Analyst Insight: Why does the 2024/25 wheat balance sheet not balance?

Tuesday, 30 September 2025

Earlier today, we released the final balance sheets of the 2024/25 season.

In theory, at the end of the season, all actual data relating to supplies, usage, trade and stocks should balance. However, given that most of the statistics included in these balance sheets are collected via survey rather than a full census, we can expect a certain level of imbalance or residual, which is identified most years.

There are also some other figures in the balance sheet, such as fed on farm (FOF) which is not informed by a survey and is an estimate based on market information.

For 2024/25, a residual of 536 Kt was identified for wheat.

This analysis will investigate the reasoning behind the wheat imbalance.

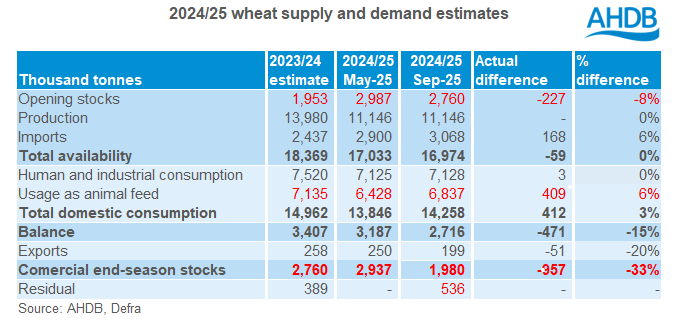

What’s changed since May’s estimates?

Of course, when we made our estimates in May, the indicative wheat balance sheet balanced, based off the information and analysis at that point in time.

So, what are the main changes in the actual data which have left this residual?

As seen above, the key changes from May are an increase in the amount of wheat used for animal feed (409 Kt), a 227 Kt drop in opening stocks, and a 957 Kt fall in closing stocks.

Fed on farm adjustments

Full season compound feed usage of wheat was higher than estimated in May. However, the rise in wheat usage in total animal feed is largely driven by an increase in FOF.

While most of the data in the final balance sheet is official/final data, the two figures that remain AHDB estimates for wheat, are the proportion of grain used by compounders that is imported (vs home-grown), and the amount of grain fed directly to livestock on farm.

The estimate for wheat FOF remained lower than average throughout last season, in line with the drop in supply.

However, with the extremely dry spring, leading to significantly less grass/forage (the impacts of which even greater than anticipated in May) and a larger amount of grain expected to have remained on farm towards the end of the season (due to lower wheat prices) we have increased the wheat FOF figure.

It is also worth noting the higher margin for livestock and dairy farmers may have encouraged walking the grain off the farm rather than selling it.

Bear in mind that the proportion of imported wheat used by feed compounders has been increased compared with May. This is based off further analysis of destination ports and origin of imports.

Typically, it is assumed that all wheat fed on farm is home grown. However, anecdotal evidence suggests a relatively small proportion of imported wheat is bought and mixed on farm in some regions, in particular Northern Ireland.

Therefore, a small proportion of the wheat fed on farm estimate is assumed to be imported.

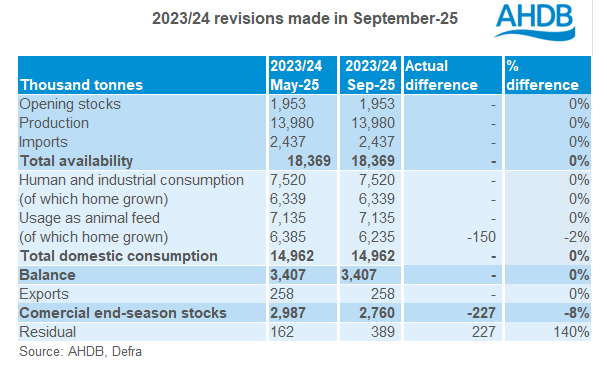

2024/25 opening stock revisions

In terms of opening stocks, we need to look back at the 2023/24 wheat balance sheet.

When pulling together data this time last year, it was suspected there was a gap in the merchants, ports and co-ops (MPC) survey. This, alongside a +/- 206 Kt confidence interval in Defra’s on farm stocks (England & Wales) survey, and anecdotal insight from industry, led to doubt over the final ending stocks figure for 2023/24.

Since the publication of the 2023/24 balance sheets in September 2024, we have undertaken a full review of the MPC survey to strengthen both the survey coverage and data handling processes.

Following this review, the June 2024 figures were revisited and subsequently revised in the latest data release.

Additionally, we undertook further analysis around the origin of imported wheat in the 2023/24 season and have since revised up the proportion of imported wheat used by compounders versus home grown wheat in the 2023/24 season.

With these changes, we have therefore updated the total ending stocks for 2023/24 (for both wheat and barley).

By revisiting the 2023/24 balance sheet and updating it with the latest data and analysis, it improves the accuracy of opening stocks for the 2024/25 season.

However, it is important to remember, due to the confidence interval on the Defra on-farm stocks figure, there will always be a margin of error in any opening stocks, unless there is a full census of growers.

These changes partly explain why the wheat ending stocks forecast in May 2024/25 were higher than the ending stocks in the final balance sheet.

However, it doesn’t paint the full picture as we are still left with the 536 Kt residual of wheat.

Where could this residual sit?

While we always expect a certain margin of error in any survey, we can be fairly confident with the reliability of the cereal usage surveys and trade data. So, when identifying where this wheat residual could be, the key areas to look at are carry-in stocks (covered above), production data, and ending stocks (on-farm stocks).

There is obviously the fed on farm (FOF) figure which is not informed by a survey and is an estimate based on market information. That said, FOF seems to be a consistent inconsistency throughout each season.

For harvest 2024, Defra reported UK production at 11.15 Mt. However, the confidence interval on Defra’s England and Wales production number was +/- 191 Kt, meaning it’s possible that production in 2024/25 was lower than outlined in the balance sheet, potentially accounting for some of the residual.

Equally, looking at Defra’s on-farm stocks survey carried out across England and Wales as of the end of June, the confidence interval was +/- 153 Kt (which accounts for 23% of the total published). This again likely accounts for some of the residual, with anecdotal reports from industry suggesting on farm stocks are higher than reported.

The proportion of the wheat residual which is imported is perhaps more difficult to account for. However, some of this is likely due to the margin of error in the estimate of the amount of imported wheat used in animal feed.

Larger confidence intervals, combined with margins of error across opening and closing stocks, and to a lesser extent over the usage surveys, likely accounts for the 536 Kt residual.

Looking ahead

We are now well into the 2025/26 season – one which has started off with low prices, sluggish demand, policy changes and a question mark hanging over the quantity and quality of 2025 crops.

This season, accurate information is going to be key to determine the UK’s position as well as individual growers’ position in today’s market.

It is important to note that data based on surveys will never be 100% accurate, but that does not mean it is not useful to understand what is going on.

There have been several improvements to the surveys over the past year, with this work continuing to ensure the information available is timely, accurate and helps aid in business decisions.

AHDB, the industry and Defra will continue to work through the Audit Function Group to improve the accuracy of the data which is fed into the balance sheets.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.