Arable Market Report - 01 September 2025

Monday, 1 September 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

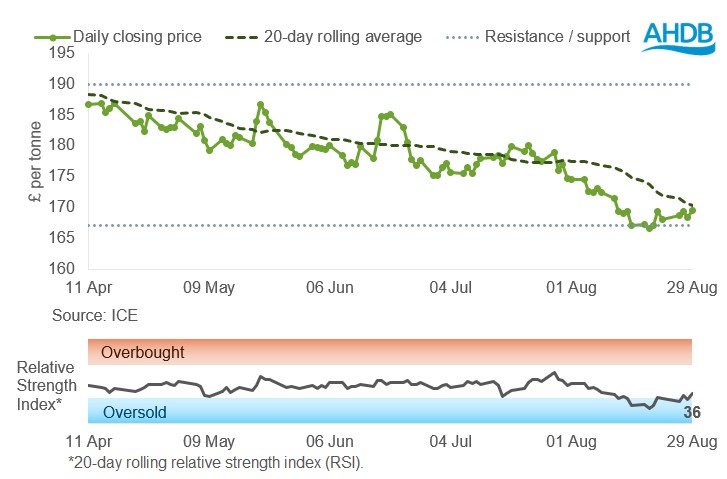

UK feed wheat futures (Nov-25)

UK feed wheat futures moved higher for the second week in a row (Friday to Friday), closing above the support level of £167/t. When analysing price trends, a ‘support line’ is seen as a level that it may be harder for prices to fall below.

The relative strength index (RSI) rose slightly from 29 to 36, moving out of the “oversold” zone. Oversold in technical analysis shows significant downward market momentum. An RSI at ‘oversold’ levels can also indicate this is a time to watch markets more closely.

Market drivers

UK wheat futures (Nov-25) gained last week, up £1.45/t (0.9%) closing at £169.05/t on Friday.

Global grain supplies look to be ample, supported by an increased forecast for Russian wheat production and Brazil’s record maize harvest, but milling wheat availability is more varied, with French quality slipping, U.S. protein levels uneven, and Canadian spring wheat stressed by drought.

In Europe, the Commission forecast 2025/26 usable production of EU maize at 57.6 million tons, down from 60.1 million forecast last month and 3.4% below last season. It lifted its estimate of EU soft wheat production this season to 128.1 million metric tons from 127.3 million in late July, now 14.7% above 2024/25, but maintained its forecast of EU wheat exports at 29.8 million tons.

French milling wheat quality has slipped, with only 69% of the crop meeting ≥11.5% protein this week, down from 74% last week, but test weights still look positive (FranceAgriMer).

MARS cut its EU maize yield forecast to 6.93 t/ha, 2% below the 5-year average, as drought and heat in Romania, Bulgaria, Hungary and eastern Croatia caused irreversible crop damage.

In Russia, wheat output is projected at a record 86 Mt (IKAR), with exports forecast at 43 Mt. Yields remain strong despite dryness in the Volga and southern steppe, and the export tax has not slowed shipments. A weak rubble has also aided export pace.

In Ukraine, harvest is nearly complete with 21.9 Mt of wheat harvested as of 30 August and maize at 27 Mt. Central and western areas outperformed expectations, but drought cut eastern yields. Exports remain constrained by limited Danube capacity and rail congestion.

Brazil’s maize harvest is 98% complete for the second crop as of 21 August. Plans to build three new maize-based ethanol plants in the country are expected to lift domestic demand. In Argentina, rains give a positive start to the 2025/26 wheat crop.

In the US, maize rose on strong export sales topping 2 Mt for a second week and concerns over Tar Spot and Southern Rust creating disease pressure.

Statistics Canada projects the country’s 2025 wheat crop at 35.6 Mt, down 1.1% from 2024. Production estimates are based on late July satellite and agroclimatic data, though analysts caution August rains may lift yields.

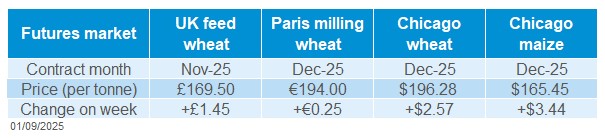

UK delivered cereal prices

Feed wheat delivered into Avonmouth (September delivery) was quoted at £173.50/t on Thursday, down £1.50/t from the previous week.

Rapeseed

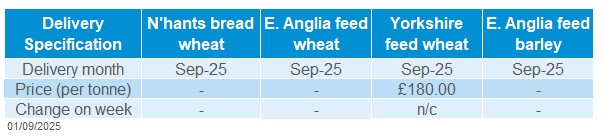

Paris rapeseed futures in £/t (Nov-25)

Paris rapeseed futures (Nov-25) fell significantly last week from close to the 20-day moving average to relatively in line with the support level of £400/t.

The relative strength index (RSI) increased from 39 to 42 during the week (Friday-Friday), suggesting some uptick in market moment.

Market drivers

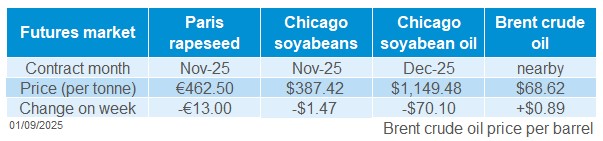

Paris rapeseed futures (Nov-25) decreased last week, finishing at €462.50/t on Friday, down €13.00/t (2.7%) from the previous Friday. During the week, Winnipeg canola futures and Chicago soyabean futures (Nov-25) also decreased by 6.0% and 0.4%, respectively. The Chicago soyabean market is closed today due to a national holiday in the US.

Both Paris rapeseed and Winnipeg canola futures were under pressure due to higher production estimates in the EU and Canada. The combination of increased canola production forecasts in Canada and uncertain export prospects, particularly to China, has led to a substantial decline in the price of Winnipeg canola futures.

Canola production was up by 3.6% from 19.2 Mt in 2024 to 19.9 Mt in 2025, according to a Statistics Canada figures released last Thursday.

Last week, the European Commission increased its forecast for EU rapeseed production in the 2025/26 season from 18.5 Mt to 18.8 Mt. This put pressure on Paris rapeseed futures and filtered through to UK domestic prices.

Last Thursday, the US Weekly Export Sales Report revealed that net sales of soyabeans for the 2025/26 season had reached 1.37 Mt by 21 August. This figure was higher than traders' estimates. Future Chinese imports of US soyabeans may add support for Chicago soybean futures moving forward – something to watch.

UK delivered rapeseed prices

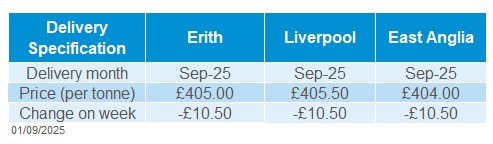

Rapeseed to be delivered into Erith for September was quoted at £405.00/t on Friday, down £10.50/t on the week.

Deliveries into Liverpool and East Anglia for September were quoted at £405.50/t and £404.00/t respectively, also both down £10.50/t on the week. Prices for delivered rapeseed generally followed Paris rapeseed futures last week.

Extra information

Our fifth harvest progress report will be published this Friday, 5 September. As the UK harvest nears completion, this update shares regional survey results on harvest progression, with a spotlight on yields and quality.

Defra’s 2025 June Survey of Agriculture results, released on 28 August, show larger English wheat and oat areas but sharply less oilseed rape and the smallest English barley area since 2014.

Cereal usage data is to be released this week (4 September) covering UK human and industrial usage as well as GB animal feed production.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.