- Home

- How will long-term constraints on EU milk production shape opportunities for British dairy?

How will long-term constraints on EU milk production shape opportunities for British dairy?

EU milk supplies are expected to contract over the next decade according to Rabobank’s medium-term outlook to 2035. Other analysis from GIRA highlights that the world will be short of dairy protein. Is there a growth opportunity for GB here?

EU milk production is expected to see decline graduallly each year, resulting in a total shortfall of 5% over the next decade.

Key drivers for the overall reduction include policy pressure, demographic shifts and the impacts of climate change on production.

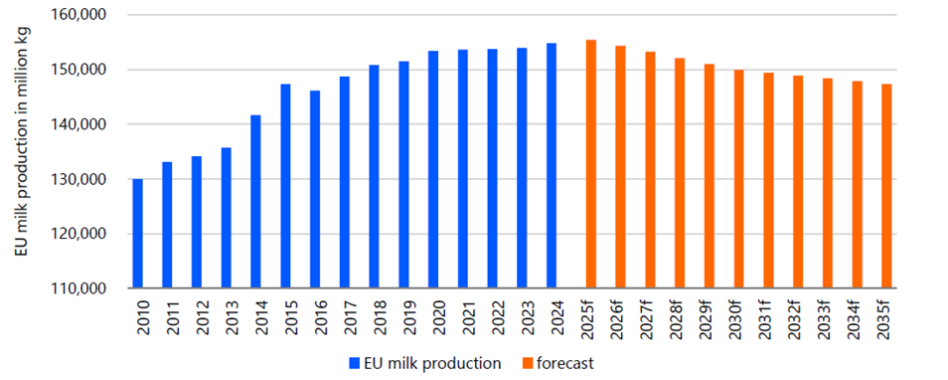

Expected milk supply development 2025–2035

Table 1. EU milk production trends and forecast, 2010–2035

Source: RaboResearch 2025

Annual milk volumes in the EU have been increasing since the abolition of milk quotas and are estimated to have peaked in 2025, where the landscape changed significantly.

The recent acceleration of volumes, supported by favourable economic conditions, has ‘masked’ the underlying structural shifts.

While the overall direction is for lower production over the next decade, nuances are expected by country (Rabobank 2025).

- Sharp decline (>1% decrease per year):

- France (-3bn kg)

- Italy

- The Netherlands (-2.7bn kg)

- Moderate decline (0.5% to 1% decrease per year):

- Germany (-3.3bn kg)

- Stable (-0.5% to 0.5% change per year):

- Belgium

- Denmark

- Ireland

- The Netherlands

- Romania

- Spain

- Sweden

- Increase (<0.5% growth per year):

- Czechia (+0.4bn kg)

- Estonia

- Latvia

- Poland (+2.7bn kg)

Gira forecasts also point towards less milk in the EU, while conversely, the EU medium term outlook is more optimistic, forecasting marginal growth (0.1% per year) and notes that an increase in milk solids production and yields will provide some counterbalance to the declining herd size.

However, all outlooks indicate that demand for dairy products globally will be ahead of what the EU can satisfy.

Rabobank identifies three main drivers for the forecast decline:

Policy pressure

There is increasing pressure from EU and national policy changes, particularly on regulations addressing the environment and animal welfare. These are increasing costs for producers and limiting stocking rates.

Most notable measures include limitations on nitrogen and phosphate production as well as greenhouse gas emissions from livestock, such as Denmark's initiative to impose a tax on agricultural emissions.

While Denmark and the Netherlands have declared their whole country an NVZ, the recent EU commission’s approval of a three-year extension of Ireland's nitrates derogation does offer temporary relief for the sector.

Stricter animal welfare rules are expected after 2026, such as the ban on transportation of calves under 5 weeks, and additional costly requirements to monitor compliance.

Rural demographic shifts

Both an ageing farmer population and rural depopulation are having a negative impact on labour availability.

The structural issue is widespread across the EU, leading to losses of active farms, particularly those classified as small or medium sized operations.

Climate impact on production systems

The impact of global warming is weighing on the projected decline in EU milk production. Although this varies regionally, the effects are widespread and becoming more severe.

Cow productivity is affected by heat stress and extreme weather events, which are becoming more common are impacting yields.

Indirect effects, such as the increase of livestock diseases, are largely linked to warming temperatures, such as bluetongue.

Stable and competitive farmgate prices are increasingly important for maintaining a longer-term supply

Growing pressures on the milk pool will lead to increasing competition for milk and affect processor operations. There is an increasing need to take steps to maintain supply in the long term.

The response from processors may include geographic relocation to reduce regional risk and exploring other procurement opportunities.

Maintaining a milk pool in the EU will require attractive market conditions, with emphasis on transparent and dependable pricing.

Investment in the industry, for example, to mitigate some of the impacts of climate change will increase in importance. Developments are necessary both to retain and attract new entrants.

In addition to this, analysis from GIRA indicates that global demand for dairy protein will increase over the next decade due to health and GLP-1 drugs – we could need as much as 83 kts more by 2030. This could present opportunities for producing markets.

Can GB fill the gap?

Ultimately, a lot can change in the next decade, but we will be operating with less milk, having a knock-on effect to the global marketplace.

As the EU supply is expected to decline, while domestic consumption is to remain stable, the bloc’s exportable surplus is forecast to reduce from 14% to 9%, creating opportunities for other exporters to fill the gap.

GB is faced with its own constraints to growth, but the growing global demand for dairy products, particularly for protein, could better position the UK as a more significant supplier and fill the gap in the medium-term.

A lot will depend on longer term investments of additional processing capacity and the emergence of new policy constraints, such as permitting.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.