Arable Market Report – 07 July 2025

Monday, 7 July 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (Nov-25)

.png)

Last week (Friday to Friday), UK feed wheat futures remained below the 20-day moving average and closing prices hovered just above the key support level of £175/t. Although the market closed above this level there were trades below it, suggesting this could be an important point to watch markets.

Find out more about the graphs in this report and how to use them here.

Market drivers

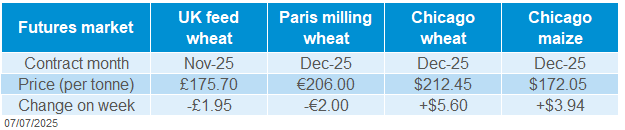

Nov-25 UK feed wheat futures fell by £1.95/t (-1.1%) last week, closing at £175.70/t on Friday. The domestic market tracked European prices lower, with Dec-25 Paris milling wheat futures down 1.0%. Pressure came from currency fluctuations, ongoing harvest progress and larger-than-expected US stocks. Meanwhile, Dec-25 Chicago wheat futures rose by 3.0% by Thursday; the market was closed for the US Independence Day on Friday.

The USDA’s quarterly grain stocks and acreage report, released on Monday, showed US old crop wheat stocks at 23.2 Mt as at 1 June. This was 22% higher than the same time last year and above analysts’ expectations. The area for the 2025 wheat crop was estimated at 18.41 Mha, slightly above forecast.

Currency movements added to the pressure. On Tuesday, the euro reached a near four-year high against the US dollar, making EU wheat less competitive and driving prices lower. This and re-positioning by speculative traders initially supported Chicago wheat futures, but gains were capped by profit-taking ahead of the Independence Day weekend.

Harvest is well underway in the Northern Hemisphere. The US winter wheat harvest was 37% complete by 29 June. Warm and dry conditions are supporting a good start in Europe, with 11% of France’s soft wheat crop cut by 30 June, well ahead of the five-year average of 4%.

According to the Buenos Aires Grain Exchange, Argentina’s 2025/26 wheat planting has reached 78.2% of the planned area, with a recent cold snap potentially benefiting crop growth.

Russia, the world’s largest wheat exporter, has cut its wheat export tax to zero for the first time since 2021, effective from 9 July (LSEG). This could potentially add more supply to global markets.

Maize remains a key focus as it enters a critical growth stage, with heat in Europe raising concerns over yields. However, forecast rainfall in the US Midwest could be supportive of yields.

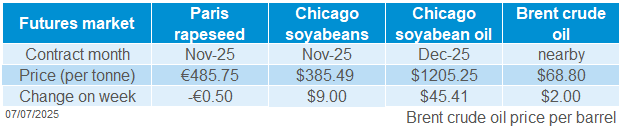

UK delivered cereal prices

Domestic delivered wheat prices were mixed from Thursday to Thursday. Bread wheat delivered into Northamptonshire in November 2025 was quoted at £219.00/t, up £1.50/t. Feed wheat for delivery to Yorkshire in November 2025 was quoted at £186.00/t, down £2.50/t.

.png)

Rapeseed

Paris rapeseed futures in £/t (Nov-25)

.png)

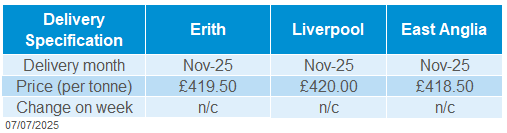

Nov-25 Paris oilseed rape futures (in £/t) finished just below the 20-day rolling average last week, despite edging above on Wednesday. Market momentum also eased; the relative strength index (RSI) fell back from 58 to 53.

Market drivers

Paris rapeseed futures (Nov-25) edged down €0.50/t (-0.1%) last week to close at €485.75/t on Friday. Chicago soyabeans and Winnipeg canola futures (Nov-25) gained 2.4% and 3.9% respectively

In the US, there was optimism around strong soyabean crop conditions, after 66% was reported in good to excellent condition on 29 June. These favourable crop conditions anchored the US market and limited price rises last week.

Argentina’s soybean harvest for the 2024/25 season has concluded, reaching 50.3 Mt, 100 Kt higher than last year’s output, according to the Buenos Aires Grains Exchange.

In Canada, a resumption of trade talks with the US and ongoing dryness in Western Canada supported prices. Crushers could also benefit from stronger US vegetable oil demand for biodiesel in 2025/26, though tight supply and logistics remain challenges.

With a smaller area year-on-year, Canadian canola production depends heavily on yields. In Saskatchewan, the top growing region, crop conditions remain variable following recent thunderstorms, which brought both beneficial moisture and hail damage across parts of the province. However, southern areas remained dry, and topsoil moisture levels overall declined week-on-week. Oilseed crops continue to develop faster than last year but lag seasonal norms, particularly in central areas.

The wider vegetable oil complex also supported oilseed markets last week. Indian palm oil imports hit an 11-month high in June, climbing 61% month-on-month to 953 Kt. India is the world's biggest buyer of vegetable oils. News of this strong buying and a Reuters poll showing industry expectations for a pullback in Malaysian palm oil stocks in June supported palm oil and wider vegetable and oilseed prices.

Looking ahead, eyes will be on Canada’s crop development as canola begins to flower as heat stress or drought during this period can significantly impact yields.

UK delivered rapeseed prices

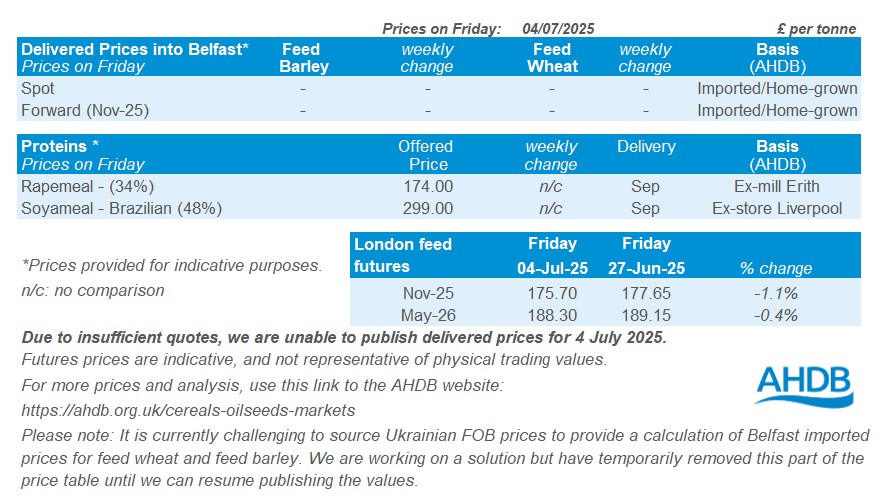

Rapeseed to be delivered into Erith in November was quoted at £419.50/t on Friday. Liverpool and East Anglia delivery in November were quoted at £420.00/t and £418.50/t respectively.

Extra information

- On Friday 4 July, AHDB released the latest UK human and industrial cereal usage and GB animal feed production, covering the period to the end of May. Barley usage by brewers, maltsters, and distillers (BMD) saw a slight increase in May, rising by 12.9 Kt. However, overall usage from July to May remains well below last season’s levels.

- AHDB’s first UK harvest progress report of 2025 will be released on Friday 11 July.

- Also, the USDA World Agricultural Supply and Demand Estimates (WASDE) report for July will be released on Friday 11 July.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.