 use, the outlook is uncertain.

Whey will continue to be an area of opportunity: it is the dairy commodity that has bucked the trend and seen continuous price growth as the world struggles to supply the growing demand for dairy whey-based protein.

Impact on farmgate prices

GB farmgate prices remained buoyant through the bulk of 2025 in the high 40s ppl range (excluding bonus and aligned contracts). The situation began to change in October 2025 when announced prices for November fell sharply. They have continued to do so through to February milk price announcements, with some contracts losing as much as 15ppl so far. It is important to note that there is high variability between contracts – those on retail-aligned contracts that are tied to the cost of production retain a high milk price, as do those on organic contracts.

The outlook is for pressure on farmgate prices, for those contracts that are exposed to falling commodity values, to continue until milk supplies come under control and start to fall. At the same time buyers are expected to come back to the market to start to absorb some of the excess global product stocks that have built up. This will not happen until after the spring flush, so farmers on non-aligned conventional contracts should expect milk prices to be low until at least the second half of 2026.

Consumption

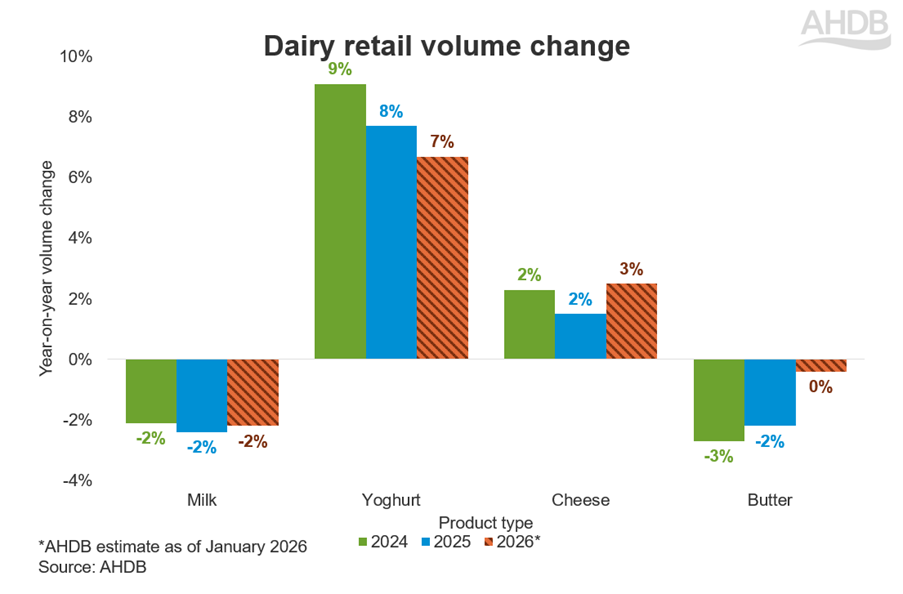

In 2025, total GB dairy retail volumes were down 1% year-on-year (NIQ panel on demand, 52 w/e 27 December 2025). We expect this trend to persist through 2026, with variations across categories. Given milk’s dominance within dairy, movements in milk largely shape overall category volume performance.

For further information and latest trends for all dairy categories, visit our Dairy retail dashboard.

For 2026, we expect consumer confidence to remain muted as high food inflation and frozen tax thresholds add pressure to household incomes, as detailed in our 2026 economic outlook. This squeeze on finances will likely impact shoppers’ standard of living, with many continuing to use savvy shopping methods to ensure they are getting the best value for money.

Milk

As consumers continue to look for more natural, less processed options, whole milk is forecast to continue to grow steadily in 2026. However, declines from skimmed and semi-skimmed milk will impact demand. While there may be some price decreases for milk in 2026, we think consumers will move this spend to other categories rather than increasing their milk consumption.

