Arable Market Report – 03 November 2025

Monday, 3 November 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

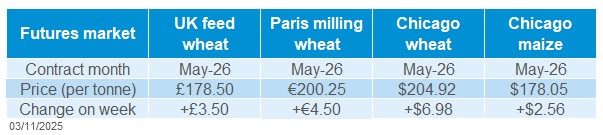

UK feed wheat futures (May-26)

May 2026 UK feed wheat futures increased last week (24 - 31 October). The nearest support level is £173/t. Prices finished above the 20-day moving average last week.

Technical indicators signalled strengthening momentum, with the relative strength index (RSI) rising from 39 to 56 over the week.

Find out more about the graphs in this report and how to use them.

Market drivers

UK feed wheat futures (Nov-25) finished the week at £163.30/t, up £3.20/t (2.0%) on the week. As the Nov-25 contract is approaching its final trading day and open interest has fallen, we have switched analysis to the May-26 futures, which rose by £3.50/t over the week, closing at £178.50/t. Domestic futures were supported by the global market and a weaker sterling against both the US dollar and the euro.

Global grain futures were supported last week. Chicago wheat and Paris milling wheat futures (Dec-25) increased by 4.2% and 1.5%, respectively. Chicago grain futures were supported by optimism around the China-US talks. Although the focus of these talks was about soyabeans, grains do come into the equation with China historically purchasing US-origin. It has been reported this morning that China is seeking US origin wheat for the first time in a year, this is supporting the market currently (LSEG).

Demand for US-origin wheat remains strong with the total volume of physical wheat exports inspected as of 23 October reported at 11.4 Mt for all US export points, which is 19% higher than the previous year (US wheat associates). If Chinese buying does materialise there could be some support for the Chicago wheat market.

The European Commission increased its 2025/26 wheat production estimate by 0.8 Mt to 133.4 Mt last week. However, the EU's exports and ending stocks remain unchanged at 31 Mt and 10.8 Mt, respectively. The ample EU wheat production in the current season limited gains on European grain futures last week as they price to compete for global demand.

The latest MARS report published last week (27 Oct) indicated favourable sowing weather conditions for winter crops in France and Poland. However, there were excessive rains in parts of Bulgaria, Hungary and Romania which has delayed the sowing of winter cereals. Currently, the weather and conditions in the US and Ukraine looks favourable for the 2026 winter wheat crop, as the market starts to focus on harvest 2026 supplies.

FranceAgriMer, estimated (to 27 Oct) that 68% of wheat and 80% of barley area had been planted due to good weather conditions, compared to 61% and 76%, based on five-year averages.

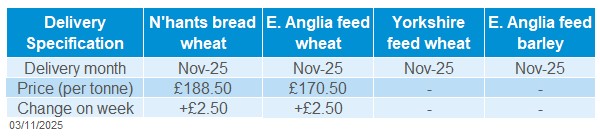

UK delivered cereal prices

Domestic delivered grain prices followed the gains in the global market week-on-week.

Feed wheat delivered into East Anglia for November delivery was quoted at £170.50/t on Thursday, up £2.50/t from the previous week.

November delivery of bread wheat into Northamptonshire was quoted at £188.50/t, up £2.50/t from the previous week.

Rapeseed

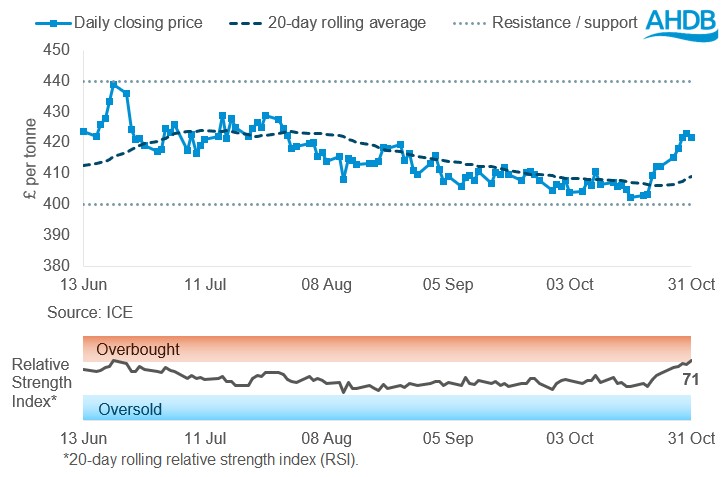

Paris rapeseed futures in £/t (May-26)

