Arable Market Report - 07 October 2024

Monday, 7 October 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

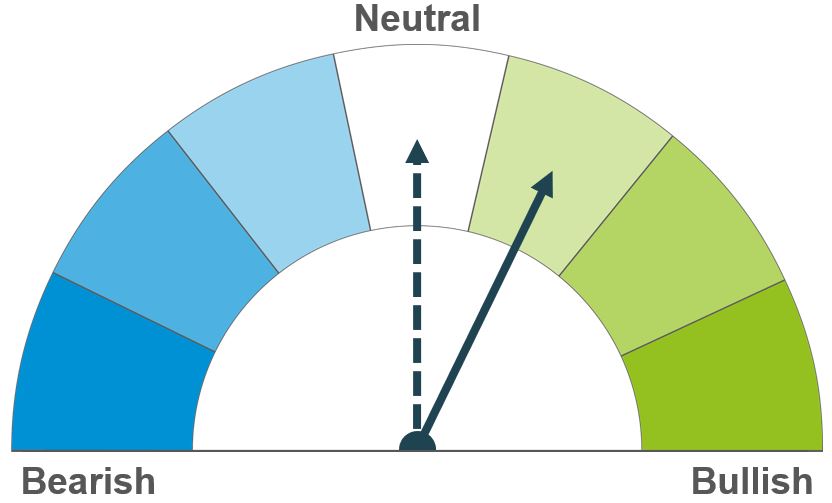

Wheat

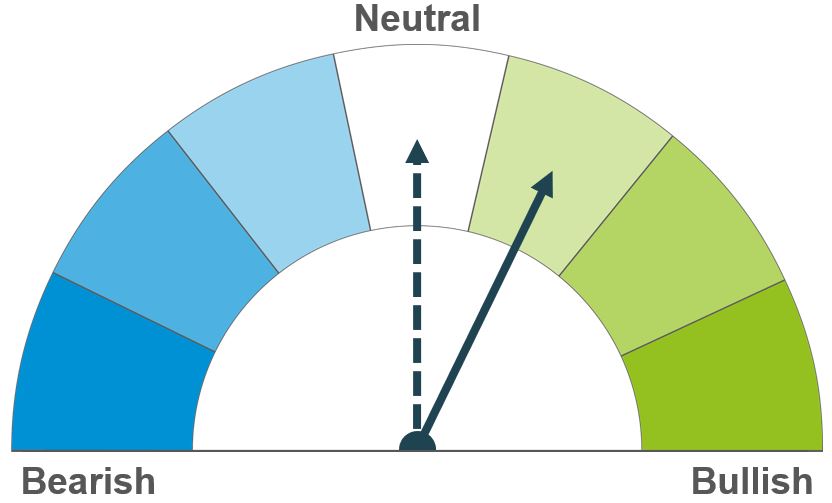

Maize

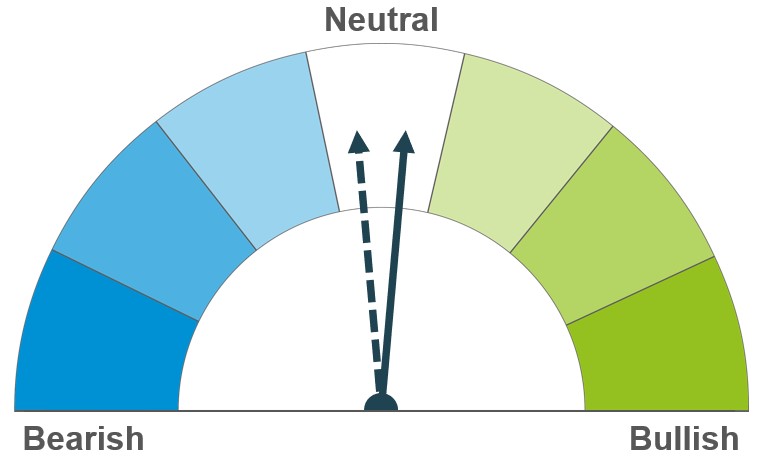

Barley

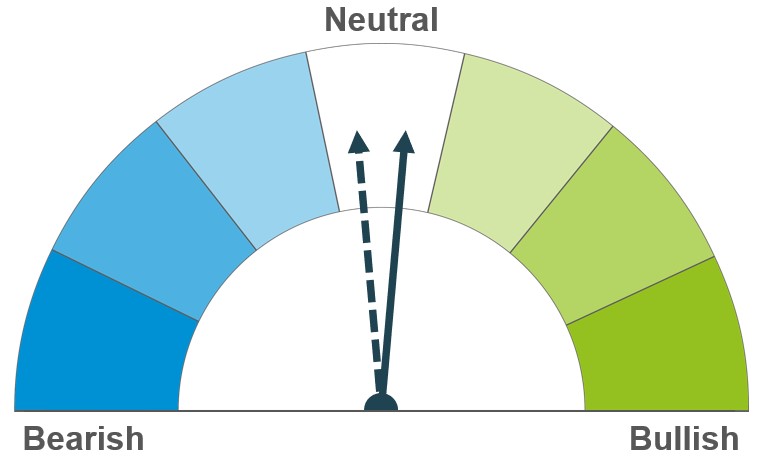

Adverse weather in major producing regions and stronger global demand are supporting prices. However, higher-than-expected stock levels in the US and Russia, along with rapid exports from the Black Sea could keep prices steady.

Tighter than expected stock levels in the US and poor yields in Europe could lend support short-term. However, global supplies are currently expected to be sufficient this season.

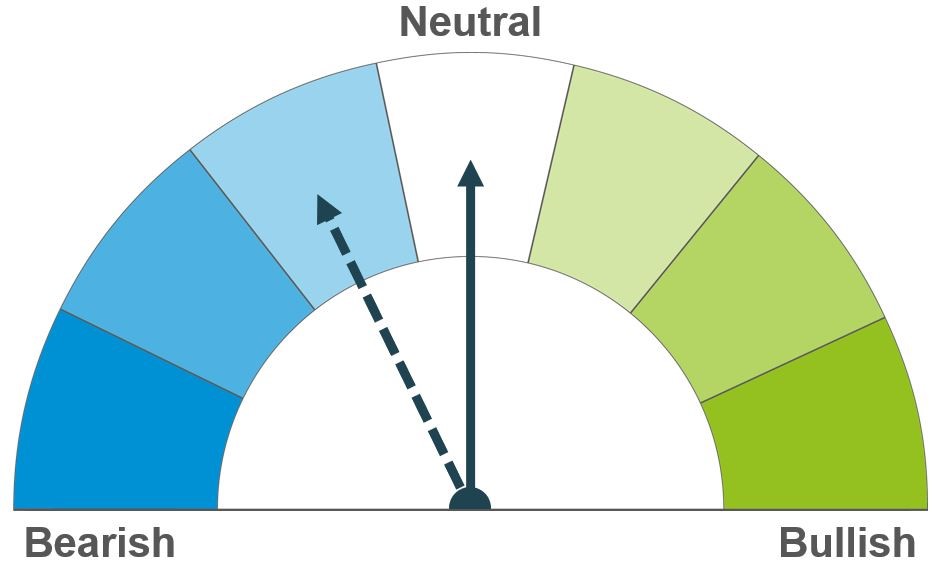

Slower planting progress in Europe due to poor weather create a longer-term watch point; short term barley prices continue to follow the trends in the broader grains market.

Global grain markets

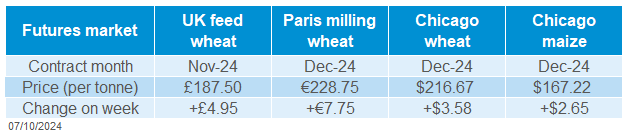

Global grain futures

Global grain prices were largely supported last week (Friday-Friday). Dec-24 Chicago wheat and maize futures gained 1.7% and 1.6%, respectively, while Paris milling wheat futures (Dec-24) rose by 3.5% on the week.

The rally through most of the week was driven by dry weather in key producing countries, escalation of crises in the Middle East and a surge in demand. However, towards the end of the week, prices were weighed on by profit-taking and a strengthening of the US dollar.

