Arable Market Report – 07 April 2025

Monday, 7 April 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

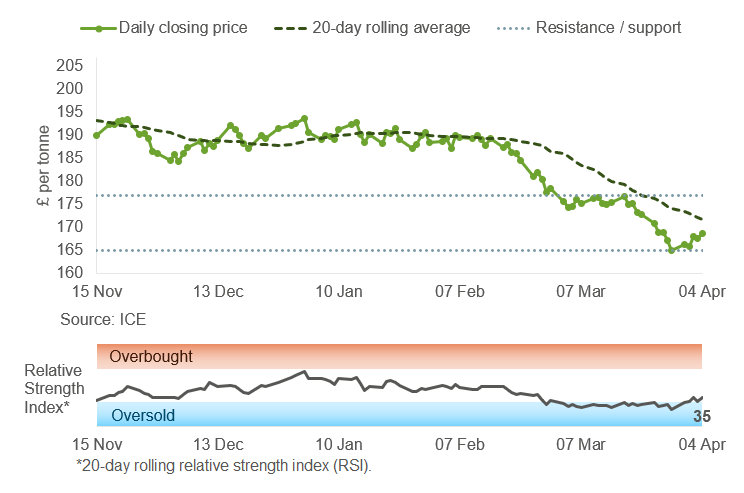

May-25 UK feed wheat futures have corrected up from the support level and may be attempting to build a rising trend. However, the price chart may find resistance at the 20-day moving average and after at £177/t.

Find out more about the graphs in this report and how to use them here.

Market drivers

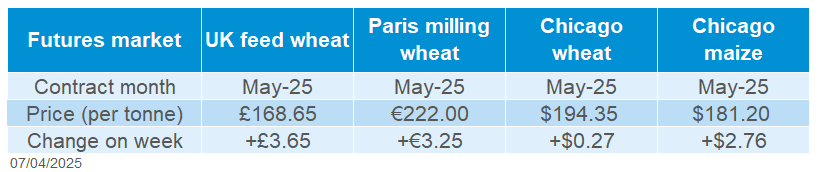

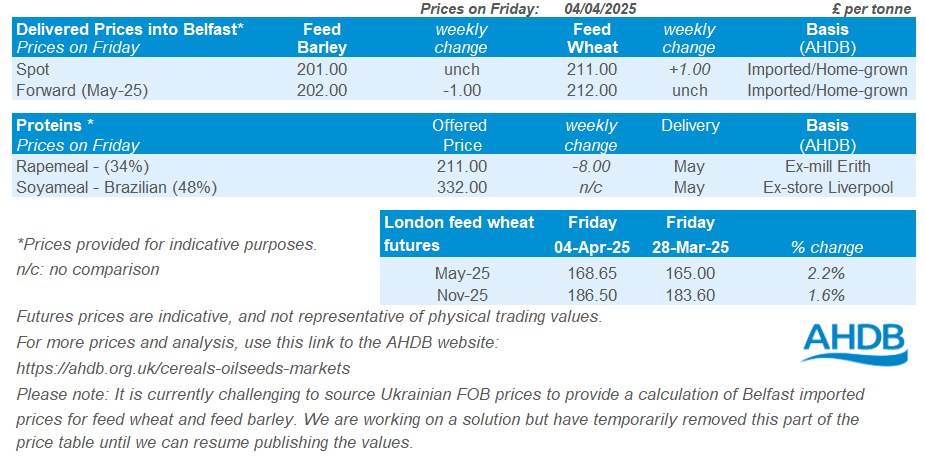

UK feed wheat futures (May-25) rose £3.65/t last week (Friday to Friday), ending at £168.65/t. The Nov-25 contract gained £2.90/t, settling at £186.50/t on Friday. The premium for Nov-25 over May-25 reached a new high of £20.25/t last Tuesday, before easing towards the end of the week.

Domestic wheat futures (old crop) generally moved in line with Paris milling wheat futures. Chicago wheat futures closed the week mixed, mainly influenced by US tariff pressure and other countries' reactions to it. For new crop futures, weather forecasts and crop conditions in the Northern Hemisphere are important factors to watch.

Paris milling wheat futures (May-25) gained last week despite the euro strengthening against the US dollar and improved crop conditions. French wheat continues to compete for export sales with the Black Sea region. FranceAgriMer estimates that 76% of soft wheat was in good or excellent condition as of 31 March, up from 74% the week before.

In the longer term, a forecast decline in Australian wheat production by 16% in 2025/26 could be supportive of new crop wheat prices.

According to the latest USDA Prospective Plantings report total wheat plantings for 2025 are estimated at 18.4 million hectares, down 2% from 2024. The first USDA crop progress report of the spring will be released later today, 7 April. This report could have an impact on wheat futures prices for the 2025 crop. Also, this week, the USDA's World Agricultural Supply and Demand Estimates will be released on Thursday.

