- Home

- Dairy market summary 2024

Dairy market summary 2024

This page provides a snapshot of key information from the dairy market 2024.

GB farm data

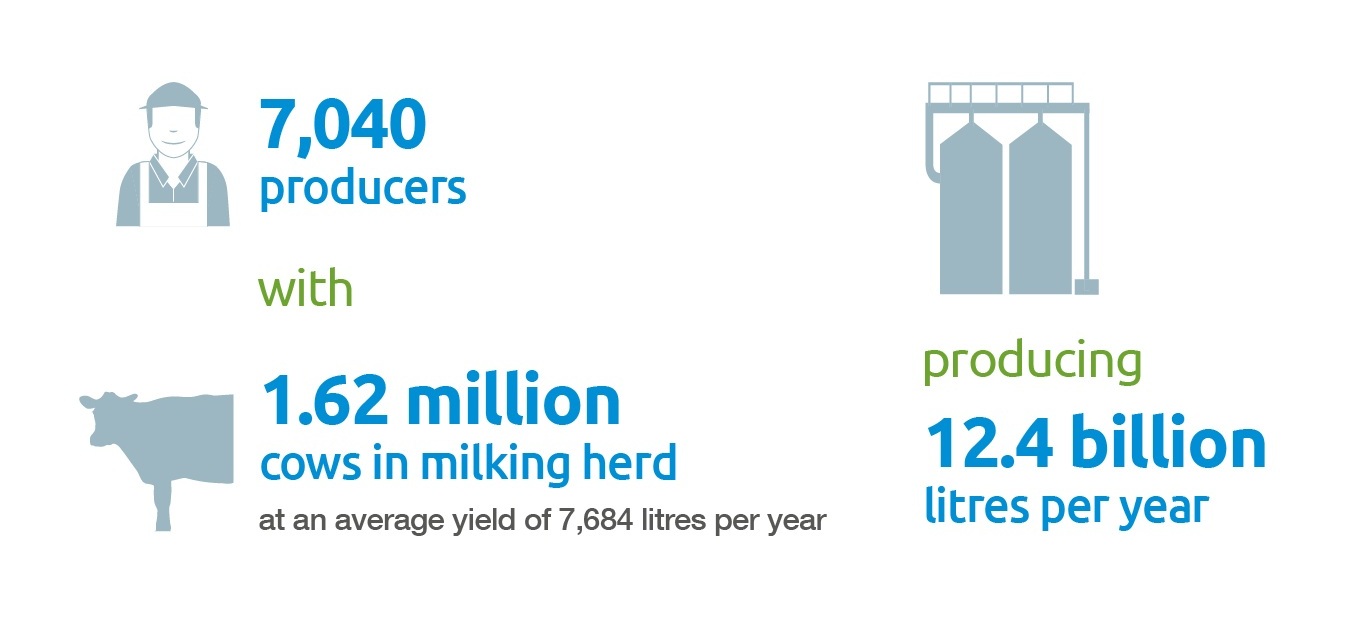

As at April 2025, GB dairy producer numbers fell by 2.6% (to 7,040) when compared to the previous year.

The herd size reduced by 200,000 head, but production was up by 900 million litres per annum. This means the average yield per cow increased by 129 litres per annum in the 2024/25 milk year, compared to 2023/24.

Figure 1. GB farm data as of 1 April 2025

Note: Milk production figures based on 2024/25 milk year.

