Arable Market Report - 08 September 2025

Monday, 8 September 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (Nov-25)

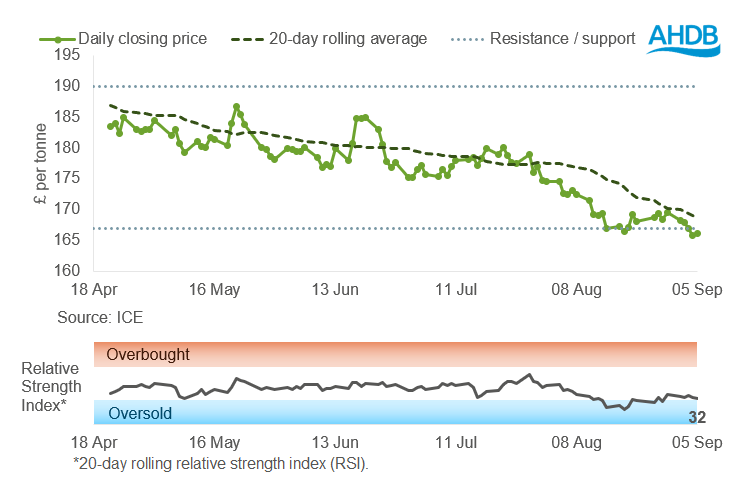

UK feed wheat futures edged lower last week (Friday to Friday), but continued to trade near the level of support of £167/t. When analysing price trends, a ‘support line’ is seen as a level that it may be harder for prices to fall below.

The Relative Strength Index (RSI) reduced from 36 to 32, indicating declining market momentum. This places the indicator near the key technical threshold of “oversold” conditions, suggesting it may be time to more closely monitor the market for potential shifts.

Find out more about the graphs in this report and how to use them.

Market drivers

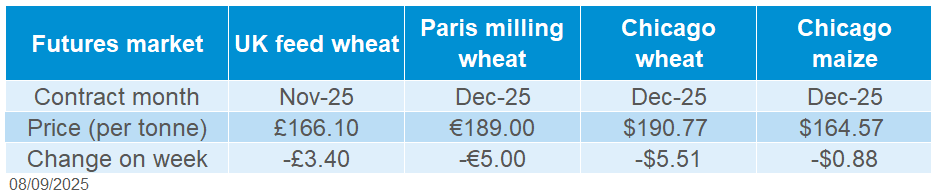

UK feed wheat futures (Nov-25) closed at £166.10/t down £3.40/t (2.0%) on the week. Strong global supply and slow demand have seen global prices come under pressure in the last week. Chicago wheat futures and Paris wheat futures (Dec-25) were down 2.8% and 2.6% respectively.

In Russia, wheat export prices have fallen due to weak demand and the arrival of new crop supplies. SovEcon raised its export forecast by 0.5 Mt, bringing the 2025–26 season estimate to 43.7 Mt.

Ukraine’s grain harvest has been revised upward. APK-Inform increased its total grain output estimate by 10.5% compared to August estimates. The consultancy now projects a harvest of 58.8 Mt, including 21.9 Mt of wheat and 30.3 Mt of maize.

Australia’s wheat crop is expected to decline by 1% year-on-year at 33.8 Mt yet remains 22% above the 10-year average. According to the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), favourable growing conditions have supported strong yields, benefiting both wheat and barley production.

Final quality results from the French soft wheat crop show protein levels below the five-year average. However, test weights and Hagberg falling numbers above 250 were both above recent averages (FranceAgriMer).

Germany’s winter wheat harvest is up by 26.3% this year, reaching 22.5 Mt despite late-summer rainfall affecting crops. The total 2025 grain harvest is estimated up by 14.8% year-on-year to approximately 44.7 Mt (German agricultural ministry).

On the demand side, Egypt (one of the world’s largest importers of wheat) imported 4.5 Mt of wheat, in the 2024-25 financial year, down more than 21% from the previous year.

UK delivered cereal prices

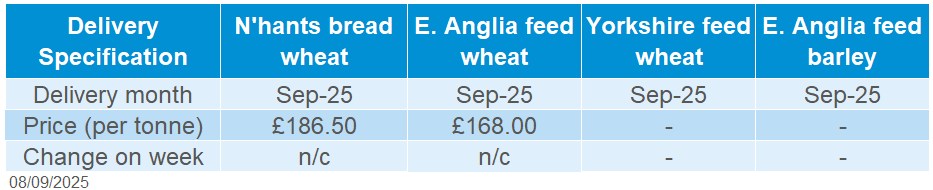

Feed wheat delivered into East Anglia for September delivery was quoted at £168.00/t on Thursday.

September delivery of bread wheat into the Northamptonshire was quoted at £186.50/t.