US wheat export sales for the week ending 27 March were reported at 340.0 Kt. This was higher than top estimates and 40% above the four-week average. Net export sales of maize also rose week-on-week to 1.17 Mt. However, responses to US tariffs could reduce the pace of US exports in the coming weeks.

The Brazilian government released export data on Friday showing that maize exports in March 2025 were twice as high as in March 2024.

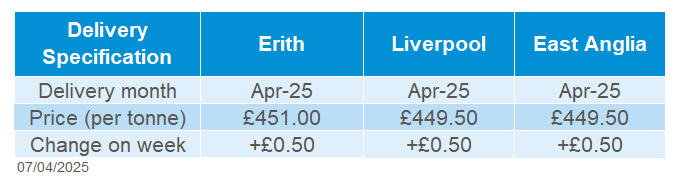

UK delivered cereal prices

Domestic delivered wheat prices up in line with futures prices from Thursday to Thursday. Bread wheat for delivery in Northamptonshire for May 2025 was quoted at £197.00/t, up £1.50/t. Yorkshire delivery was quoted at £202.50/t, up £3.00/t.

Rapeseed

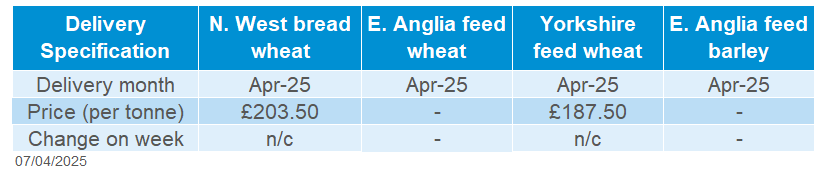

In £/t terms, May-25 Paris rapeseed futures continued to trade between the 20-day moving average and resistance level of £452/t last week (Friday to Friday). This could limit upward movements in the short term, depending on wider market and currency developments.

Find out more about the graphs in this report and how to use them here.

Market drivers

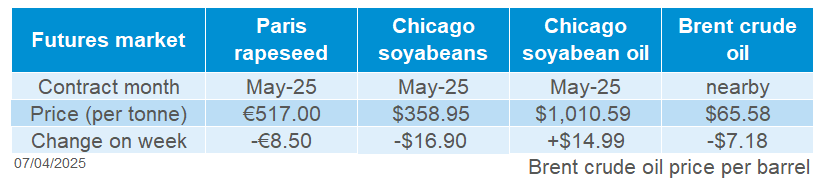

The rapeseed markets saw significant price fluctuations last week (Friday to Friday), with Paris rapeseed futures (in €/t) reflecting the decline in Chicago soybean prices.

Old crop Paris rapeseed futures (May-25) closed at €517.00/t, down €8.50/t from the previous week, while the Nov-25 contract dropped €11.00/t, ending at €478.25/t. This decline followed Chicago soybean futures, which fell 4.5% for May-25 and 4.4% for Nov-25 contracts.

The market volatility was sparked by President Trump’s announcement on April 2 of a minimum 10% tariff on all US imports. However, some tariffs were much larger, including a 34% tariff on imports from China, the biggest buyer of US soybeans.

Before the tariff news, Chicago soyabean futures (May-25) had reached a two-month high of $380.02/t, driven by optimism around US biofuel mandate discussions with the Environmental Protection Agency (EPA). But after the tariff announcement, prices quickly dropped due to uncertainties about demand.

On Friday, China responded with a 34% counter-tariff on all imports from the US, raising concerns about weaker export demand for US soyabeans. However, this could open opportunities for South American exporters to gain a larger share of the Chinese market.

As at 4 April, speculators held a net short position of 29,847 in Chicago soyabean futures and options markets, suggesting expectations of lower prices in the short term.

Meanwhile, in Brazil, the soyabean harvest is progressing well, with 85.8% of the 2024/2025 crop harvested according to Patria Agronegocios. This is up from 79.4% at the same time last year.

Strategie Grains kept its 2025/26 EU rapeseed production forecast at 19.0 Mt, a 13% rise from 2024/25 due to favourable weather forecast for oilseeds production. The sunflower production forecast has been slightly increased to 10.6 Mt, now up 26% from this season.

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in May was quoted at £453.50/t on Friday, up £2.00/t from the previous week. Delivery to East Anglia in May was quoted at £452.00/t, also gaining £2.00/t.

Domestic delivered prices showed a divergence from Paris futures due a weakening of sterling against the euro. Sterling reached a seven-month low on Friday against the euro (£1 = €1.176, LSEG) due to falls in the London stock market and expected changes to Bank of England policy.

Extra information

On Thursday, AHDB published the latest GB animal feed production figures, including information on cereal usage and feed production up to February. This season-to-date (Jul-Feb) total feed production, including by Integrated poultry units (IPU), totalled 8.94 Mt. This is up 0.8% on the same period last year, when feed production totalled 8.86 Mt.

AHDB also published data on Human and industrial (H&I) usage of cereals in February. This included data which suggested that bioethanol output from wheat had declined further.

Last week AHDB published information on the impact of the US imposing a 10% tariff on all UK exports to the US.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.