- Home

- Cover crops, Countryside Stewardship, and failed crops guidance – arable crops

Cover crops, Countryside Stewardship, and failed crops guidance – arable crops

We have created this guidance to give you a fuller picture of your business and provide details on how to handle your cover crop, Countryside Stewardship and failed crops on the Farmbench tool.

Enterprise types

Crops

Recorded for a specific growing season, from establishment to harvest. Many crops are harvested in summer/autumn, and the most common production year is September to September.

Peas

Only covers combined peas. In enterprise details, the user indicates whether for feed or human consumption. Enter vining peas as ‘Other crop’.

Companion crops

Enter additional seed costs with the related main harvested enterprise crop.

An example of a companion crop would be buckwheat grown with OSR to reduce cabbage stem flea beetle.

Under-sown grass is not a companion crop, and seed costs are allocated to the subsequent grass crop.

Cover crops and catch crops not used (grazed or harvested) by benchmarked enterprises

This assumes there is a separate benchmarked harvested cash crop after the cover/catch crops in the same harvest year. If this is not the case, see below ‘Cover crops in stewardship’.

- Create a new enterprise under ‘Other crops’ and enter the area as one hectare

- Record all costs included in the whole rotation for the harvest year

- Enter the total of any income under ‘Straw’, e.g. if income is received by grazing cover crop before destruction

- Income and costs should reflect the total area grown even though entered as one hectare

- Costs of establishment and treatments should be included in full (you may have to manipulate the % automatically allocated) but property and administration costs are likely to be zero as these would be carried by the main crop

Cover crops and catch crops used (grazed or harvested) by benchmarked enterprises

Record as forage crop to enter grazing and harvested details.

Cover crops in stewardship

This assumes no separate benchmarked harvested cash crop on the area in the harvest year.

Create a new enterprise under ‘Other crops’ and enter actual hectares planted, seed and establishment costs. Enter any stewardship income under ‘Straw’, i.e. if wild birdseed and/or nectar/pollen mix option is taken up, enter income from the scheme in ‘Straw’ and seed and establishment costs under the appropriate cost sections. Note this assumes there is no other cash crop harvested in the area during the harvest year.

Failed crops

Scenario 1: This assumes there is a separate benchmarked harvested cash crop after the failed crop in the same harvest year. For example, the winter-sown crop fails, and spring crops are sown instead. Create a new enterprise under ‘Other crops’ and enter the area as one hectare. Record all failed crop costs incurred. Following this protocol means that the cost of crop failure will be accounted for across the whole rotation for the harvest year without distorting the benchmarking of the replacement crop.

Scenario 2: Where a crop fails, and no replacement crop is sown in the same harvest year, benchmark the failed crop in the usual way with the full area, costs, and any income (e.g. insurance) entered under ‘Straw’.

Other income:

- Insurance receipts for crop failure

- Faulty seed

- Agronomist error

- Crop compensation received from utility companies

- Income from stubble, beet tops or vegetable waste grazing

Enter income under ‘Straw’, except in the case of sugar beet, then enter under ‘Other sales’.

Farmbench guide – Countryside Stewardship (CS)

Options for entering stewardship schemes onto Farmbench

Option 1 – Whole scheme entry

Enter total environmental stewardship area, income, and costs as a whole enterprise.

- Add Enterprise – Select the ‘Other crop’ enterprise. Make sure you name this enterprise appropriately so it is easily defined in the costs section.

- Enter the income of the total stewardship payment in the production section, in ‘Actuals’, in the ‘Straw sales’ box.

- For variable costs, the enterprise will appear as you have named it, allowing you to enter any costs accrued, such as seed, etc.

- For fixed costs, including labour, machinery, property and admin, the enterprise will appear in a standalone entry named ‘Other crops’. This will allow you to allocate any fixed costs associated with the stewardship scheme only.

Why use ‘Other crop’ and not a combinable enterprise?

- Only costs accrued by the stewardship scheme will be allocated to the scheme. Therefore, no depreciation of large combinable equipment, for example, combine, dryer.

- Will allow the stewardship scheme to be viewed on the multi-enterprise report.

Option 2 – Split by scheme options

Enter the individual environmental stewardship option, their income per ha and costs as an option.

To enter schemes individually, they must fit the below criteria:

- If an option is under 1 ha, these should not be entered individually.