Source: AHDB, BCMS

GB milk production

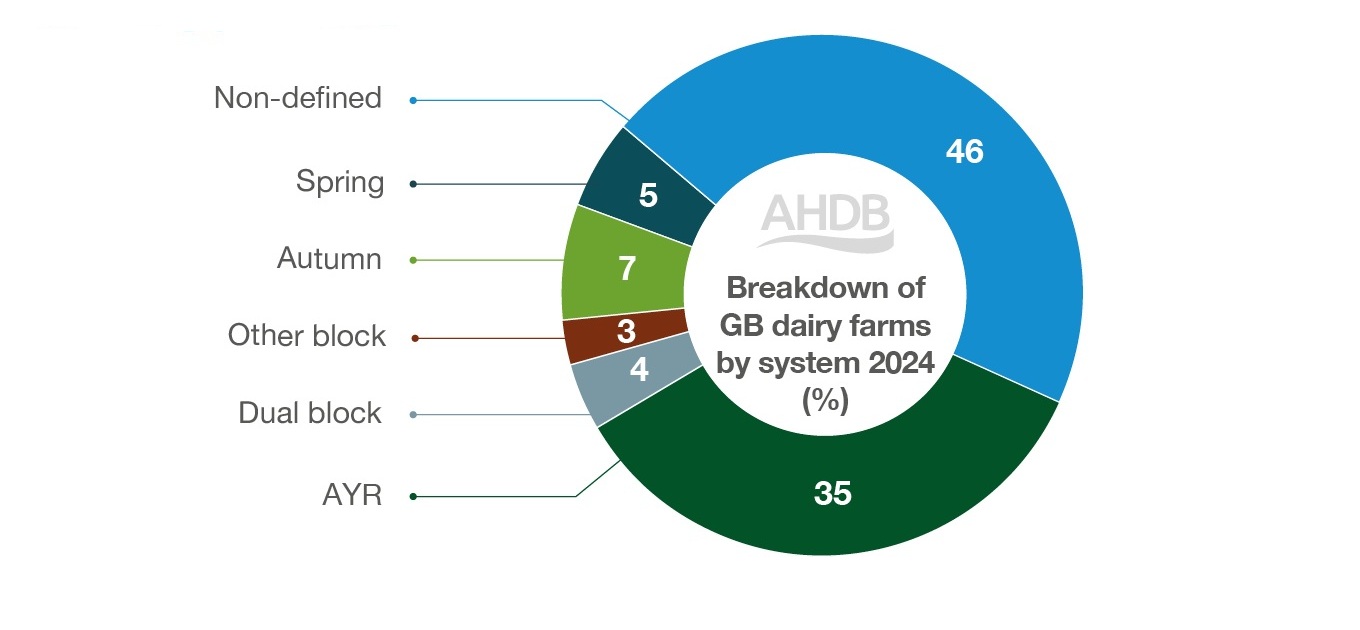

The split in the breakdown of GB dairy farms by system in 2024 remains broadly unchanged on the previous year – 45.8% were classed as undefined, a slight reduction to last year. There was a slight increase in all-year-round calving systems, to 34.6%.