This is because we expect to continue to see consumers shift away from meals and drinks that include milk. This is particularly true for tea, which accounted for 46% of all milk in-home occasions. Cereal at breakfast, which accounts for 29% of Milk Occasions in 2025, is also seeing decline, potentially driven by consumer concerns around ultra-processed foods (Worldpanel by Numerator Usage, 52 w/e September 2025). Therefore, we anticipate retail milk volume to drop by 2%.

Butter

Consumers looking for more natural options will continue to drive growth in block butter which saw volumes up 6% in 2025 (NIQ Panel on demand, 52 w/e 27 December 2025).

The price differentiation between butter and plant spreads will be a key one-to-watch as we move through 2026. Lower prices for butter are expected to be seen on shelf from around April due to the falling wholesale prices, which could bring a boost to the category as we anticipate some shoppers will switch out of higher priced plant-based options.

We expect to continue to see losses in Q1 for the total cow’s butter category, which will wipe out some of the growth we expect to see for the rest of the year. We predict retail volumes of butter will remain flat at 0% change year-on-year.

Cheese

Consumers are looking for small treats, and premium cheese is hitting the spot with consumers. Premium own-label cheese volumes grew by over 8% in 2025 driven particularly by Cheddar and mozzarella. The social media trends for cottage cheese boosted volumes, and it accounted for over a third of cheese growth in 2025. While we don’t anticipate the growth to continue at the same rate as 2025 (up 38%), this will still be a key area for cheese growth.

Lower wholesale prices being passed on to shoppers means retail cheese prices are expected to fall in the second half of 2026 which will likely benefit more everyday varieties of cheese such as Cheddar. Unlike in some other categories, we anticipate shoppers will buy more cheese if the prices are reduced. Therefore, we predict retail cheese volumes will increase by 3% year-on-year.

Yogurt

In 2026, yogurt will continue to benefit from health and affordable indulgence remaining central in food choices. Yogurts with health claims are projected to continue performing strongly among consumers seeking additional health benefits. These may be of particular interest to shoppers using GLP-1 medications looking for nutrient-dense foods.

Luxury yogurts are expected to benefit from treating occasions, as consumers seek affordable indulgence.

As a result, we anticipate the overall yogurt category to continue seeing strong growth but slightly lower than 2025, up 7% year-on-year.

There is a similar story for yogurt drinks where we expect a continuation of trends. The Soft Drinks Industry Levy expansion to include milk-based drinks comes in to play in 2028 – so won’t affect prices for a few years. Yogurt drinks are expected to perform less strongly compared to last year but still up 3% year-on-year.

Foodservice

Overall foodservice demand is expected to be down in 2026; however there could be opportunities for dairy. We expect there may be a small increase in out-of-home hot drink demand in 2026 through trending products like matcha and ready-to-drink iced coffees.

Coffee shops were the only out-of-home channel to see an increase in trips in the final quarter of 2025, which could continue through to 2026 (Worldpanel OOH, 12 w/e 28 December 2025).

How might the dairy outlook be improved?

- Retailers passing on price drops to consumers would boost demand in some categories and be a key way to improve the outlook for dairy. This would help to balance the current oversupply of milk with increased demand

- Enhance in-aisle messaging and imagery as well as label communications, as recommended in our optimising milk research to help shift consumers’ perceptions

- Encourage milk’s role in key meals, such as hot drinks and cereals. Consider how to bring social media and foodservice trends to life in-home to boost other dairy products beyond cottage cheese

- Some consumers turning to weight loss drugs such as GLP-1 is an opportunity for dairy. These consumers are looking for healthy nutrient-dense options. Ensure dairy is communicating how it can easily meet these needs

- In the longer term, look to maintain and build consumer trust, demonstrating where farming values (animal welfare, environmental stewardship and expertise) are shared with consumers

AHDB has a range of marketing activities planned for the year, including the Let’s Eat Balanced campaign. Please visit our marketing pages for more information.

For more insight around consumer demand, visit our retail and consumer pages.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.