- Home

- How has the structure of the beef and lamb processing sector changed over time?

How has the structure of the beef and lamb processing sector changed over time?

Here we examine trends in the supply chain infrastructure for beef and lamb production in England, covering abattoirs, cold storage facilities, cutting and other processing sites.

Meat production needs to be assisted by appropriate and accessible infrastructure for slaughtering and processing. While GB-specific data underpinned much of the analysis, UK-wide and England-only data is also referred to.

Key points

- In 2024, there were 143 abattoirs in England that processed red meat. Cattle were processed at 118 of these facilities and sheep at 115 of them

- Between 2019–2024, the number of abattoirs processing cattle and sheep reduced by 16% and 15%, respectively

- Supplies of cattle and sheep have also changed during this time, but at differing rates. Maintaining a critical mass of domestic supply is crucial for the processing sector to maintain capacity and efficiency

- The majority of cattle and sheep processing is undertaken by a small number of multi-purpose businesses as the number of smaller, independent firms has declined

- Increased reliance on fewer sites for slaughter, cold storage, cutting and ‘further processing’ may present efficiency gains but raise the exposure of the supply chain to disruption risks

- A resilient processing supply chain is imperative for facilitating domestic production and delivering for food security

A vital link in the chain

According to the Food Standards Agency, the UK meat industry supported an estimated 50,000 farmers and employed around 97,000 people directly in 2023. The domestic abattoir and processing industry is crucial for livestock producers and interconnected industries, such as the dairy sector, which supplies over half the cattle slaughtered for beef in GB.

The importance of meat processing goes beyond the cattle and sheep sectors: it is of national importance for concerns around food self-sufficiency.

Key details of slaughterhouses and the species they process for England and Wales are displayed on the AHDB eFoodchain map.

The effect of restructuring on processing capacity

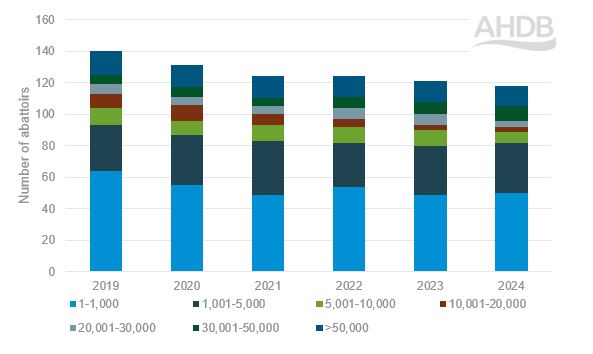

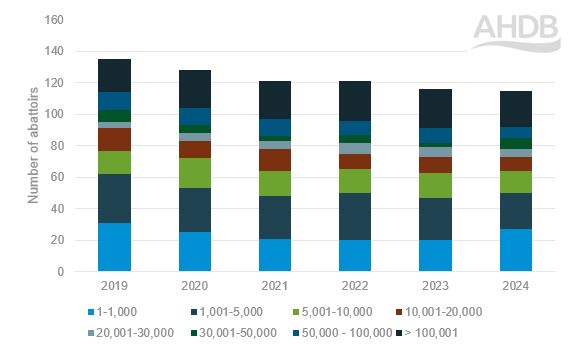

The reduction in abattoirs between 2019–2024 mainly occurred in smaller and medium-sized abattoirs, as the industry has consolidated. Small abattoirs (those who processed less than 10,000 head per year) for cattle and sheep declined by 14% to 89 and 17% to 64, respectively, from 2019 to 2024.

The downward trajectory has been ongoing for decades. The British Meat Processors Association (BMPA) Meat Industry Manifesto indicates substantial reductions dating back to the 1970s.

According to AHDB abattoir numbers, almost half (46%) of the cattle kill in 2024 took place in the 13 largest abattoirs (those abattoirs killing +50,000 head a year), while the 50 smallest abattoirs (abattoirs killing up to 1,000 head a year) account for only 3% of throughputs.

The sheep processing sector is even more concentrated, with 62% of the sheep kill occurring in the 23 largest abattoirs in England (abattoirs killing +100,000 head a year), and just 1% in the smallest 27 (abattoirs killing up to 1,000 head a year).

Supplies of cattle and sheep have also changed during this time, but at differing rates. Between 2019 and 2024, total GB cattle and calf slaughter increased by 5.4% to 2.2 million. Meanwhile, total sheep slaughter declined by 13% to 11.4 million.