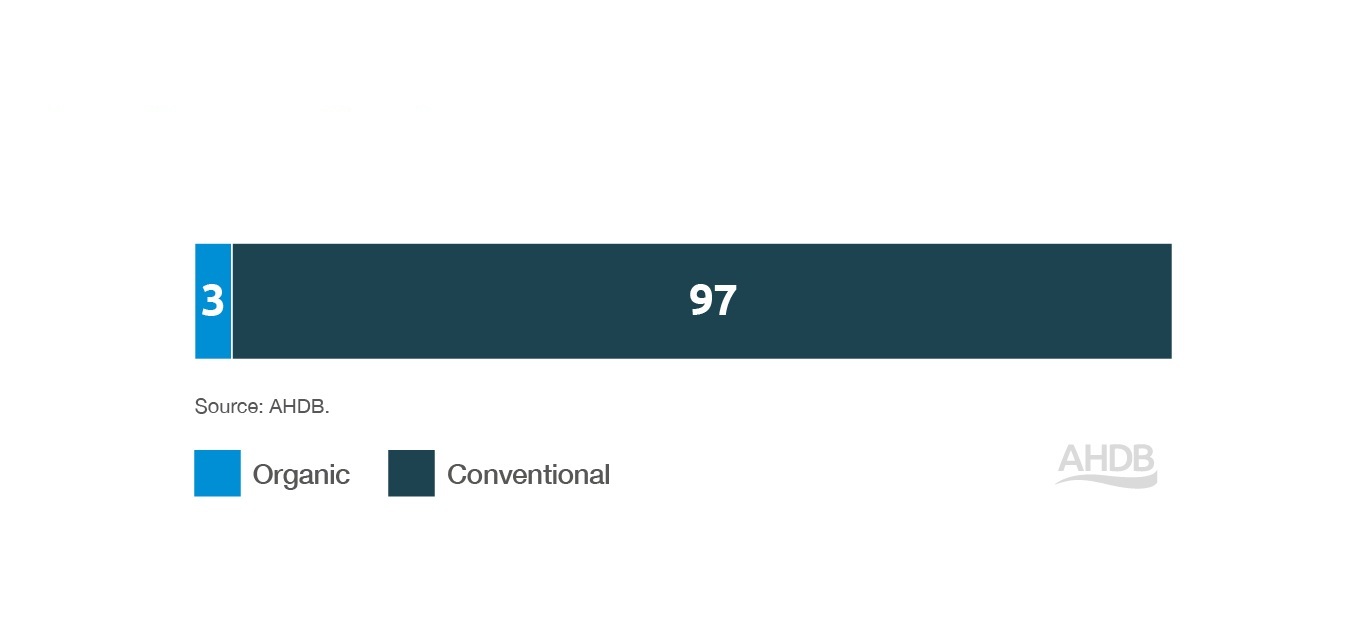

GB organic milk production as a percentage of total milk was 3% in 2024/25, unchanged on 2023/24.

Figure 2. GB milk production: Calving patterns

Figure 3. GB milk production (2024/25 milk year): Organic vs conventional milk (%)

Spring block: 80% of registrations occur within 4 months 1 Feb–31 May.

Autumn block: 80% of registrations occur within 4 months 1 Aug–30 Nov or 1 Sep–31 Dec.

Other block: 80% of registrations occur within 4 months outside a defined spring or autumn block.

Dual block: 90% of registrations occur within the spring block or autumn block defined above.

AYR: Registrations are spread relatively evenly throughout the the year but can be based on a 10–12 month calving system.

Non-defined covers any farm not falling into one of the other catagories.

Source: BCMS, AHDB

UK milk utilisation

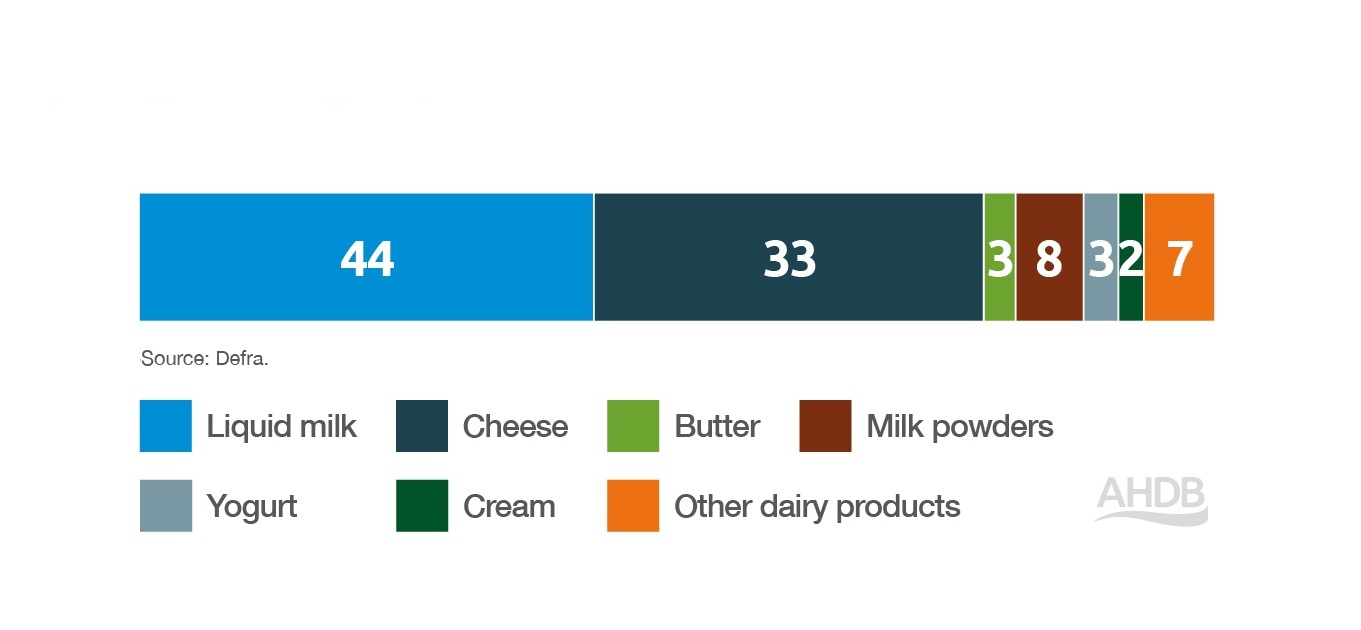

In 2024/25, UK liquid milk utilisation remained at 44% of total milk, with milk for cheese at 33%, also unchanged on the year.