Rapeseed

Paris rapeseed futures in £/t (Nov-25)

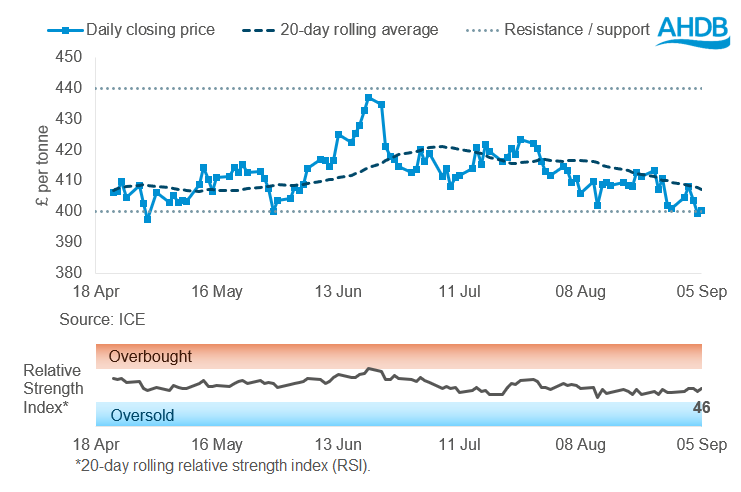

Last week (Friday to Friday), Paris rapeseed futures (in £/t) closed below the 20-day moving average for a second consecutive week. However, the £400/t support level continued to hold firm for closing prices.

The Relative Strength Index (RSI) rose slightly from 42 to 46, indicating a period of price consolidation rather than a clear directional move.

Find out more about the graphs in this report and how to use them.

Market drivers

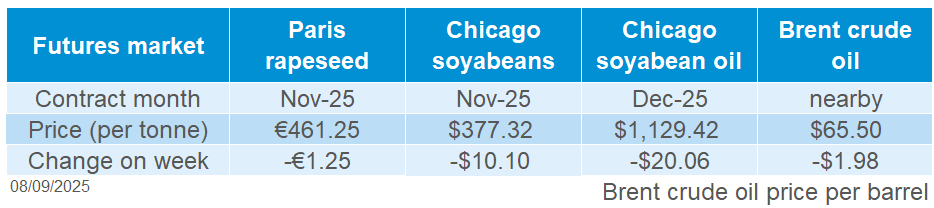

The oilseed complex remained under pressure last week amid ample supply and subdued demand. Paris rapeseed futures (Nov-25) fell by €1.25/t (0.3%) to close at €461.25/t, while Winnipeg canola and Chicago soyabean futures (Nov-25) declined by 1.5% and 2.6% respectively.

In the US, weekly soyabean export sales totalled 818.5 Kt for the week ending 28 August. The volume fell short of expectations amid weak Chinese demand, driven by ongoing trade tensions and elevated stock levels. However, the impact on prices may have been softened by the USDA’s lower-than-expected crop rating as at 31 August.

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) has raised its 2025/26 canola (rapeseed) production forecast from 5.7 Mt to 6.4 Mt. This is now a 1% year-on-year increase due to improved winter growing conditions. Meanwhile, Germany’s Agriculture Ministry estimates the 2025 rapeseed crop at 3.96 Mt, up 9.4% on the year and slightly ahead of the EU Commission’s 3.90 Mt forecast.

Ukraine has introduced a 10% export tax on rapeseed and soyabeans to encourage domestic processing. As a major rapeseed supplier, this could tighten global availability and lend support to prices. Separately, APK-Inform has lowered Ukraine’s 2025 sunflower production forecast to 13.6 Mt from a previous estimate of 13.8 Mt, due to poor weather in the southern regions. This remains slightly above the USDA’s estimate of 13.5 Mt.

Crude palm oil production is expected to rise for a second consecutive month in Malaysia during August, adding pressure to the vegetable oil market. However, Indian import demand is picking up ahead of the festival season, which could offer some modest support, with a potential knock-on effect for rapeseed prices.

Looking ahead, market attention will turn to the upcoming USDA supply and demand estimates due out on Friday.

UK delivered rapeseed prices

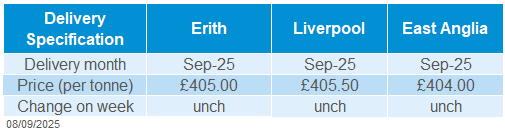

Rapeseed to be delivered into Liverpool for November was quoted at £409.00/t on Friday, down £1.00/t on the week. November deliveries into Erith and East Anglia were quoted at £408.50/t and £407.50/t respectively, both down £1.00/t week-on-week. Delivered rapeseed prices generally tracked movements in Paris rapeseed futures over the week.

Extra information

AHDB’s fifth harvest report, released on Friday 5 September, confirms that harvest is now complete across England, except for some remaining pulses. In Scotland and Northern Ireland, some cereals are still to be cut. Yields have been highly variable both across and within regions. Read the full report here.

On Thursday 4 September, AHDB published the latest data for UK human and industrial cereal usage and GB animal feed production for July, marking the first month of the 2025/26 season.

The latest Agri-market outlook for cereals and oilseeds has been released by AHDB, offering a comprehensive market overview and insights into future trends.

New analysis from AHDB explores how the Middle East crisis could influence UK fertiliser prices, and why the region remains strategically important. Read more here.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.