Arable Market Report – 06 May 2025

Tuesday, 6 May 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

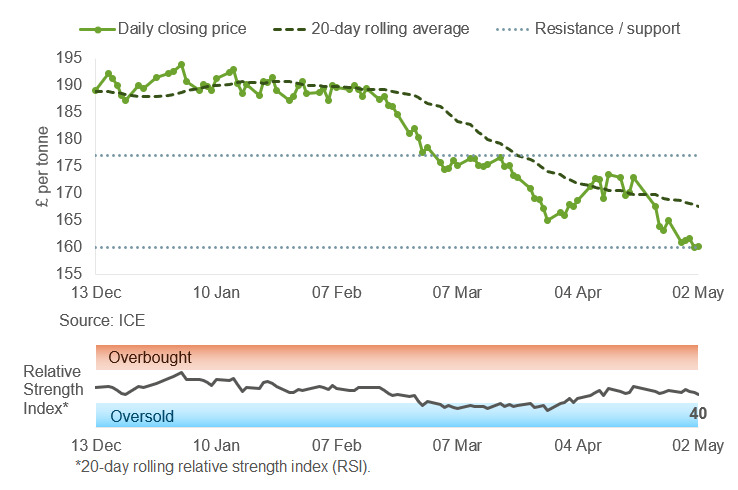

UK feed wheat futures (May-25)

May-25 futures held above the recent support level of £160/t last week. With the RSI at 40, this could offer some support to old crop futures prices. However, the May-25 contract’s value as a market indicator is decreasing as it enters its final weeks of trading. From next week, we’ll report on the Nov-25 prices here.

Click here for more details on the graphs in this report, including how to use them.

Market drivers

Global wheat futures prices lost more ground last week and again yesterday. Forecasts of rain in the US winter wheat areas and improving crop conditions weighed on prices in the early part of the week.

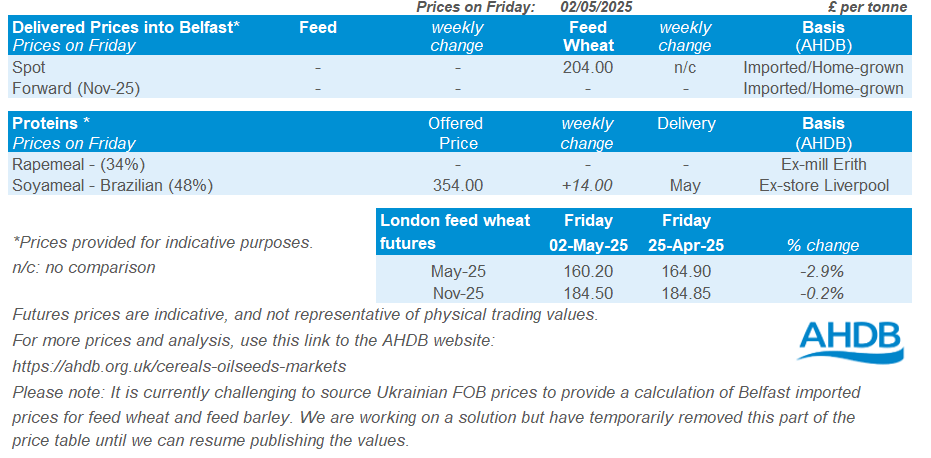

Old crop prices also had pressure from uncertainty over global demand and technical trading as the May futures contracts approach expiry. UK feed wheat futures for May-25 reached a new contract low of £160.00/t on Thursday and ended the week at £160.20/t, down £4.70/t from 25 April.

However, the Nov-25 contract ended the week down just £0.35/t at £184.50/t after partially rebounding on Friday. The market was supported on Friday by 'bargain buying' in Chicago futures (LSEG).

Yesterday, falls in wider markets including crude oil, confidence in US crops and forecasts of rain for Black Sea crops pushed global wheat prices lower. Dec-25 Paris wheat futures lost a further €4.25/t to close at €212.50/t and Chicago Dec-25 wheat futures declined $3.95/t to $208.68/t.

Dry weather is a growing concern across Northern Europe, but markets are currently focusing on the improved weather outlook for 2025/26 US and Black Sea crops.

Last night, the USDA reported that US maize planting was 40% complete by 4 May, up from 24% a week earlier. Also, the proportion of US winter wheat in good or excellent condition rose week-on-week from 49% to 51%, now the highest rating since 2020.

This morning, Russian consultancy IKAR increased its 2025 production forecast by 1.3 Mt to 83.8 Mt, now 1.4 Mt above the 2024 crop.

Market attention will increasingly focus on Monday night (12 May), when the USDA will release its first estimates of global supply and demand in 2025/26. The forecasts can influence market sentiment in the weeks and months that follow.

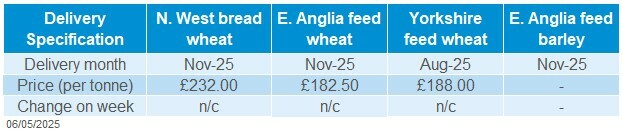

UK delivered cereal prices

There were mixed movements in domestic delivered feed wheat prices last week (Thursday–Thursday). Prices for feed wheat for May delivery in East Anglia declined by £2.50/t to £165.50/t, while there was a gain for the same delivery in Avonrange.

