Arable Market Report - 08 December 2025

Monday, 8 December 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

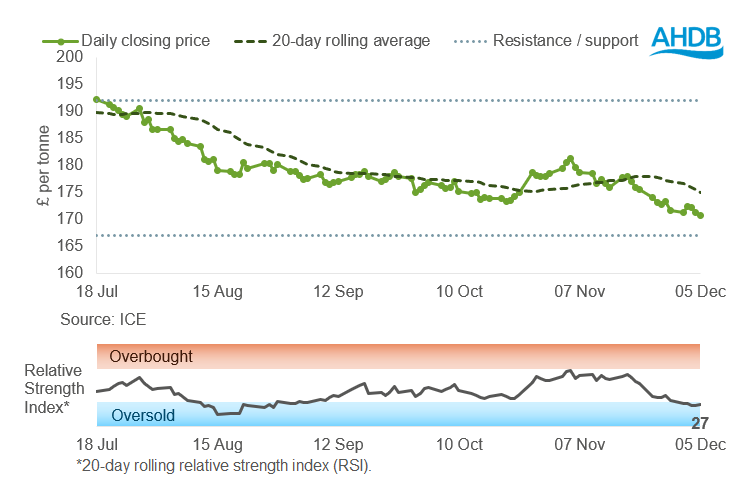

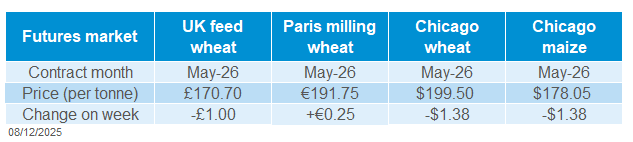

UK feed wheat futures (May-26)

Last week, UK feed wheat futures (May-26) finished below the 20-day average but above the support level of £167/t.

The relative strength index (RSI) eased to 27 from 32 the previous week, indicating a significant decrease in price. RSI is now approaching the oversold zone.

Find out more about the graphs in this report and how to use them.

Market drivers

UK feed wheat futures fell over last week (28 November – 05 December). The May-26 contract closed at £170.70/t down £1.00/t (0.6%) on the week, setting a new contract low. Chicago wheat futures broadly ended down, while Paris milling wheat ended mixed but hovering around contract lows.

The domestic market was weighed on by currency movements and strong production statistics released last week from Canada and Australia, adding to what is already a sizable year for global production of grains. Sterling reached its strongest against the euro and the dollar for just over a month last week, ending Friday at £1 = €1.145 and $1.333, respectively.

The final 2025 production of principal field crops report was released in Canada, total wheat production (inc. Durum) was revised upwards for 2025 to 39.9Mt, this is up 11.2% year-on-year (StatsCan). The total wheat figure surpassed an average Reuters poll (LSEG survey based on seven analysts), which estimated the crop at 38.5Mt, adding to global supplies for 2025/26.

In Australia, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) released its crop report for December. Australia’s winter crop production is expected to increase by 10% to 66.3 Mt in 2025/26, the second largest winter crop on record. Wheat output is forecast at 35.6 Mt against 33.8 Mt in September estimates (USDA 36 Mt). Barley has been revised to 15.7 Mt up 1.1 Mt from September (USDA 15.0 Mt). Some of this increase was expected given the better-than-expected growing season in Western Australia.

Some tensions persist in the Black Sea region. Russia threatened Ukraine’s access to the Black Sea after drone attacks on Russian vessels last week. The threat unsettled grain markets and have buoyed some prices as war-risk premium was built in, this soon subsided, but this is a key watchpoint for grain prices going into 2026.

UK delivered cereal prices

Domestic delivered wheat prices were down Thursday to Thursday, following movements in futures.

Nearby prices were pressured with feed wheat delivered into East Anglia in December was quoted at £168.50/t, down £5.00/t on the week. While for Jan-26 prices were quoted at £170.50/t, down £3.00/t week-on-week and for May-26 were quoted at £177.50/t, unchanged week-on-week.

There was pressure for milling wheat, as bread wheat for December delivery into Northamptonshire was quoted at £182.00/t, down £4.00/t on the week.