Maintaining a critical mass of domestic supply is crucial for the processing sector to maintain capacity and efficiency. Indeed, the whole supply chain is dependent on sufficient livestock numbers.

Our analysis of the long-term outlook for domestic GB cattle and sheep production shows a continued decline in output by 2030 unless action is taken to mitigate reductions. Declining livestock numbers implicate national production levels, which directly effects food security.

Trends in the number of English cattle abattoirs by size, 2019-2024 (head of cattle processed per year)

AHDB

AHDB

Source: AHDB

Trends in the number of English sheep abattoirs by size, 2019–2024 (head of sheep processed per year)

AHDB

AHDB

Source: AHDB

Closure of small abattoirs

Despite the maintenance of overall capacity levels, the closure of small abattoirs is detrimental to the supply chain overall.

As well as the social and welfare benefits they bring, small and localised abattoirs provide business to farmers, butchers and rural communities. For example, private kill which enables sales direct to consumers.

The Sustainable Food Trust details the numerous benefits of small and localised abattoirs, and the vital services they provide. In particular, abattoir closures have negative implications on welfare and environmental impact for producers who may have to travel further.

Smaller abattoirs often have flexibility advantages. For example, accepting smaller batch sizes and ability to handle animals with specific traits, such as long coats and horns (Rare Breeds Society). In addition, producers often rely on smaller processors for private kill orders.

Cold store, freezing and cutting facilities

Aside from abattoirs, processing also involves cold storage, cutting and ‘further processing’ sites. Cold store and freezing facilities are vital for maintaining an even supply throughout demand fluctuations. For example, seasonality and different events throughout the year lead to variation in consumer demand but also variation in supply, particularly for lamb.

Integration and consolidation of processing facilities can offer significant economic and communication advantages. These facilities often deal with more than one species and apply economies of scale for efficient production.

When volumes do not align with requirements, the modern supply chain structure facilitates the large-scale trade of these perishable products. The broadening of the market addresses carcase balance challenges. However, greater reliance on fewer sites may increase vulnerability to disruptions.

Pressure on operating costs

A number of pressures disproportionately impact small abattoirs, such as:

- High operating costs are likely to incentivise further economies of scale

- Abiding to increasing food safety, traceability and welfare regulations alongside individual market requirements may threaten lower margins

- Recent proposals to increase food safety fees in abattoirs could “catastrophically impact small and medium businesses”, according to the National Sheep Association (NSA)

Rising costs of waste management combined with lower values of hides and skins also pose challenges. Exports are vital for utilisation of fifth-quarter products, as well as cuts surplus to the requirements of the domestic market.

It is often easiest for large, integrated businesses to negotiate deals in order to get favourable prices and reduce waste.

Labour shortages remain a significant challenge for the meat industry, which relies heavily on migrant workers. Exacerbated by Brexit and the Covid pandemic, the long-term challenge has proven both costly and capacity-limiting to some businesses.

What could the future hold?

Current economics and trends in livestock numbers may suggest further consolidation in the meat processing sector is likely, with small and medium-sized abattoirs likely to be most vulnerable.

The forecast reduction in stocking numbers would lead to abattoirs operating on reduced throughputs, which could threaten the economic viability of plants and create increased competition for finished livestock.

A strained supply chain, alongside a rising population, risks creating a higher dependency on imported products.

Integration is developing in the supply chain, with some schemes (such as integrated dairy-beef schemes) evolving on-farm production systems, managing the chain from breeding and genetics through to finishing and processing.

Leaner and more machine-led systems which focus on optimising production processes may increase requirements on producers to provide larger batches of uniformly finished livestock.

New infrastructure will be strategically placed, taking into account nearby plants and transport links to maximise logistical efficiency.

What are the profitability prospects for small abattoirs? While key advantages have been acknowledged, and some government funding has been provided, the long-term economic viability of these facilities remains in question.

What are the opportunities?

Large abattoirs benefit from both advanced facilities and market access for maximising carcase value. Investment in automation and technology can help address workforce challenges, improving efficiency, while creating a more desirable workplace environment.

Small abattoirs should capitalise on their unique selling points and communicate the benefits. While expanding capacity could incur further costs, expansion of services could result in new income streams.

Opening a butcher’s shop, for example, might enable a business to capitalise on the local benefits and quality of product. Collaboration with larger abattoirs could provide access to resources, such as butchery training, waste management and transport.

The BMPA Meat Industry Manifesto sets out the role government policy can play to shape the meat industry in a sustainable way.

Explore how beef and sheep meat production levels in Great Britain may change by 2030