On Monday, USDA published its third quarter stock estimates in the US. Wheat inventories were estimated at 54.0 Mt, slightly above 53.7 Mt analysts expected. Maize stocks were reported at 44.7 Mt, 4.6% lower than analysts’ estimate (LSEG).

Prolonged dry weather in parts of Argentina is affecting the country’s wheat production. The adverse conditions have led to an increase in abandoned wheat fields and pest outbreaks, which could further impact overall wheat yields. However, maize planting is in progress, with 14% of the expected 6.3 Mha already completed this season.

In Australia, a dry start to spring and widespread frost damage in New South Wales, Victoria, and South Australia, has negatively affected crop potential. Australian Crop Forecasters expect this to reduce wheat production for the 2024/25 season by more than 1.7 Mt from earlier estimates.

SovEcon lowered its 2024/25 Russian wheat export forecast by 0.5 Mt to 47.6 Mt due to bad weather affecting harvest. Despite this, the agency noted that wheat exports from Russia are progressing rapidly, supported by higher stock levels.

Egypt’s state buyer, GASC has agreed to a private deal to purchase wheat totalling 3.12 Mt wheat from November to April this season, from the Black Sea region. The deal is one of the largest ever announced (LSEG).

This Friday, the USDA releases its next World Agricultural Supply and Demand Estimates, which could influence markets going forward.

UK focus

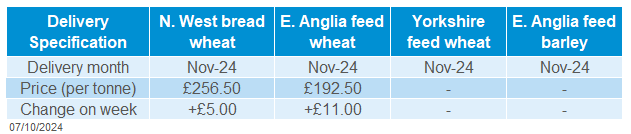

Delivered cereals

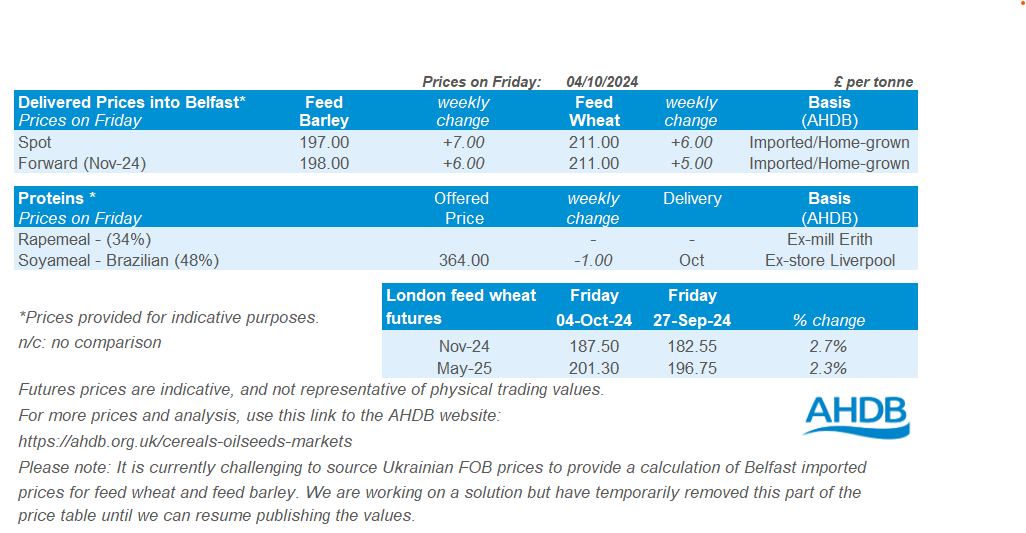

Last week (Friday-Friday), the domestic feed wheat markets followed global wheat futures up. Earlier gains were mostly offset by a decline at end of the week. Nov-24 UK feed wheat futures rose 2.7%, to close at £187.50/t on Friday, while the May-25 contract closed at £201.30/t, up 2.3% over the same period.

UK delivered prices broadly followed futures prices direction Thursday to Thursday. Feed wheat delivered into East Anglia for October delivery was quoted at £190.50/t on Thursday, up £10.00/t on the week. Over the same period, bread wheat delivered into the North West for November rose £5.00/t, quoted at £256.50/t.