Figure 4. UK milk utilisation 2024/25 milk year: Milk supply 14.2bn litres (%)

UK production

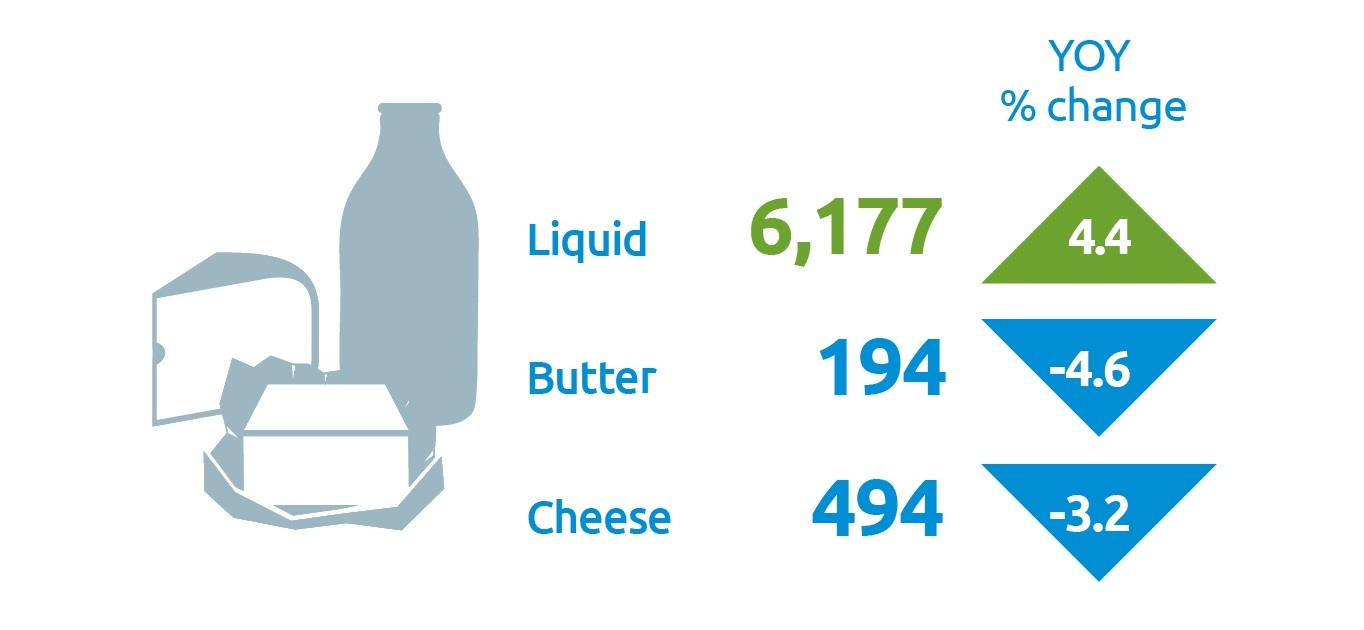

In 2024/25, UK production of liquid milk increased by 4.4% on the previous year. There were reductions for butter (by 4.6%) and cheese (by 3.2%).

Figure 5. UK production ('000 tonnes)

Note: Volumes are 12-month totals for the 2024/25 milk year.