.png)

Rapeseed

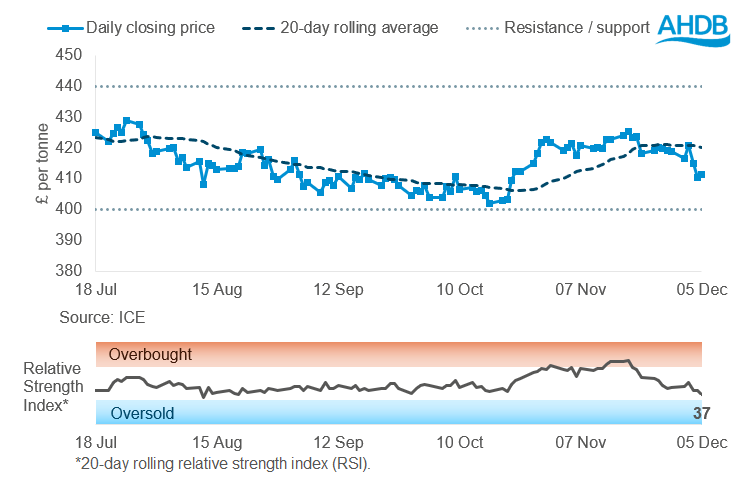

Paris rapeseed futures in £/t (May-26)

In £/t terms, May-26 Paris rapeseed futures decreased last week (28 November – 05 December), and closed below the 20-day moving average near £411/t. The RSI fell from 45 to 37, signalling weaker momentum as it moved closer to the oversold zone.

Find out more about the graphs in this report and how to use them.

Market drivers

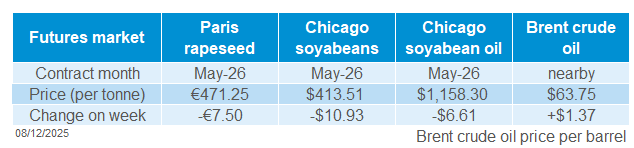

Global oilseed markets weakened last week, with Paris rapeseed futures (May‑26) falling by €7.50/t (1.6%) to €471.25/t. This pressure is filtering into UK prices, with domestic rapeseed values easing in line. Chicago soyabean and Winnipeg canola futures also dropped, reflecting ample global supplies.

China’s slower pace of US soyabean purchases continues to weigh on market sentiment. Although the USDA confirmed a further 462 Kt sale last week, total reported volumes of 2.7 Mt since 30 October from the USDA’s daily reporting system, demand remains below expectations. This uncertainty over the scale and timing of Chinese demand keeps global soyabean markets pressured and reverses the premium that has been built in, which in turn limits support for UK rapeseed prices.

South America remains a key driver of global supply. Brazil’s 2025/26 soyabean crop forecast has been slightly reduced to 177.2 Mt in December, down from 178.9 Mt last month, due to uneven rainfall, though expectations still point to a record harvest (StoneX). Planting is nearly complete, with 91% of the area sown, slightly behind last year’s pace but finished in key states including Mato Grosso, Mato Grosso do Sul and Paraná (Patria Agronegocios). In Argentina, 2025/26 soyabean planting lags due to recent rains limits access to fields, although crop conditions remain mostly good (Buenos Aires Grain Exchange).

Elsewhere, the Australian Bureau of Agricultural and Resource Economics and Sciences forecasts 2025/26 canola production at 7.2 Mt, up 1.2 Mt (13.1%) on last year, while the USDA estimates 6.7 Mt. In Canada, Statistics Canada projects a record 21.8 Mt canola crop for 2025/26, 13.3% higher year-on-year and above analysts’ expectations of 21.25 Mt, supported by timely summer rainfall that boosted yields across the Prairies. Canadian canola is currently subject to significant tariffs in China, restricting access to this key market and contributing to larger supplies globally.

The market now looks to the USDA World Agricultural Supply and Demand Estimate out Tuesday (09 Dec), a Reuters poll of analysts anticipate marginally higher US and global soyabean stocks in 2025/26 ahead of the report. Other key areas will be to see if EU-27, Australian and Canadian rapeseed/canola production is revised up further, given the recent increases from government agencies.

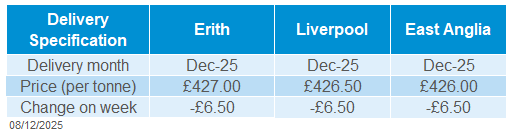

UK delivered rapeseed prices

UK delivered rapeseed prices tracked Paris rapeseed futures lower over the week. December delivery into Erith was quoted at £427.00/t, down £6.50/t from the previous week. Prices for December delivery into Liverpool also fell £6.50/t to £426.50/t, while East Anglia eased to £426.00/t, likewise down £6.50/t week-on-week.

These values are based on a survey conducted mid to late Friday morning and may not fully capture movements in Paris futures by the close of trading.

Extra information

On Thursday 4 December, AHDB published UK cereal usage data for September, covering human and industrial consumption as well as GB animal feed production. Total animal feed usage is up 2.9% in the season so far. Brewers, maltsters and distillers’ barley usage is down 14.3% over the same period.

HMRC will release UK trade data for October 2025 on Thursday 11 December.

On Thursday 11 December Defra is to release its cereal and oilseed production estimates for the 2025 UK harvest.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.