- If there is less than 5 ha total of non-rotational options, these need to be grouped together as per option one.

- Any grass options less than 12 months which are not grazed or conserved can be added as ‘Other crop’.

- Any grass options greater than 12 months, which are grazed and conserved, must be entered as a forage enterprise, as other forage. These will appear on a separate forage report.

Steps

- Set up enterprise according to scheme option, either ‘Other Crop’ or ‘Other forage’.

- Please name each enterprise with an option code per example, ‘Other Crop – AB16’.

- Production – enter income for the option as ‘Straw sales’, as per price per ha earned for each option x number of ha

- For variable costs, the enterprise will appear as you have named it, allowing you to enter any costs accrued, such as seed, etc.

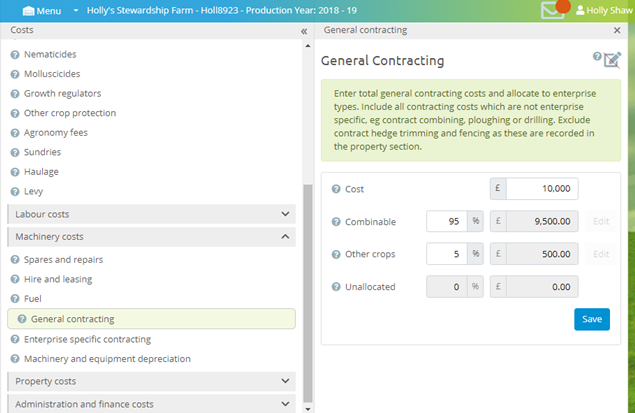

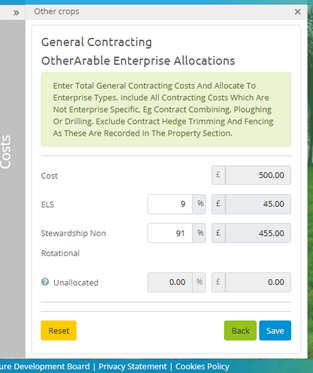

- Fixed costs (which includeslabour, machinery, property and admin), the ‘Other Crops’ include your enterprise this will allow you to allocate any fixed costs associated with the stewardship options.

- If you have multiple stewardship options, these will be grouped as ‘Other crops’. To edit this further, please use the edit button to allocate more specific items to the relevant option.

Countryside Stewardship (CS) option list

| Option code | CS option title | Rotational/ Non-rotational | Enterprise type |

|---|---|---|---|

|

AB1* |

Nectar flower mix |

Rotational |

Other arable |

|

AB6* |

Enhanced overwinter stubble |

Rotational |

Other arable |

|

AB9* |

Winter bird food |

Rotational |

Other arable |

|

AB11* |

Cultivated areas for arable plants |

Rotational |

Other arable |

|

AB13 |

Brassica fodder crop |

Rotational |

Other forage |

|

AB15 |

Two yr. legume fallow |

Rotational |

Other arable |

|

AB16* |

Autumn bumblebird mix |

Rotational |

Other arable |

|

GS4 |

Legume and herb rich sward (12 months) |

Rotational |

Other arable |

|

SW6 |

Winter cover crops |

Rotational |

Other forage |

|

GS4 |

Legume and herb-rich sward (greater than 12 months) |

Rotational |

Other forage |

|

AB8* |

Flower-rich margins and plots |

Non-rotational |

Other arable |

|

SW3 |

In-field grass strip |

Non-rotational |

Other arable |

|

AB3 |

Beetle banks |

Non-rotational |

Other arable |

|

AB12 |

Winter feeding for farmland birds |

Non-rotational |

Other arable |

|

SW1 |

4–6 m buffer strip on cultivated land |

Non-rotational |

Other arable |

|

WT2 |

Buffering in-field ponds and ditches on arable land |

Non-rotational |

Other arable |

|

BE3* |

Man. hedgerows |

Non-rotational |

Other arable |

N.B. Costs associated with any legume options over 12 months should be spread over the total year's ley, such as seed and establishment costs.

Any forage options, for example, GS4, where there is a grazing or hay sales income, should be included in the production section. Where own animals are grazed, please enter these in ‘Grazing’. If there is an income derived from this grazing, include this in ‘Grazing income’, along with any hay/silage sales.