Arable Market Report – 06 October 2025

Monday, 6 October 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (Nov-25)

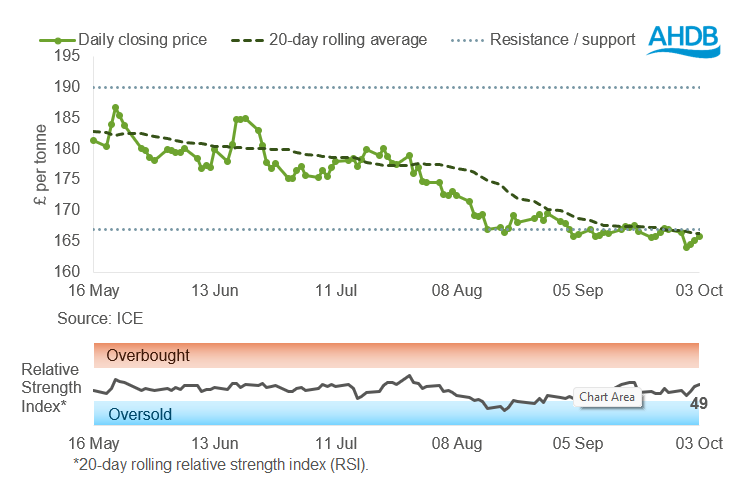

November UK feed wheat futures traded largely below the support level of £167/t last week (26 September–03 October), before recovering slightly to finish the week closer to that mark. In technical terms, a support level represents a price point where markets often find it harder to fall much further.

The relative strength index (RSI) also moved up from 39 to 49, suggesting momentum is improving though not yet enough to point to a firm upward trend.

Find out more about the graphs in this report and how to use them.

Market drivers

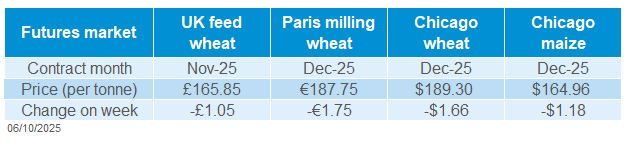

Global wheat markets fell further last week (Friday-Friday) as ample global supplies continued to weigh on prices, despite a brief boost midweek from import tenders in Jordon, Taiwan and Saudi Arabia. UK feed wheat futures (Nov-25) closed at £165.85/t, down £1.05/t (0.6%) over the week, while Chicago wheat and Paris milling wheat futures (Dec-25) each slipped by 0.9%.

In the US, winter wheat drilling reached 34% by 28 September, below the five-year average, although dry conditions across the Plains could slow progress. The maize harvest is gathering pace, with 18% complete and 66% of the crop rated good to excellent, well above the five-year average of 58%. The USDA’s Quarterly Grain Stocks and Small Grains Summary, report released on Tuesday (30 September), showed higher-than-expected wheat production and inventories compared with Refinitiv trade estimates, adding to global supply pressures.

In Ukraine, wheat exports so far this season (01 July-03 October) totalled 4.75 Mt, compared with 6.40 Mt at the same stage last year. The Ukrainian agriculture ministry expects the 2026 winter wheat area to grow by 9% to 5.2 Mha year-on-year, as farmers shift land away from maize and sunflower, following drought conditions that devastated this year’s sunflower crop and sharply reduced corn yields.

SovEcon has trimmed its September forecast for Russian wheat export to 4.3 Mt, lower than both last month (4.4 Mt) and a year earlier (5.1 Mt). The Russian agriculture ministry also confirmed last week that the wheat export duty will be reduced by 20% from 08 October.

In Argentina, the Buenos Aires Grain Exchange raised its 2025/26 wheat crop forecast to 22.0 Mt up from 20.5 Mt, supported by strong yields and ample soil moisture. Maize output is also expected to reach a record 58.0 Mt, supported by an expansion in planted area.

The EU commission reported soft wheat exports for 01 July–28 September at 4.37 Mt, down from 6.36 Mt over the same period last year, with some data from France and others member states still pending. In France, maize harvesting reached 24% by 29 September, up from 14% the previous week, with 62% of the crop rated good or excellent, unchanged on the week but below 79% a year ago (FranceAgriMer).

UK delivered cereal prices

Feed wheat delivered into Avonmouth for October delivery was quoted at £175.50/t on Thursday, down £0.50/t from the previous week. December delivery of bread wheat into the Northamptonshire was quoted at £190.00/t, down £1.50/t from the previous week.

