Analyst Insight: Why US maize data matters

Thursday, 31 March 2022

Market commentary

- UK feed wheat (May-22) gained £2.25/t yesterday, to close at £305.50/t. The new-crop contract (Nov-22) gained £5.00/t to close at £259.00/t. Tracking global wheat higher.

- Chicago maize (May-22) gained $4.63/t yesterday to close at $290.55/t.

- Brent crude oil (nearby) closed up $3.22/barrel yesterday, to close at $113.45/barrel. This has traded down this morning though.

- The latest cereal usage data for GB animal feed and UK human and industrial are now available.

Why US maize data matters

Volatility continues in global grain prices, following peace talks between Russia and Ukraine.

Key US data on prospective planting is due out today at 5pm (BST), as well as March stocks for US grains and oilseeds. This data is key for understanding market direction.

This article looks at maize specifically and why this data is important for global grain prices longer term. In short, it gives us an insight into how tight stocks may be heading into the new season, and what we can expect new-season supply (global availability) to look like.

Global supply squeeze

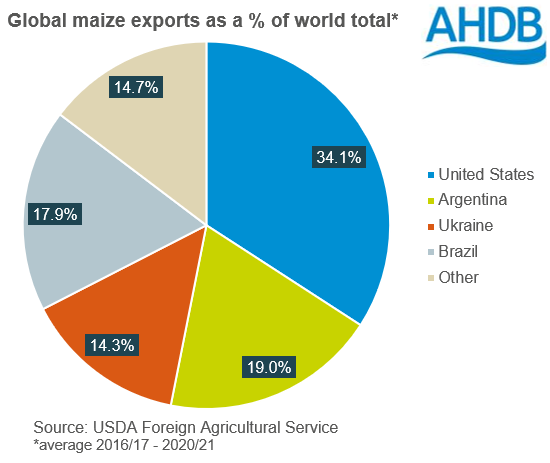

Currently, global maize availability is being squeezed. Ukraine accounts for c.14% of global maize exports (average 2016/17 -2020/21). Despite Ukraine reportedly having 13.0Mt of maize in stock this month, only small volumes are currently leaving Ukraine by rail, as ports remain closed.

This leaves global availability this season tighter, with countries having to switch demand to alternative origins. This includes the UK looking to other origins.

2022/23

Looking to next season, there are still questions around Ukrainian maize plantings. Spring planting is underway and reportedly ahead of last year, despite fuel shortages. However, what is planted remains a concern, with many expecting buckwheat, oats, and millet to be prioritised. When sea exports can resume is also still unknown.

As the largest single global maize exporter, US maize production will likely set the tone for northern hemisphere supply next season.

A small drop in maize area is forecasted by trade, in favour of soyabeans. It is likely the prospective planting survey captured the developments of the Ukraine and Russian war to some extent, which supported maize prices. But the question remains, how much was factored in and had farmers already made decisions?

US ethanol production continues

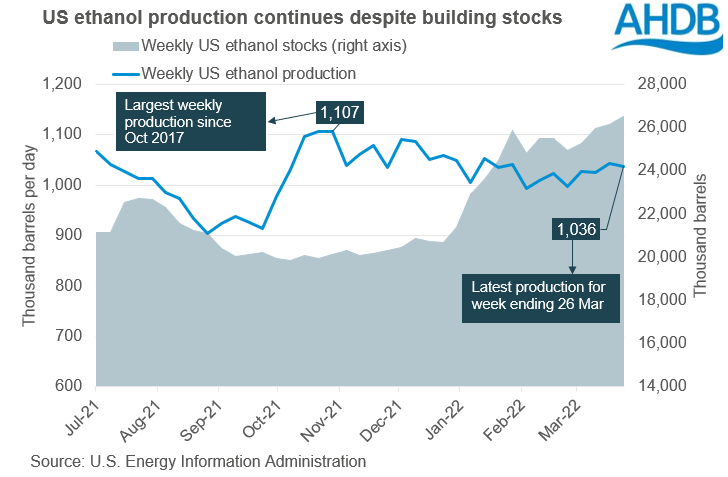

Looking to US demand, exports sales may be lagging against last season but domestic ethanol demand keeps rolling. Though ethanol stocks are building.

The March world agricultural supply and demand estimates (WASDE) increased its forecast for domestic maize use for ethanol to 135.9Mt.

With Brazil also lifting its tariff on US ethanol until the end of the year, this could result in increased demand and a depletion of those building ethanol stocks.

Looking ahead, the US administration is also considering removing restrictions on summer sales of E15 (15% ethanol) to reduce fuel costs. Should this be approved, this may boost ethanol production.

US domestic demand makes an impact, like supply, on price and availability for export.

How does this impact on the UK?

Firstly, if today’s data does not show what the trade anticipates, we may see large price volatility in both grain and oilseed futures across the board.

Looking to the remainder of this season, US maize stocks will be important to global availability. Especially as countries look to the US, South America, Canada, and EU to fulfil Ukrainian demand.

To note, the UK agreed to lift the tariff on US maize imports from 1 June 2022.

For next season, any further tightening of global maize supply and demand may add to price support. And as such, provide a floor for other feed grains like wheat and barley too.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

.jpg)