Analyst's Insight: Could we see increased demand for British oats?

Thursday, 7 August 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £172.45/t yesterday, down £0.15/t from Tuesday’s close. The May-26 contract fell £0.50/t over the same period, ending the session at £184.40/t

- Global wheat markets were mixed yesterday. Paris milling wheat futures (Dec-25) slipped by 0.6%, while Chicago wheat futures (Dec-25) saw a slight gain of 0.1%. Overall sentiment remains bearish, with ongoing harvest pressure across the Northern Hemisphere. There are also reports that grain from central Russia is now reaching ports, adding to available supplies and weighing on prices (LSEG).

- Nov-25 Paris rapeseed futures closed yesterday at €469.75/t, down €5.75/t on the day, while the May-26 contract dropped by €6.50/t to €476.75/t. This follows general weakness across the vegetable oil complex. Winnipeg canola futures (Nov-25) fell by 0.4%.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Could we see increased demand for British oats?

UK oat production has seen stable growth in recent years, with the 2025/26 planted area provisionally estimated at 207 Kha, by the results of the AHDB planting and variety survey (PVS). This is a 13% rise from 2024, making it the largest area since 2020. This expansion has been driven by improved planting conditions, particularly a favourable late autumn in 2024 and supportive spring weather in 2025 making oats highly suitable.

Oats have become an increasingly attractive crop for UK farmers due to their compatibility with low-input, environmentally friendly rotations and their rising value in food markets. The UK's potential production of oats for the 2025/26 season could range from 1 Mt to 1.2 Mt. This is calculated using the UK’s minimum (4.9t/ha) and maximum (5.7t/ha) yields recorded between 2020 and 2024 (Defra), along with the provisional planted area of 207 Kha.

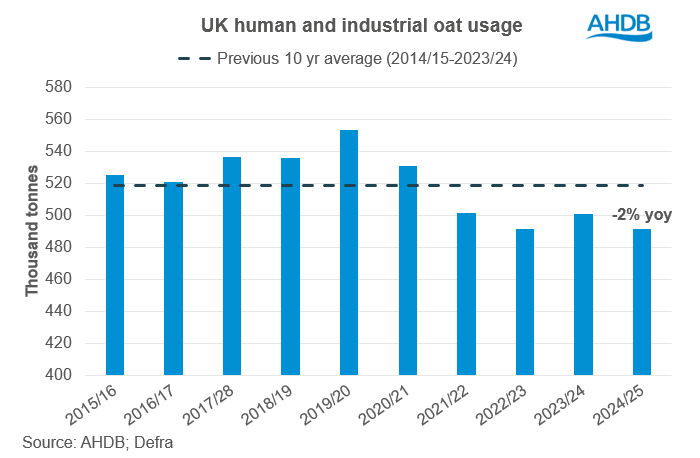

On the demand side, 2024/25 human and industrial (H&I) consumption of oats was 5% below the previous five-year average, according to data released today by AHDB. This is partly due to reduced usage by millers driven by higher extraction rate because of better quality oats. However, demand for oats in animal feed is on the rise, due to greater availability.

With another year of strong production likely, and higher than average carry in stocks expected for 2025/26, the UK oat balance could be looking well supplied this season, especially with muted H&I uptake from the previous season. However, there are signs H&I demand could pick up as the season progresses.

Potential increase in demand – Alpro’s move to 100% UK sourcing

Earlier this year, Danone announced that Alpro, a leading plant-based drink manufacturer, will be using 100% British oats for its long-life oats drink and chilled oat drinks, with plans to expand this sourcing to its barista range in the future. This follows a significant investment by the company aimed at supporting UK agriculture and expanding its plant-based product range.

Alpro plans to produce around 58 million litres of British oat drink annually at its Kettering plant, representing nearly a quarter of its UK plant-based drinks production. The oats will be processed at the relatively new mill, Navara, in Kettering and will be sourced within an 80-mile radius of the mill.

Alpro’s oat drink production appears geared primarily toward the UK market, although further expansion or export opportunities could arise in future.

What does this mean for UK oat demand?

Producing oat milk requires about 90–100 grams of oat flour per litre, meaning Alpro’s planned 58 million litres would need around 5,800 tonnes of flour. After processing to make flour, 28-32% of raw oat weight is lost as hull and around 10% can be lost during milling.

This means producing 5,800 tonnes of flour could require 8000 – 9500 tonnes of raw oats, depending on quality.

Summary

The move to using 100% British by Alpro could somewhat boost domestic oat milling demand, especially at a time when H&I demand has lagged behind historical average. Although the increase in demand will likely be relatively small (c. 2% of total UK oat H&I consumption), if other manufacturers follow suit or if Alpro expands production further, this could lead to a more structurally supported domestic oat market.

Additionally, the emphasis on local sourcing may strengthen regional supply chains particularly in the East Midlands and surrounding regions, supporting more resilient agri-supply chains.

This may help guide cropping decisions for oats, supporting the steady increase in planted area. Oats perform well in low-input systems, and growing consumer demand in the UK suggests that support for British-grown oats could continue to build in to the years ahead.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.