Source: Defra

GB retail spend

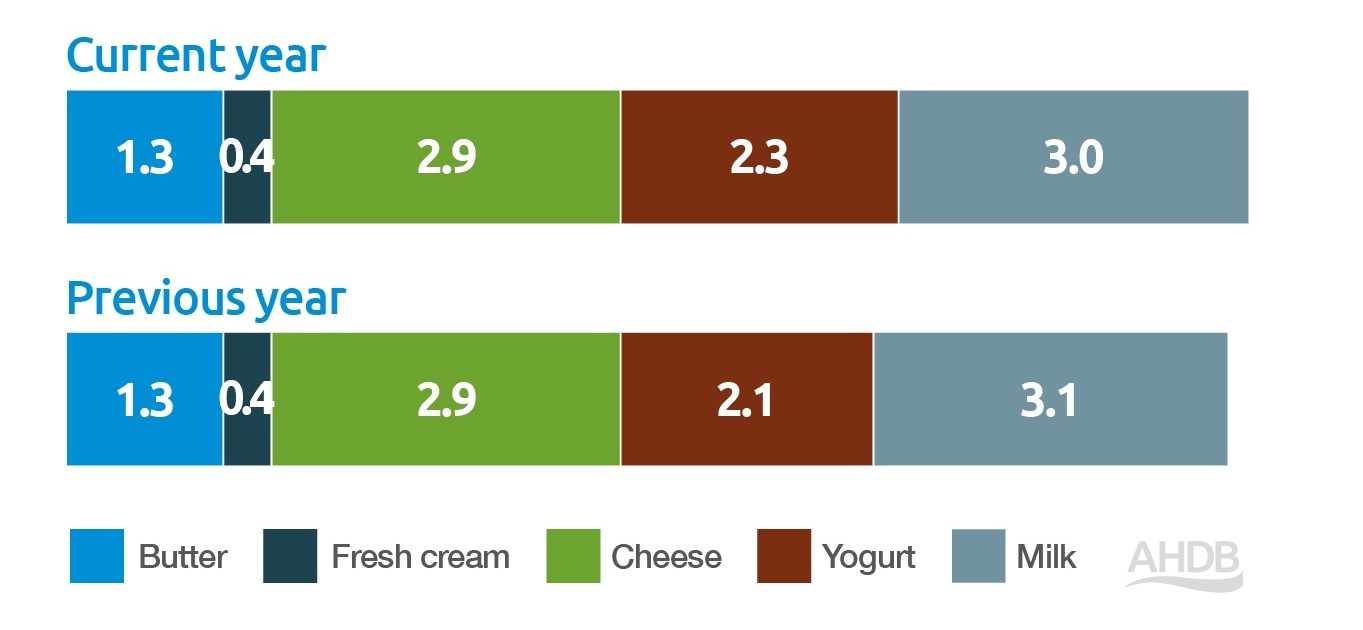

Retail spend for butter, fresh cream and cheese for the year ending March 2025 was unchanged compared to the previous year. However, spend on yogurt was up by £200 million and milk was down by £100 million.

Figure 6. GB retail spend (£bn)

Source: NIQ Panel on demand GB value, cows, dairy for 52 w/e 22 March 2025 and 52 w/e 23 March 2024