Trading was reportedly thin last week, as favourable weather conditions across much of the country kept farmers focused on drilling, with grain marketing taking a lower priority while fieldwork is ongoing.

Rapeseed

Paris rapeseed futures in £/t (Nov-25)

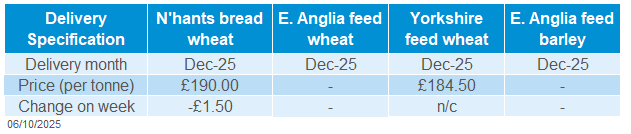

Last week (29 September - 03 October), Paris rapeseed futures (in £/t) reached a support level of £400/t, finishing at slightly below at £399.65/t.

The relative strength index (RSI) showed a fall in market momentum fell from 58 to 51 over the week. However, there is no clear indication of the direction of future price movements.

Find out more about the graphs in this report and how to use them.

Market drivers

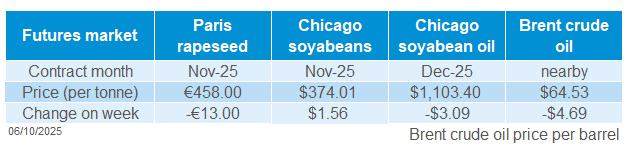

The price of global oilseeds has been volatile over the last week, driven by a decrease in the price of crude oil and unpredictable soyabeans demand. Paris rapeseed futures (Nov-25) fell by €13.00/t (2.8%) to €458.00/t on the week. As the last trading day for Paris rapeseed November 2025 futures approaches, open interest is decreasing, while it is increasing for February 2026.

Chicago soyabeans futures (Nov-25) gained by 0.4%, while Winnipeg canola futures (Nov-25) fell 1.6%, respectively on the week. Winnipeg canola futures are under additional pressure as weather across the Canadian Prairies has aided the canola harvest finishing up.

After testing a strong technical support level of $10/bushel ($367.44/t) last week, Chicago soyabean futures finally closed higher in response to news of potential further trade deal negotiations between the US and China. However, harvesting pressure on soyabeans in the US is still a current bearish market concern. The US federal government “Shutdown” that began last week could lead to a lack of transparency in the market, with delayed or missed publications from the USDA.

Additional pressure on the oilseed complex came from a fall in Brent crude oil futures (Dec-25), which dropped by 6.8% over the course of the week. Market sentiment was affected by expectations that OPEC+ could increase supply.

Ukraine's government has developed, though not yet launched, a mechanism for duty-free exports of rapeseed and soybeans, which have been halted due to confusion over documentation (LSEG). Market participants will be focusing on this situation in the near future, given Ukraine’s role in the global oilseed complex.

The European Commission published that, by 28 September, rapeseed imports for the 2025/26 season, which began in July, had reached 0.92 Mt. This was a 30% decrease compared to the same period the previous year. The main countries from which the EU imports rapeseed in the current season are Ukraine (56%), Moldova (18%), Australia (15%) and Serbia (9%).

UK delivered rapeseed prices

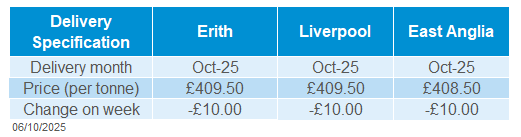

Delivered rapeseed prices fell last week. These prices are based on a survey typically carried out mid to late Friday morning, so they may not always reflect trends seen in the Paris futures by close of play.

Rapeseed for November delivery into Liverpool was quoted at £411.50/t on Friday, down £9.00/t on the week. In East Anglia, November delivery was quoted at £410.50/t, marking a £9.00 decrease week-on-week.

Extra information

The end of season estimates of 2024/25 supply and demand were released last week. You can view the estimates here.

In our recent Analyst inside, you could find the answer to the question “Why do prices feel lower than they are?”.

2025 AHDB phoma leaf spot forecast suggests that many oilseed rape (OSR) crops could reach the spray threshold for the disease in the few weeks.

AHDB’s published cereal usage data last week (2 October), which covers UK human and industrial usage, as well as GB animal feed production. Compared to the same months in 2024, the usage of both home-grown and imported milled grain decreased by 5% and 11%, respectively, in July and August 2025.

Defra will release provisional English crop production estimates on Thursday 9 October.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.