A first look at the USDA’s 2025/26 estimates: Grain Market Daily

Tuesday, 13 May 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £181.00/t yesterday, up £1.80/t from Friday’s close. The May-26 contract gained £0.20/t over the same period, to close at £190.80/t.

- UK feed wheat futures closed higher yesterday influenced by Paris milling wheat futures, which were up 0.9% over the session. However, Chicago wheat futures (Dec-25) were down 1.2% . The weakening of the euro against the US dollar supported Paris futures. Chicago wheat futures were also under pressure after the USDA crop progress report showed a 3% week-on-week improvement in the proportion of the winter wheat crop rated in good or excellent condition.

- Paris rapeseed futures (Nov-25) closed at €485.00/t yesterday, up €9.25/t from Friday’s close.

- Chicago soyabean and Winnipeg canola futures (Nov-25) were up 2.6% and 0.9% respectively. The easing of US-China trade tensions is supporting Chicago soybean futures and the wider oilseed complex.

A first look at the USDA’s 2025/26 estimates

Yesterday's USDA World Agricultural Supply and Demand Estimates (WASDE) report provided a first look at expectations for the 2025/26 season.

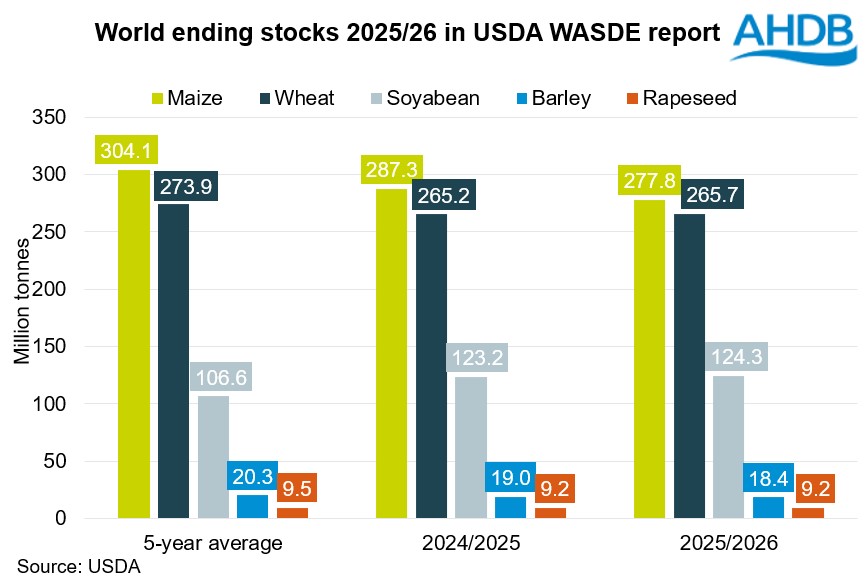

Both world wheat production and consumption are both expected to rise by 1% next season. Ending stocks in 2025/26 are pegged at 265.7 Mt, up slightly (0.2%) from the 2024/25 season, but down 3% from the previous five-year average. This was also above the average trade estimate of 261.2 Mt.

For maize, production in 2025/26 is forecast up 4% on a year earlier, with consumption expected to increase by 2%. The USDA estimates world ending stocks of maize at 277.8 Mt, 3% lower than in the 2024/25 season and 9% lower than the last five-year average. This was well below the average trade estimate of 297.4 Mt.

World production of soyabeans is forecast up 1% on the year in 2025/26, while consumption is expected to rise by 3%. Ending stocks are pegged at 124.3 Mt, rising for the fourth consecutive season, up 1% from this season and 17% above the last five-year average. However, this is slightly below the trade estimate of 126.0 Mt.

What does this mean for prices?

Unexpected figures compared to average trade estimates ahead of the USDA's WASDE report can impact market sentiment in the short term. For example, 2025/26 world ending stocks were lower than anticipated for maize and soybeans, and as such, we saw US maize and soyabean futures prices rising at yesterday's close. On the other hand, world ending stocks for wheat were higher than previously expected, and consequently, sentiment in the market was more bearish. We could see this filter through to European markets today.

Longer term, further revisions to these figures as we approach next season will be in focus as crops move through their key development phase in the northern hemisphere. Fundamentally, we are seeing a trend of falling global ending stocks for wheat and maize, but rising stocks for soyabeans. While this could underpin grain markets, concerns remain over global economic growth and demand, and geopolitical factors are in focus.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.