Stronger demand for cattle and sheep feed helped limit the decline in overall GB compound feed production in August in the latest data from AHDB. Total feed produced by GB feed compounders and integrated poultry units (IPUs) combined in August dipped (-0.4%) below last year’s level. For the season to date (July and August) feed production is now up 1%, but 2% below the five-year average.

Oilseeds

Rapeseed

Soyabeans

Increasing oil price volatility, weather concerns and smaller harvests from major producers could provide support both short and longer term. However, the expectation of ample soyabean and palm oil supplies longer term keeps prices stable.

Escalations in the Middle East could offer some support for vegetable oil markets, though improved weather in Brazil weighs. Longer-term, amply global soyabean supplies are still expected.

Global oilseed markets

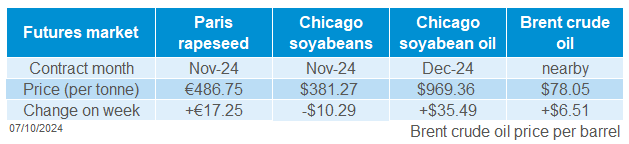

Global oilseed futures

Chicago soyabean futures (Nov-24) were pressured 2.6% last week (Friday to Friday), on the back of an improved weather outlook in Brazil, favourable harvest weather in the US and news around the potential delay on implementing anti-deforestation rules in Europe.

Dry weather in key producing regions of Brazil as of late has led to planting delays for the world’s largest producer of soyabeans. According to AgRural, as of 26 September, planting had reached 2% of the total expected area, below the 5.2% at the same point last season. However, forecasts of rain towards the end of this week in the Mato Grosso region put some pressure on prices.

Warm and dry weather across the US Midwest over the last week has likely favoured harvesting. As of 29 September, the US soyabean harvest was 26% complete, ahead of the previous five-year average of 18%. Another update from the USDA will be published this evening, and with more favourable weather forecast it’s likely that the soyabean harvest will continue at pace.

Last week, the EU Commission strengthened support for the EU Deforestation Regulation implementation and proposed an extra 12 months of phasing-in time, in response to calls from global partners. If approved by the European Parliament and the Council, this delay will mean any impact from the new regulation on soyabean prices will be longer term and we could see some pressure in the short-term with South American soyabeans continuing to flow.

Despite pressure on soyabeans, soya oil gained over the week, with some support in the vegetable oils market coming from a rise in crude oil prices, on the back of escalations in the Middle East. Nearby Brent crude futures were up 9.1% Friday to Friday. The potential for an attack on Iran’s oil facilities will likely keep markets supported for now, though OPEC has announced that is has enough spare oil capacity to offset if Israel knocked out Iranian supplies. The organisation added that it would struggle should Iran retaliate by attacking installations in neighbouring gulf countries – something to keep an eye on.

Rapeseed focus

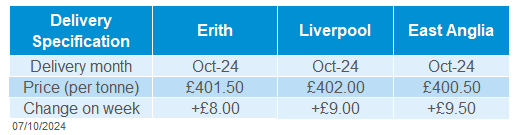

UK delivered oilseed prices

Paris rapeseed futures gained on the week (Friday to Friday). The Nov-24 contract rose by €17.25/t to close at €486.75/t on Friday. A rally in futures prices last week came from supported oil markets following escalating tensions in the Middle East, and weather concerns in Australia and the Black Sea region. Also, a weaker euro against the US dollar supported European markets specifically.

The EU Commission reported last Tuesday that EU rapeseed imports since July had reached 1.19 Mt by 29 Sept, 13% greater than this time last year when 1.05 Mt had been imported. The main rapeseed exporters to the EU were Ukraine (744 Kt) and Australia (352 Kt), both increased compared to the previous marketing year (2023/24). Current weather risks in Canada and Ukraine could have short term and longer-term impacts on rapeseed futures moving forward.

Rapeseed to be delivered into Erith in November was quoted at £405.00/t, up £10.00/t on the week. Near-term physical prices rose less than Paris Nov-24 futures, likely due to weaker trading activity on the physical market.

Australia would be the potential winner in canola (rapeseed) trade flows to China, if China imposes tariffs on Canadian imports of the oilseed, but Beijing would need to reassured on worries about the blackleg fungus.

Dalian's vegetable oil markets were closed for China's Golden Week holiday.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.