UK trade

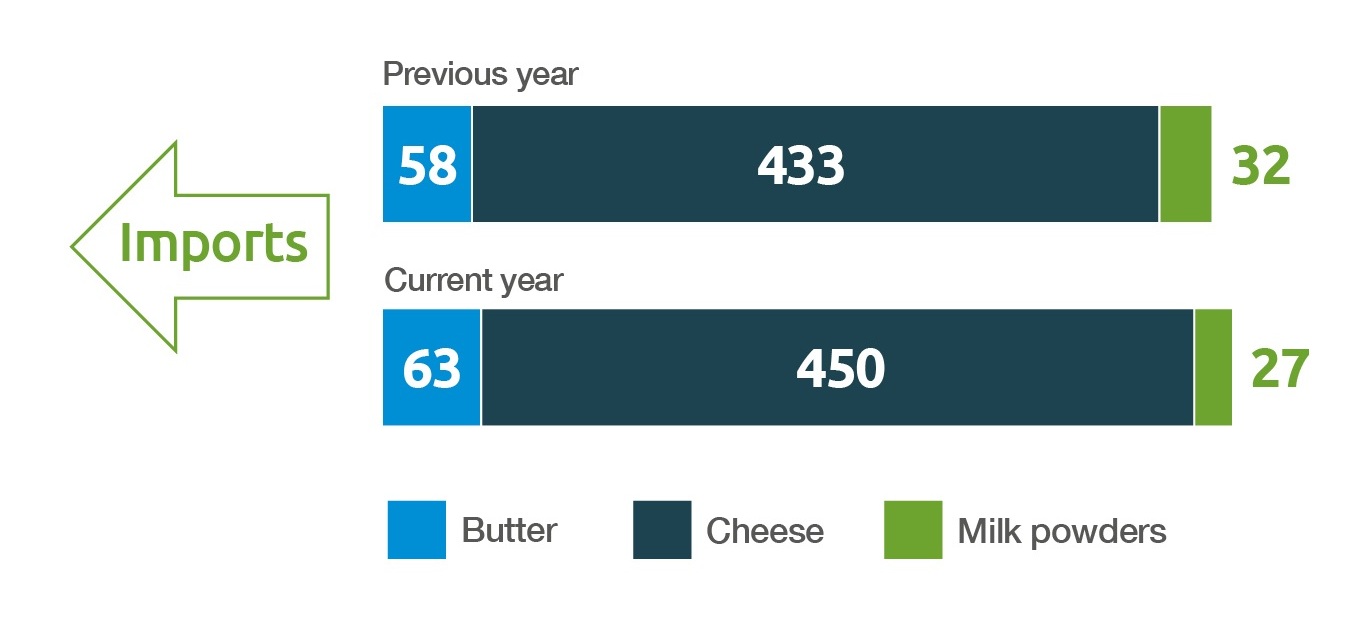

In 2024, imports by volume increased on 2023 of cheese (by 3.9%) and butter (by 9.7%). However, milk powder imports reduced (by 15.4%).

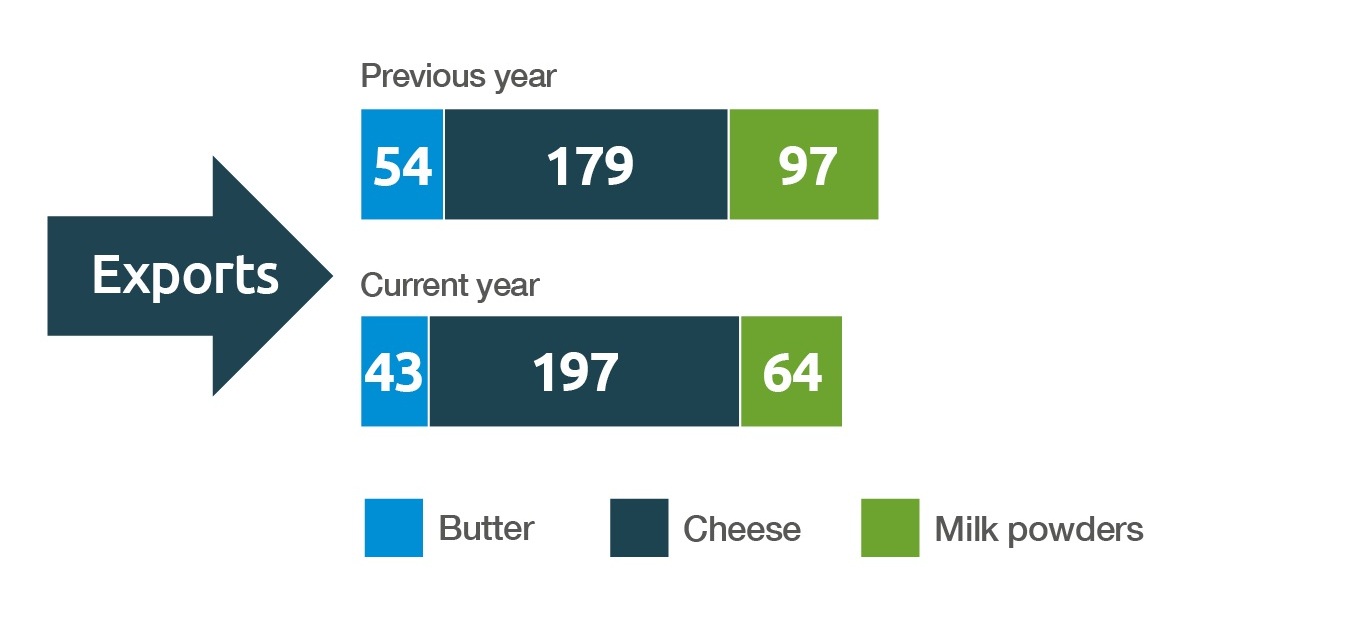

The export of cheese by volume in 2024 grew by 9.8%, but both butter and milk powder reduced compared to 2023 by 19.5% and 33.8%) respectively.

Figure 7. UK trade: Imports ('000 tonnes)

Figure 8. UK trade: Exports ('000 tonnes)

Note: Full year trade 2023 vs 2024

Further publication of the trade data is prohibited unless expressly permitted by Trade Data Monitor LLC.

Source: UK HMRC compiled by Trade Data Monitor LLC