Trading was reportedly thin last week with good coverage amongst buyers and uncertainty over crop potential on farm in some areas.

Bread wheat for Nov-25 delivery was reported at £232.00/t, a £49.00/t premium to Nov-25 UK feed wheat futures at Thursday’s close. Meanwhile, feed wheat for new crop (Nov-25) delivery in East Anglia was reported at £182.50/t, £0.50/t below the Nov-25 futures price.

Rapeseed

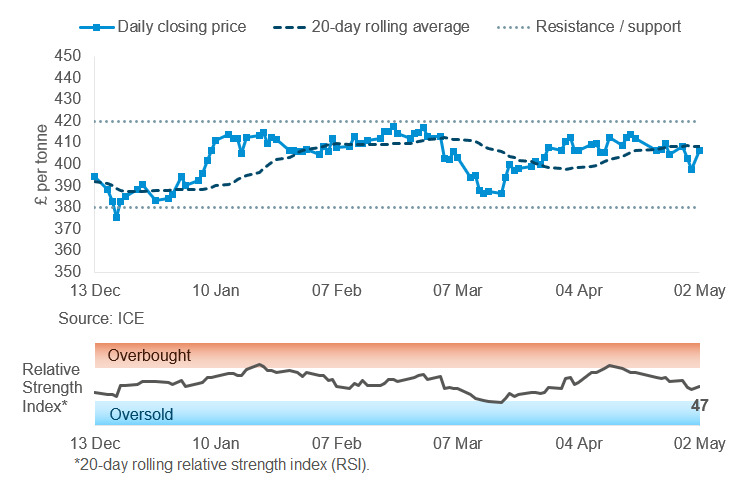

Paris rapeseed futures in £/t (Nov-25)

Nov-25 Paris rapeseed futures in £/t continued to trade around the 20-day moving average last week, suggesting a period of price stability as recent resistance and support levels hold steady.

Find out more details on the graphs in this report, including how to use them.

Market drivers

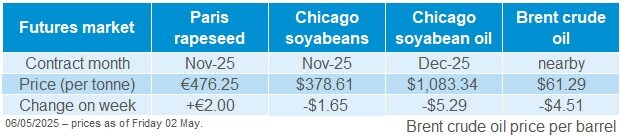

Nov-25 Paris rapeseed futures ended the week up €2.00/t (Friday–Friday), closing at €476.25/t. The main driver was a weaker euro against the US dollar, which helped increase the competitiveness of EU exports. This came despite the broader oilseeds complex ending the week lower.

Chicago soya bean futures (Nov-25) lost 0.4% over the week, due to the advancing harvest in South America and concerns about global demand amid the ongoing US–China trade war. Technical buying towards the end of the week helped limit the losses, but underlying fundamentals remain weak.

China is reportedly looking to reduce soya meal use in livestock feed to 10%, to cut its reliance on US soya bean imports. There is still no clarity on potential negotiations between the two parties.

Despite harvest delays due to heavy rainfall and uncertainty around export policies and exchange rates, Argentine farmers made their biggest one-day soyabean sales of the year last week, according to the Rosario Grain Exchange. As of 29 April, harvest progress stood at 24%, down from 36% at the same time last year (Buenos Aries Grain Exchange). However, dry weather forecast for the coming week could accelerate progress.

US soya bean export sales totalled 428.2 Kt for the week ending 24 April, falling within analysts’ expectations of between 150 Kt and 600 Kt. This offered some support despite the broader demand concerns.

Rapeseed imports into the EU continue to rise due to tight domestic supplies. The EU Commission shows season-to-date imports at 5.55 Mt, up 15% year-on-year. Looking ahead, production prospects are improving. LSEG has revised its 2025 forecast for the EU-27 plus the UK crop up by 1.8% to 20.2 Mt, due to improved weather conditions.

In Ukraine, the sunflower area for 2025 is expected to grow by 5% from 2024, according to the Ukrainian Agribusiness Club (UCAB). In addition, consultancy APK-Inform forecasts the 2025 sunflower harvest to rise by 14% year-on-year, projecting a total of 15.2 Mt.

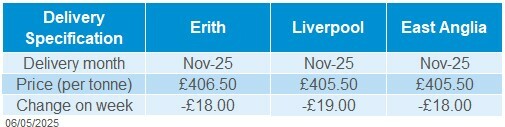

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in November was quoted at £406.50/t on Friday, down £18.00/t from the previous week. Delivery to East Anglia in November was quoted at £405.50/t, also falling £18.00/t. Domestic delivered prices diverged from Paris rapeseed futures (Nov-25), with a stronger pound against the euro putting added pressure on domestic prices.

Extra information

The Met Office estimates that just over half (56%) of usual rainfall fell across the UK in April, with temperatures also well above average. While this helped spring planting, the latest AHDB crop development report shows that the weather is now beginning to impact both spring and winter crop development. Read more here

Join us online this Thursday (8 May), for our Spring Grain Market Outlook briefing to discuss the season ahead, what this could mean for prices and the watch points to look out for. The webinar is from 10.30am–11.30 am.

Click here for more details and how to register

Also on Thursday, AHDB will release data on cereals usage across the UK in March, as well as data on cereal stocks held by merchants, ports and co-ops at the end of February. Plus, Defra will release data on cereal stocks held on-farm in England and Wales.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.