In £/t terms, May-26 Paris rapeseed futures gained last week (24 – 31 October), closing above the 20-day moving average near £420/t.

The relative strength index (RSI) rose from 55 to 71, signalling a significant increase in market momentum, now moving to the overbought zone and extra attention should be paid to the market.

Find out more about the graphs in this report and how to use them.

Market drivers

Paris rapeseed futures (May-26) gained €6.00/t (1.3%) on the week (Friday-Friday) closing at €478.50/t on Friday. Paris rapeseed futures were supported by global oilseeds movements with Chicago soyabean futures (May-26) gaining 4.4% on the week, with US-China talks the focal point of the week.

Nearby Chicago soyabean futures hit their highest point since July 2024 (LSEG). After negotiations it was reported last week that China have agreed to purchase up to 12Mt of US soyabeans this marketing year. China had further committed to purchasing 25Mt annually for the next three years, this news largely contributed to the market gain.

US harvest is near completion with a Reuters poll of 10 analysts estimating the US soybean harvest at 84% complete, compared to 89% at the same time last year. Rain slowed progress across the southern Midwest but harvesting continued elsewhere. In the coming week, there are forecasts of 1–2 inches of rain in eastern soyabean states, but this shouldn’t impact timings towards the end of this harvest campaign.

As the US soyabean crop finishes, focus will now turn towards South American crops being sown over the next few weeks. With plantings underway and progressing well in Brazil in addition to fieldwork starting over the last couple of weeks in Argentina. This sowing campaign will be a watchpoint for the oilseed market, given the large supplies priced into the market.

In Europe, winter plantings are progressing well. However, in the latest EU mars report published last week (27 Oct), there was downward adjustments to sunflower yields, now down 11% on the five-year average, after dry conditions impacted crop development. Similar outcomes are expected for the Ukrainian sunflower crop as 2025 production is expected at 10.5Mt, down from 12Mt last year (Ukroliyaprom). This may support sun seed price basis in the EU, but ample global supplies hold back any significant upside.

UK delivered rapeseed prices

Domestic delivered prices followed the upward movement in Paris rapeseed futures. Currency movements meant we saw larger gains in UK delivered rapeseed than in the Paris rapeseed. Sterling fell against the euro and the US dollar week to week, finishing at €1.391 (-1.2%) and $1.3151 (-0.5%) respectively on Friday.

Delivered rapeseed into Erith for December delivery was quoted at £430.50/t, up £8.00/t from the previous week. While December into Liverpool and East Anglia were at £429.50/t, gaining £8.00/t week-on-week, respectively.

Extra information

AHDB’s annual Cereal Quality Survey is set to be published tomorrow, 4 November. This key report provides insight into the quality of the most recent UK harvest, focusing on:

- Wheat: protein content, Hagberg Falling Number, specific weights and moisture content

- Barley: nitrogen levels, screenings, moisture, and specific weights.

The survey offers a valuable benchmark for stakeholders across the industry, helping assess suitability for end-use and guide market expectations.

Has Europe faced the same OSR challenges as the UK?

“We can see there are challenges in OSR production across the countries analysed, which impacts the area grown each year. Growing OSR is still a profitable option for some farmers.”

Read more in the latest article from Farmbench manager, Laura Smith.

AHDB’s cereal usage data is to be published this week (Thursday 6), which covers UK human and industrial usage, as well as GB animal feed production.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.